Global| Oct 18 2011

Global| Oct 18 2011Economic Sentiment Of The German Financial Community Wanes

Summary

The ZEW Sentiment indicator represented by the economic expectations among institutional investors and analysts declined 5.0 percentage points in October to -48.3, close to the levels last seen in the 2008 recession. This was the [...]

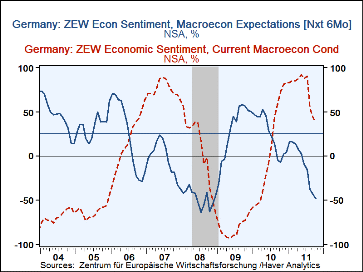

The ZEW Sentiment indicator represented by the economic expectations among institutional investors and analysts declined 5.0 percentage points in October to -48.3, close to the levels last seen in the 2008 recession. This was the eighth month of decline from the recent peak of 15.7 reached in February of this year. Although the indicator of current conditions is still positive, it too, has trended downward since May of this year. The two indicators are shown in the first chart together with the long term average--25.3--of the expectations indicator and the shading for the 2008 German recession.

During the period in which the survey was taking place--October 4th to October 17th--the the finance ministers and central bankers of the Group of 20 discussed various proposals for addressing the Euro Debt Crisis and urged the leaders of the Euro Area to formulate a plan that would begin to resolve some of these problems at their October 23rd summit meeting. Among the problems before the Summit are the recapitalization of Europe's banks, how to structure the EFSF (European Financial Stability Facility) and a deeper restructuring of Greek Debt. Meanwhile, the realization that any such plan could not be formulated without extensive and time consuming discussions has grown and may have led to the increase in pessimism about expectations among the participants in the ZEW survey.

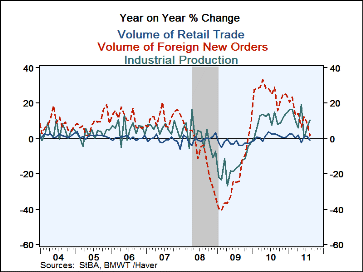

While the economic expectations indicator is at levels last seen in the depth of the 2008 recession, the current conditions indicator is at about the same level reached at the beginning of the 2008 recession. Signs of a slowdown in current activity have occurred in recent months in retail trade, foreign domestic orders and industrial production as can be seen in the second chart. Growth in industrial production, however, recovered in August. The year to year growth was 10.53%. Foreign new orders have taken a bigger blow. The year to year growth was only 1.46% in August, compared to mostly double digit growth in the past year or so. The year to year change in retail sales was negative, a decline of 1.02% in August.

| ZEW Indicators (% bal) | Oct 11 |

Sep 11 |

Aug 11 |

Jul 11 |

Jun 11 |

May 11 |

Apr 11 |

Mar 11 |

Feb 11 |

|---|---|---|---|---|---|---|---|---|---|

| Economic Expectations | -48.3 | -43.3 | -37.6 | -15.1 | -9.0 | 3.1 | 7.6 | 14.1 | 15.7 |

| Current Conditions | 38.1 | 43.6 | 53.5 | 90.6 | 87.6 | 91.5 | 87.1 | 86.4 | 85.2 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates