Global| Feb 04 2008

Global| Feb 04 2008Currencies in Australia and New Zealand Continue to Strengthen

Summary

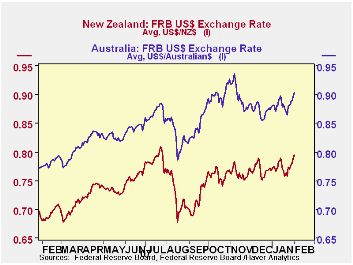

Both the Australian and New Zealand dollars have rebounded, if somewhat irregularly, since the U. S. Federal Reserve Board started to lower interest rates in September, as can be seen in the first chart, showing the daily values of [...]

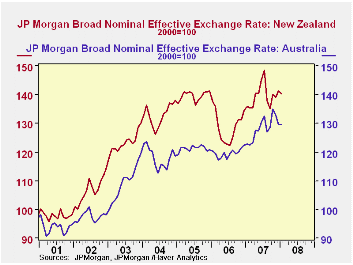

Both the Australian and New Zealand dollars have rebounded, if somewhat irregularly, since the U. S. Federal Reserve Board started to lower interest rates in September, as can be seen in the first chart, showing the daily values of the two currencies for the past year or so. A longer term perspective is shown in the second chart where the broad J. P. Morgan effective nominal trade weighted indexes are shown. This chart shows not only that the appreciations of these currencies have been underway since the beginning of this decade, but it also shows that the appreciations have been widespread and not simply with the U. S. dollar.

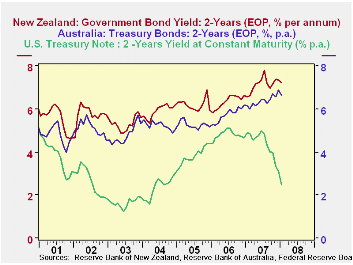

While interest rate differentials are not the only factor in the relative value of one country vis-à-vis another, they are among the more important. The third chart shows the yield on a 2-year government security in the three countries. Interest rates in Australia and New Zealand have been substantially above those in the U. S and steady while those in the U. S. have dropped sharply since the Fed began to cut rates. As of January of this year the differential between the 2-year security in Australia and the U. S. was 4.25 points and in New Zealand and the U. S. security, 4.73 points.

| AUSTRALIA AND NEW ZEALAND | Jan 31, 2008 | Sep 7, 2007 | Jul 24, 2007 | Jan 31, 2007 |

|---|---|---|---|---|

| Australian $ (U. S.$) | .8968 | .8259 | .8841 | .7740 |

| New Zealand $ (U. S.$) | .7884 | .6889 | .8069 | .6856 |

| Jan 2008 | Sep 2007 | Jan 2007 | -- | |

| Australian Trade Weighted 2000=100 | 129.6 | 128.7 | 122.7 | -- |

| New Zealand Trade Weighted (2000=100) | 140.4 | 135.1 | 135.9 | -- |

| 2-Year Government Security (EOP) % | ||||

| Australia | 6.63 | 6.43 | 6.15 | -- |

| New Zealand | 7.21 | 6.97 | 9.57 | -- |

| U. S. | 2.48 | 3.97 | 4.88 | -- |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates