Global| Jun 25 2020

Global| Jun 25 2020Durable Goods Orders Rebounded in May though Remain Depressed

by:Sandy Batten

|in:Economy in Brief

Summary

• Durable goods orders rebounded in May, rising a more-than-expected 15.8% m/m, the largest monthly increase since July 2014. • This was led by transportation orders, which jumped up a record 80.7% m/m but recouped only about a third [...]

• Durable goods orders rebounded in May, rising a more-than-expected 15.8% m/m, the largest monthly increase since July 2014.

• This was led by transportation orders, which jumped up a record 80.7% m/m but recouped only about a third of their March/April declines.

• Both core capital goods shipments and orders rose more than expected in May.

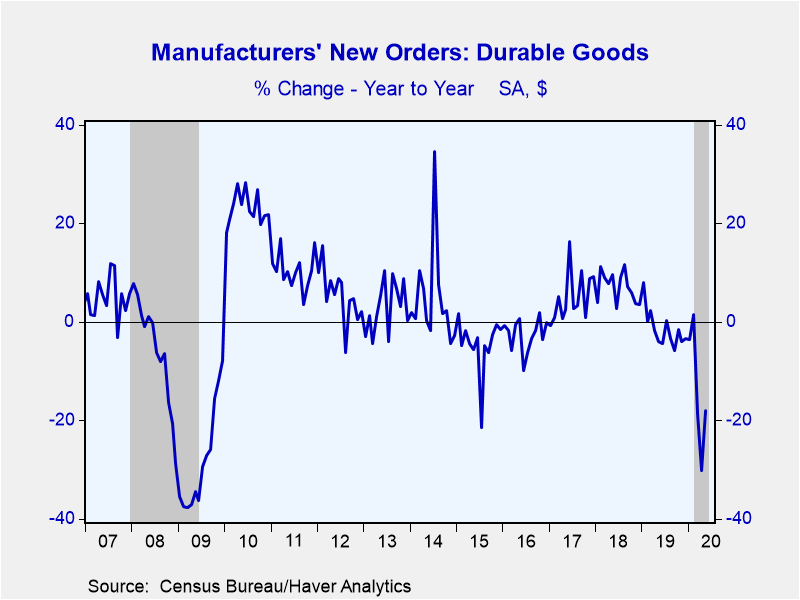

Orders for durable goods were stronger than expected in May, rising 15.8% m/m (-17.9% y/y), retracing about one third of their March/April declines. The Action Economics Forecast panel had anticipated a 11.5% m/m increase in May. The initially reported 17.2% m/m decline in April was revised down slightly to -18.1%. Even with the May rebound, orders are still down 21.0% from February. Transportation orders led the May revival. They jumped up a record 80.7% (dating back to 1992) but still failed to offset the 48.6% m/m drop in April and the 43.2% m/m decline in April. Reflecting the base effect in calculating monthly percent changes, May transportation orders were still 47% below those in February.

Orders excluding transportation rose a robust 4.0% m/m in May (-6.3% y/y). This was the strongest monthly gain since November 2010. Orders rose in every major category in May. After two months of negative readings (that is, order cancellations exceeding new orders), nondefense aircraft orders were positive in May. Following calamitous declines in March and April, motor vehicle orders rose a record 27.5% m/m in May but were still down 52.5% from February.

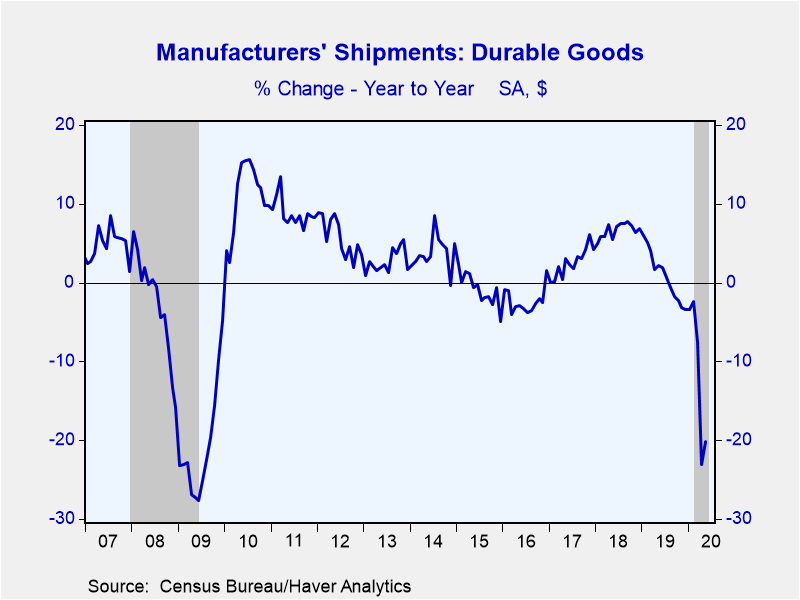

Shipments of durable goods also revived in May, rising a more modest 4.4% m/m (-20.1% y/y). The initially reported 17.7% m/m decline in April was revised down to -18.6% m/m. While shipments increased in all major categories in May, the rebound was also led by a 12.1% m/m increase in transportation shipments--all due to a record 26.7% m/m jump in shipments of motor vehicles.

