Global| Aug 30 2007

Global| Aug 30 2007Consumer Confidence is Retreating in Italy

Summary

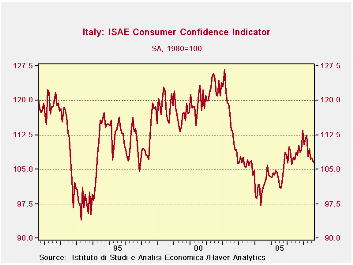

In early 1990 and again in early 2002, Italy scored its highest readings on this index. But since 2002 confidence has dropped. As the Euro area picked up, Italys confidence also recovered but could barely get half-way back to its [...]

In early 1990 and again in early 2002, Italy scored its highest readings on this index. But since 2002 confidence has dropped. As the Euro area picked up, Italy’s confidence also recovered but could barely get half-way back to its former peak at the end of 2006 and has since experienced back-sliding. The backsliding continues.

The confidence reading by consumers is only in the bottom third of its range of values since 1990. It has only been weaker in 1992-93, in the previous slowdown in late 2003-2004 and then in a short-lived bout of weakness in 1996. The weakening at this juncture is part of an established trend and so is more worrisome.

The overall situation over the next 12 months assesses out as in the bottom 8 percentile of is range. Unemployment appears more likely to respondents, in the top quarter of its range. Households put their past 12-month and future 12-month household financial situation in the bottom 25 percentile of its range. They say past savings were in the top 10% of their range but see savings prospects ahead in the bottom 10%. The purchase environment is in the bottom 40% of its range but ahead consumers expect it to be in the bottom 16 percentile.

Clearly, Italian consumers are not happy campers. They see many challenges and are having a harder time of it than other large Euro economies such as Germany and France. Italy, it seems, has lot of work to do. There is no longer a lira to depreciate when things get tough.

| Since January 1999 | ||||||||||

| Aug-07 | Jul-07 | Jun-07 | May-07 | Percentile | Rank | Max | Min | Range | Mean | |

| Consumer Confidence | 106.5 | 107.4 | 107.2 | 109.4 | 31.6 | 68 | 127 | 97 | 30 | 111 |

| Last 12 months | ||||||||||

| OVERALL SITUATION | -57 | -59 | -60 | -52 | 42.6 | 48 | -22 | -83 | 61 | -54 |

| PRICE TRENDS | -25 | -26 | -27.5 | -24.5 | 24.0 | 75 | 4 | -34 | 38 | -16 |

| Next 12months | ||||||||||

| OVERALL SITUATION | -29 | -25 | -22 | -18 | 8.6 | 93 | 24 | -34 | 58 | -12 |

| PRICE TRENDS | 22.5 | 18.5 | 19 | 17.5 | 36.9 | 46 | 49 | 7 | 42 | 23 |

| UNEMPLOYMENT | 0 | -3 | 2 | -5 | 76.9 | 21 | 9 | -30 | 39 | -6 |

| HOUSEHOLD BUDGET | 7 | 4 | -1 | 3 | 23.5 | 79 | 33 | -1 | 34 | 15 |

| HOUSEHOLD FIN SITUATION | ||||||||||

| Last 12 months | -37 | -34 | -40 | -35 | 25.0 | 65 | -7 | -47 | 40 | -28 |

| Next12 months | -10 | -10 | -9 | -10 | 25.0 | 96 | 14 | -18 | 32 | -1 |

| HOUSEHOLD SAVINGS | ||||||||||

| Current | 55 | 54 | 59 | 58 | 89.7 | 6 | 59 | 20 | 39 | 38 |

| Future | -35 | -34 | -33 | -28 | 10.3 | 97 | -9 | -38 | 29 | -23 |

| MAJOR Purchases | ||||||||||

| Current | -41 | -39 | -40 | -46 | 38.1 | 42 | -15 | -57 | 42 | -40 |

| Future | -68 | -68 | -63 | -71 | 16.1 | 74 | -42 | -73 | 31 | -62 |

| Total number of months: 100 | ||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates