Global| Sep 24 2007

Global| Sep 24 2007E-zone Orders Show a Loss in Momentum in July

Summary

July orders are weak across the EU main countries In July EMU-13 orders were off by 4%, a sharp reversal of Julys 4.5% gain. In August the twin forces of the US subprime meltdown and the Euros rise will be further impediments for [...]

July orders are weak across the EU main countries…

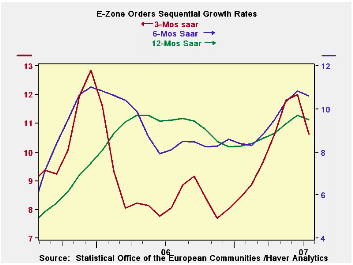

In July EMU-13 orders were off by 4%, a sharp reversal of July’s 4.5% gain. In August the twin forces of the US ‘subprime’ meltdown and the Euro’s rise will be further impediments for Europe to deal with. But as of July, ahead of those forces there is already some evidence of weakening. The Yr/Yr chart and graphs show that momentum is still upward, though not as strong. Obviously when orders jump by 4.5% only to fall by 4% the next month the trend is not greatly damaged. But, injured more noticeably is the path for orders early in the new, third, quarter. Orders are off at a 4.5% pace in Q3. Meanwhile sales are still strong growing at an annual pace of 6.7% in early Q3.

In July orders are off by 7.2% in Germany, by 2.9% in France and by 0.4% in Italy. The EU’s UK, by contrast, has orders up a sharp 20.2%. Starting out the new quarter Germany shows the weakest result at -18.2%. France shows orders up by 1.3% annualized in Q3 while Italy’s orders are up at a strong 13.3%.

The EMU data reveal that domestic orders reported by the main 13-countires edged lower by 0.2%. The weakness in orders was concentrated in export orders where they dropped by 10%. We have been seeing consistent reports of weak export orders from those European countries that report them. So now the reports of weakness have hit the aggregated EMU figures.

This slowing adds to the reversals we have seen already in the FLASH PMI report (for Sept) from NTC/Reuters. The weakness in July sales is somewhat apparent in consumer goods where EU sales are off by 0.4% in July. Capital and intermediate goods are not yet showing ill effects on their sales from overall weak orders, at least not in July. The temporal shifting in many of these reports makes it harder to nail down the picture since orders sound alike they are more in vanguard than the PMI barometers but the PMI data are in fact fresher by TWO FULL MONTHS. Still, what we find is that foreign orders are dropping, domestic orders have weakened and there is a loss in industrial momentum ahead of the problems initiated in US financial markets and before the recent run-up in the Euro Vs the dollar. More of this bad news may therefore lie ahead. It’s no wonder that there are all sorts of cautionary statements about the strong Euro and its risk being bandied about.

| E-zone and UK Industrial Orders & Sales Trends | ||||||||

|---|---|---|---|---|---|---|---|---|

| Saar except m/m | % m/m | Jul-07 | Jul-07 | Jul-07 | Jul-06 | Jul-05 | ||

| E-zone Detail | Jul-07 | Jun-07 | May-07 | 3-Mo | 6-mo | 12-mo | 12-mo | 12-mo |

| MFG Orders | -4.0% | 4.5% | 1.4% | 7.0% | 7.8% | 8.0% | 9.8% | 3.7% |

| MFG Sales | 0.2% | 1.0% | 0.7% | 7.8% | 6.5% | 7.0% | 7.6% | 3.5% |

| Consumer goods | -0.4% | 0.5% | 0.4% | 1.9% | 2.5% | 3.9% | 7.6% | 3.5% |

| Capital goods | 0.9% | 0.4% | 0.4% | 7.3% | 7.3% | 8.5% | 4.1% | 2.0% |

| Intermediate goods | 0.2% | 1.0% | 0.7% | 9.0% | 10.1% | 7.8% | 6.8% | 3.1% |

| MFG Orders | ||||||||

| Total Orders | -4.0% | 4.5% | 1.4% | 7.0% | 7.8% | 8.0% | 9.8% | 3.7% |

| E-13 Domestic MFG orders | -0.2% | 1.7% | 0.6% | 9.0% | 10.1% | 7.8% | 8.8% | 1.2% |

| E-13 Foreign MFG orders | -10.0% | 8.5% | 3.5% | 4.3% | 7.9% | 8.4% | 10.1% | 6.2% |

| Countries: | Jul-07 | Jun-07 | May-07 | 3-Mo | 6-mo | 12-mo | 12-mo | 12-mo |

| Germany: | -7.2% | 4.8% | 3.2% | 1.5% | 8.3% | 6.9% | 9.7% | 8.0% |

| France: | -2.9% | 3.4% | 3.1% | 14.6% | 4.9% | 15.5% | 2.6% | -0.5% |

| Italy: | -0.4% | 2.5% | 2.5% | 20.3% | 19.5% | 7.9% | 8.7% | 8.1% |

| UK: | 20.2% | 0.0% | -0.7% | 103.8% | 62.6% | 26.0% | -0.8% | 0.7% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.