Global| Jun 24 2005

Global| Jun 24 2005Despite Strong Oil Revenues and Big US Exports, Mexican Trade Runs Overall Deficit

Summary

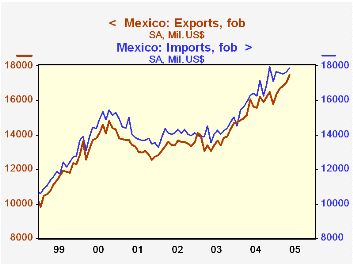

Are you aware that Mexico runs a trade deficit? In May, this was $434.6 million; in 2004, it averaged $726.7 million a month. Over the past year, exports, not seasonally adjusted, have grown 13.3%; while higher petroleum exports are [...]

Are you aware that Mexico runs a trade deficit? In May, this was $434.6 million; in 2004, it averaged $726.7 million a month. Over the past year, exports, not seasonally adjusted, have grown 13.3%; while higher petroleum exports are part of this growth, nonpetroleum exports have risen 12.4%.

So Mexico is yet another instance in which conventional wisdom would suggest that a specific nation must surely have a huge trade surplus: don't "we" import a lot from Mexico, as "we" do from China and India? But contrary to popular belief, those are both countries which have near balances in their trade accounts, not big surpluses.

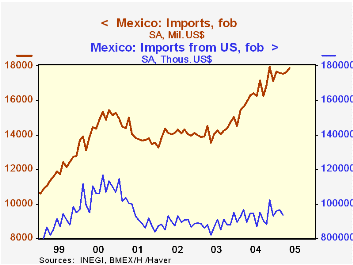

Mexico does run a substantial surplus with the US, recently around $5 billion monthly. US purchases account for about 87% of Mexican exports, a substantial part of which involves the "maquiladora" trade, the plants near the US border which import parts and components for products that they assemble and re-export.

While the shares of Mexican trade connected to the US and/or to the maquiladora operations are large, Mexico does engage other countries and purposes. Particularly in the past couple of years, Mexican imports from non-US countries have grown rapidly: In March (the latest available), they were $8.2 billion, almost half of that month's total goods imports. In 2002, these imports averaged just $5.1 billion monthly, 36.5% of imports. In the more recent periods, Brazil, China and the EU have accounted for notable parts of the Mexico's import business. Further, consumer goods imports have been expanding. Over the last 12 months, they have grown by 17.4%, compared with an increase of 14.3% for total imports. Capital goods imports have also strengthened. These upturns coincide with the run-up in oil prices and the consequent surge in Mexico's petroleum exports. Quite possibly, these additional oil revenues are being recycled into the world economy, perhaps into countries other than the ones who bought the oil.

| MexicoSeas Adj, Mil.$ | May 2005 | Apr 2005 | Mar 2005 | Monthly Averages|||

|---|---|---|---|---|---|---|

| 2004 | 2003 | 2002 | ||||

| Trade Balance | -434.6 | -587.9 | -734.2 | -726.7 | -475.0 | -627.6 |

| Exports | 17476.7 | 17039.4 | 16836.7 | 15620.2 | 13738.0 | 13407.1 |

| To US | -- | -- | 14690.7 | 13732.8 | 12046.1 | 11846.0 |

| All Other | -- | -- | 2146.0 | 1897.4 | 1691.9 | 1561.1 |

| Imports | 17896.2 | 17651.6 | 17574.0 | 16318.1 | 14213.8 | 14040.5 |

| From US | -- | -- | 9354.7 | 9272.0 | 8810.3 | 8910.2 |

| All Other | -- | -- | 8219.3 | 7046.1 | 5403.5 | 5130.3 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.