Global| Oct 15 2010

Global| Oct 15 2010Consumer Sentiment Largely Stable, a Little Worse than Expected

Summary

Consumer sentiment is stuck: for a fourth consecutive month, the University of Michigan Index of Consumer Sentiment has hovered within a range of 1.1 points and eased just slightly in the latest, mid-October reading to 67.9 from 68.2 [...]

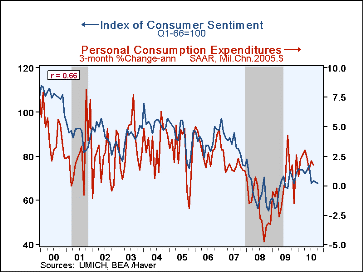

Consumer sentiment is stuck: for a fourth consecutive month, the University of Michigan Index of Consumer Sentiment has hovered within a range of 1.1 points and eased just slightly in the latest, mid-October reading to 67.9 from 68.2 for the month of September. Markets, however, were disappointed, since consensus forecasts anticipated at least a modest improvement to 68.9.

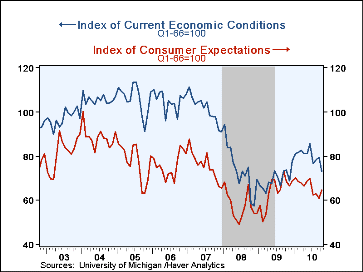

The near stability in the total index for the first half of October was the product of offsetting moves in the two major components: sentiment about current economic conditions declined from September while expectations moved higher. The current conditions figure fell to 73.0 from 79.6, pushed down by buying conditions for large household goods; this reading dropped from 123 in September to 108, the lowest since April 2009. People's assessment of current personal finances also deteriorated, but just a little to 79 from 82 in September. This level sustains a modestly firming trend that has lasted all of this year so far.

The consumer expectations index, by contrast, show a pointed gain, from 60.9 in September to 64.6 for early October. Weakness in people's outlook over the summer has given way to better prospects for overall business conditions. Their outlook for the next 12 months jumped to 70 from 61, and for the next five years to 80 from 73. These are not high readings in historical context, but they reverse a dip over the last three months. Expected personal finances, however, did not mirror the upswing in general business prospects, as people's feelings about their own prospects edged back to 107 after a small rise in September to 108.

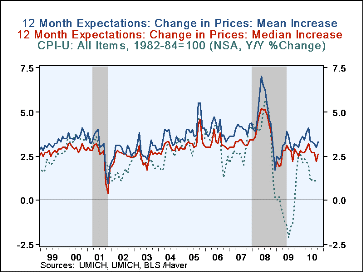

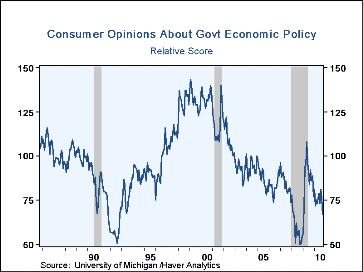

Expected price inflation during the next year edged back up to 3.3% from 3.0% in September. We notice that this figure bears little resemblance to the current pace of CPI inflation, 1.1% over the last year; even the median expectation, which is 2.6% at present and has run closer to the trend in actual inflation over time, remains noticeably higher than the recent pace of the CPI. Respondents' view of government policy, which may eventually influence economic expectations, fell further this month to 67 from 76 in September; this latest is the lowest reading since January 2009. Only 11% of respondents think that a good job was being done by government while 44% thought a poor job was being done, the most since January 2009.

The Reuters/University of Michigan survey data are not seasonally adjusted. The readings are based on telephone interviews with just over 300 households during early-to-mid October. The summary indexes are in Haver's USECON database with details in the proprietary UMSCA database.

| University of Michigan | October | Sept. | August | July | Oct. Y/Y | 2009 | 2008 | 2007 |

|---|---|---|---|---|---|---|---|---|

| Consumer Sentiment | 67.9 | 68.2 | 68.9 | 67.8 | -3.8% | 66.3 | 63.8 | 85.6 |

| Current Economic Conditions | 73.0 | 79.6 | 78.3 | 76.5 | -0.9% | 69.6 | 73.7 | 101.2 |

| Expectations | 64.6 | 60.9 | 62.9 | 62.3 | -5.8 | 64.1 | 57.3 | 75.6 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.