Capital goods orders and shipments also revived in May by a little more than generally expected. Core capital goods orders (orders excluding defense and aircraft) rose 2.3% m/m (-3.6 y/y) but the initially reported 5.8% m/m decline in April was revised lower to -6.5%. Orders in May were 5.6% lower than in February, and orders in April/May were down 6.4% from the Q1 average. Core capital goods shipments (a good coincident indicator of business spending on equipment in the national accounts) increased 1.8% m/m (-6.5% y/y) in May with a slight downward revision in the April decline. Compared to February, core capital goods shipments were down 5.7% and down 6.4% from the Q1 average, auguring a decline in business spending on equipment in Q2--though not as large as had been feared previously.

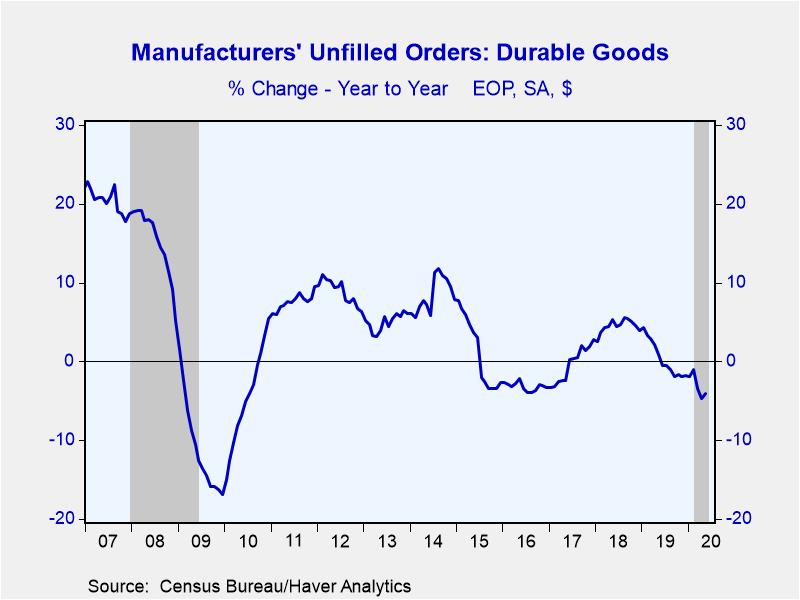

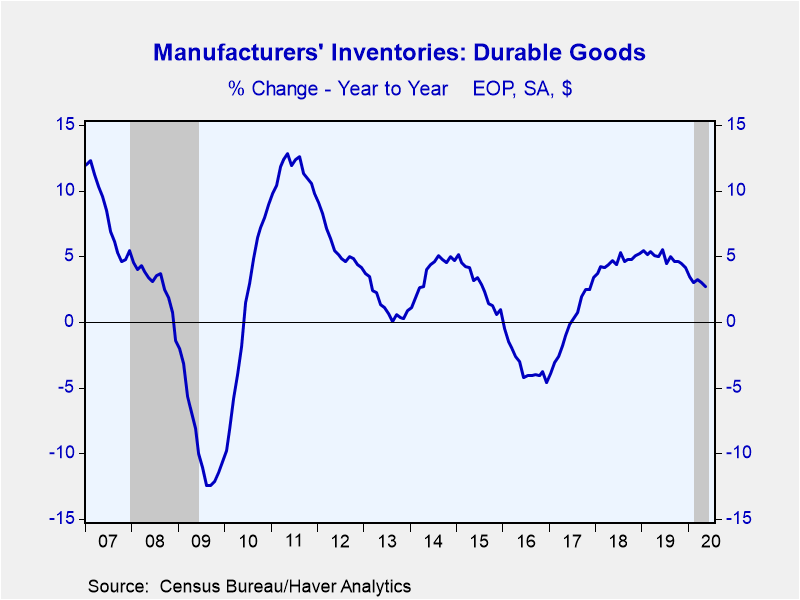

Both unfilled orders for durable goods and inventories edged up 0.1% m/m in May.

The durable goods figures are available in Haver's USECON database. The Action Economics consensus forecast figure is in the AS1REPNA database.

| Durable Goods NAICS Classification | May | Apr | Mar | May Y/Y % | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| New Orders (SA, % chg) | 15.8 | -18.1 | -16.7 | -17.9 | -1.7 | 7.3 | 4.7 |

| Transportation | 80.7 | -48.6 | -43.2 | -40.9 | -5.3 | 9.5 | 4.6 |

| Total Excluding Transportation | 4.0 | -8.2 | -1.8 | -6.3 | 0.3 | 6.0 | 4.8 |

| Nondefense Capital Goods Excl. Aircraft | 2.3 | -6.5 | -1.3 | -3.6 | 1.7 | 4.7 | 3.9 |

| Shipments | 4.4 | -18.6 | -5.5 | -20.1 | 0.6 | 6.8 | 2.3 |

| Nondefense Capital Goods Excl. Aircraft | 1.8 | -6.2 | -1.3 | -6.5 | 2.3 | 5.8 | 0.8 |

| Unfilled Orders | 0.1 | -1.5 | -2.1 | -4.1 | -1.9 | 3.8 | 2.7 |

| Inventories | 0.1 | 0.0 | 0.5 | 2.7 | 4.1 | 5.3 | 3.4 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.