Global| Nov 13 2007

Global| Nov 13 2007Economic Sentiment Among the German Financial Community Takes a Tumble in November

Summary

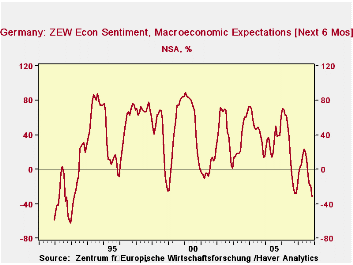

After remaining steady in October at -18.1%, the ZEW indicator of economic sentiment among institutional investors and analysts for the next 6 months took a tumble in November, falling sharply to -32.5%. The decline brought the [...]

After remaining steady in October at -18.1%, the ZEW indicator of economic sentiment among institutional investors and analysts for the next 6 months took a tumble in November, falling sharply to -32.5%. The decline brought the indicator to its lowest value since February 1993. (The history of this indicator is shown in the first chart.)

The indicator is a percent balance measure, that is, it measures the difference between those participants who are optimistic and those who are pessimistic. In October, the pessimists outweighed the optimists by 32.5%. The indicator is based on the qualitative assessments of the participants regarding the macro economic outlook, the inflation rate, short and long term interest rates, the stock market and exchange rates. The decline in sentiment reflects the deterioration that has been taking place in most of these components. The continuing uncertainty regarding the magnitude and spread of the sub prime mortgage collapse in the U. S. has been a major depressant, but other factors have also contributed to the decline in sentiment. Inflation has been rising and in October was 2.45% compared with 1.65% in January. During the time that the survey took place--October 29 to November 12, the Euro rose 7.23% from $1.3596 to $1.4579. The Frankfurt Xetra Dax (12/31/87=1000) stock market index declined 2.5% during this same time. The second chart shows the year over year changes in the daily figures for the Euro and the Dax stock market index from late October to date, roughly the time during which the survey took place.

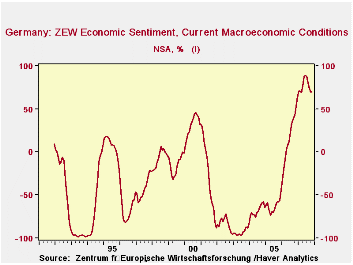

In contrast to their pessimistic views about the next six

months, investors and analysts continue to view current conditions very

favorably with the optimists outweighing the pessimists by 70%, one of

the highest balances on record. The third chart shows the history of

the indicator of current conditions.

| ZEW INDICATOR OF ECONOMIC SENTIMENT (% Balance) | Nov 07 | Oct 07 | Nov 06 | M/M Dif | Y/Y Dif | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|

| Macro Expectation (Next 6 Months) | -32.5 | -18.1 | -28.5 | -14.4 | -4.0 | 22.3 | 34.8 | 44.6 |

| Current Economic Conditions | 70.0 | 70.2 | 53.0 | -0.2 | 17.0 | 18.3 | -61.8 | -67.7 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates