Global| Sep 10 2012

Global| Sep 10 2012Consumer Credit Falls $3.3B in July

Summary

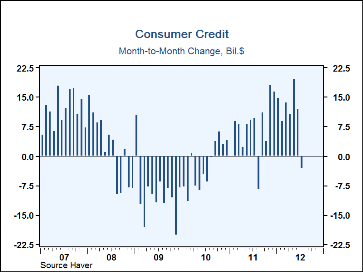

Consumer credit declined in July, by $3.3B, seasonally adjusted, the first outright decline since August 2011. However, revisions to recent months raised their amounts, June from $6.5B reported previously to $11.8B in today's data, [...]

Consumer credit declined in July, by $3.3B, seasonally adjusted, the first outright decline since August 2011. However, revisions to recent months raised their amounts, June from $6.5B reported previously to $11.8B in today's data, and May from $16.7B before to $19.3B today. The Action Economics survey consensus had called for a July increase of $9.1B, so the net paydown of $3.3B was quite unexpected. Relative to a year ago, total credit grew 4.4%.

Consumer credit declined in July, by $3.3B, seasonally adjusted, the first outright decline since August 2011. However, revisions to recent months raised their amounts, June from $6.5B reported previously to $11.8B in today's data, and May from $16.7B before to $19.3B today. The Action Economics survey consensus had called for a July increase of $9.1B, so the net paydown of $3.3B was quite unexpected. Relative to a year ago, total credit grew 4.4%.

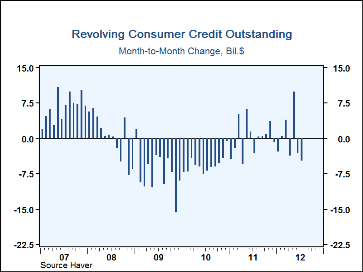

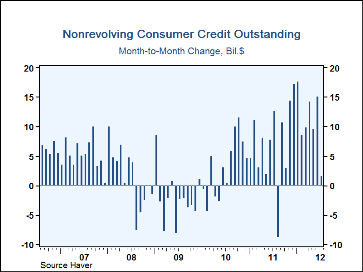

Revolving credit accounted for the July contraction, as it dropped $4.8B, a second successive decrease following $3.2B in June. Its year-on-year change was a mere 0.4%. Nonrevolving credit, mostly auto and student loans, still grew in July, by $1.6B. It had surged $15.1B in June and was up 6.3% from July 2011

In this month's report, the Fed incorporated revisions back to December 2010, reflecting new data from a Census of Finance Companies taken in 2010 and the annual Survey of Finance Companies for 2011. Monthly flows and annual growth rates are published by the Fed with a break-adjustment for the associated discontinuities, although amounts outstanding for the total and nonrevolving portion show sizable jumps in December 2010.

The consumer credit data are available in Haver's USECON database. The Action Economics figures are in the AS1REPNA database.

| Consumer Credit Outstanding (M/M Chg, SA | Jul | Jun | May | Y/Y | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|

| Total | -$3.3B | $11.8B | $19.3B | 4.4% | 3.4% | -1.3% | -4.5% |

| Revolving | -$4.8B | -$3.2B | $9.8B | 0.4% | 0.2% | -7.4% | -8.8% |

| Non-revolving | $1.6B | $15.1B | $9.6B | 6.34% | 5.0% | 2.5% | -1.8% |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.