Global| Jan 15 2021

Global| Jan 15 2021Empire State Manufacturing Index Declines in January

Summary

• Empire State Business Conditions Index decreases to 3.5 in January; fourth consecutive monthly decay. • ISM comparable series edges up to 53.0 from 52.9. • Expectations index falls to 31.9 from 36.3. The Empire State Manufacturing [...]

• Empire State Business Conditions Index decreases to 3.5 in January; fourth consecutive monthly decay.

• ISM comparable series edges up to 53.0 from 52.9.

• Expectations index falls to 31.9 from 36.3.

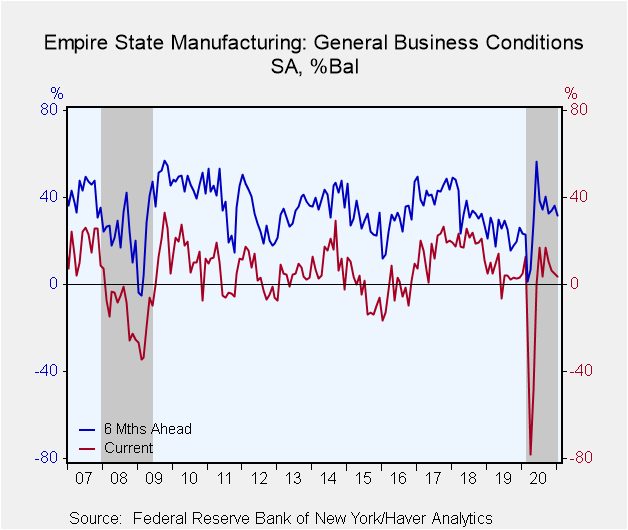

The Empire State Manufacturing Index of General Business Conditions decreased to 3.5 in January from 4.9 in December. This is the fourth consecutive monthly decline, and the lowest level since June, though the above zero reading suggest continued, albeit slower growth in activity. While the share or respondents expecting improving and worsening conditions both rose – to 26.6% and 23.1% respectively – the share expecting decreasing conditions rose more. The Action Economics Forecast Survey expected a reading of 5.6. The Empire State data, reported by the Federal Reserve Bank of New York, reflect business conditions in the manufacturing sector in New York, northern New Jersey and southern Connecticut.

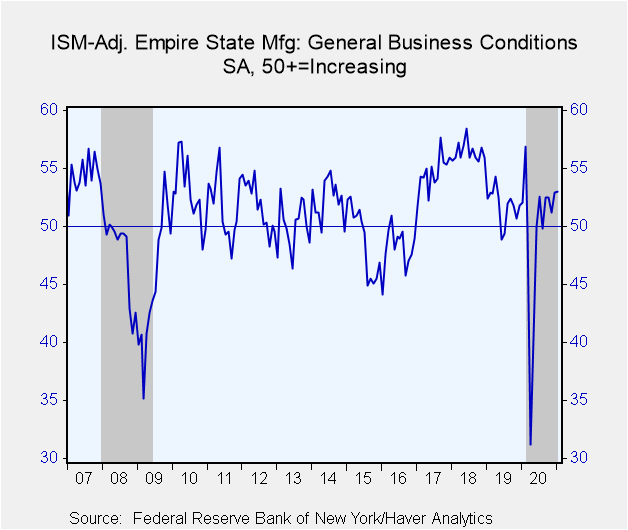

The headline measure is constructed from the answer to a single question on business conditions. Haver Analytics calculates a seasonally adjusted index that is comparable to the ISM series. The calculated figure edged up to from 53.0 in January from 52.9.

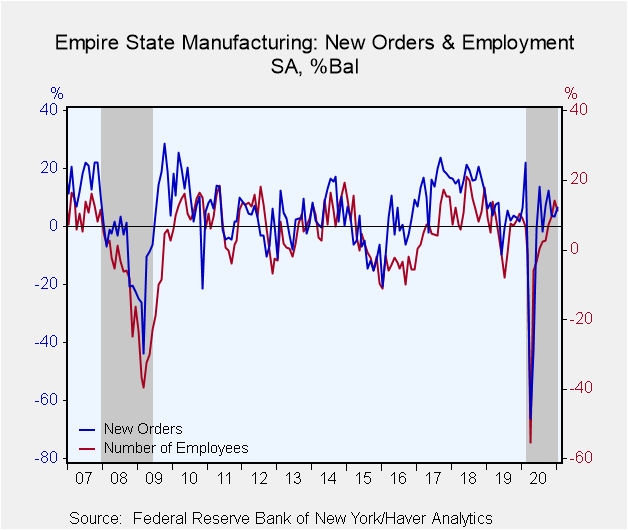

Three of the five production measures improved, most notably the new orders index which rose to 6.6 from 3.4. Meanwhile, the shipments reading fell to 7.3 from 12.1. The employment index decreased to 11.2 from 14.2 as the share of respondents reporting increased employment, declined to 20%, while the share reporting decreasing employment rose to 8.8%.

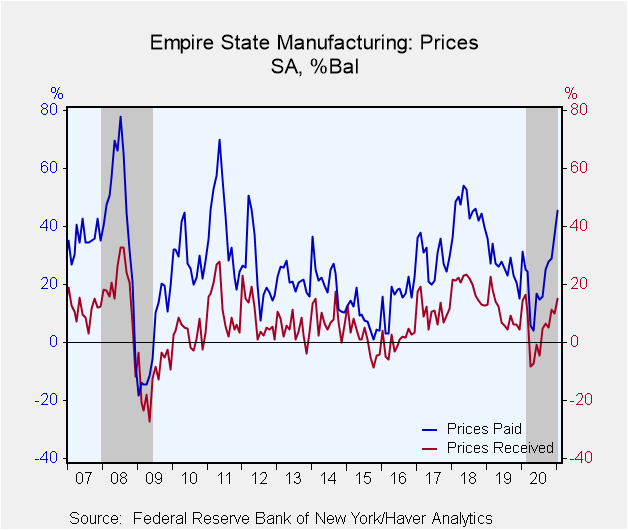

The prices paid index jumped to 45.5 from 37.1, its highest level since September 2018, as 46.2% of respondents indicated increased prices, while just 0.7% reported a decrease. Prices received rose to 15.2, the strongest reading since February 2020.

The series measuring expectations for business conditions in six months declined to 31.9 its lowest level since May 2020.

The Empire State figures are diffusion indexes, which are calculated by subtracting the percent of respondents reporting declines from those reporting gains. The data are available in Haver's SURVEYS database. The ISM-adjusted headline index dates back to 2001. The Action Economics Forecasts can be found in Haver's AS1REPNA database.

| Empire State Manufacturing Survey | Jan | Dec | Nov | Jan'20 | 2020 | 2019 | 2018 |

|---|---|---|---|---|---|---|---|

| General Business Conditions (Diffusion Index, %, SA) | 3.5 | 4.9 | 6.3 | 4.8 | -5.9 | 4.8 | 19.7 |

| General Business Conditions Index (ISM Adjusted, >50=Increasing Activity, SA) | 53.0 | 52.9 | 51.2 | 52.1 | 49.3 | 51.8 | 56.4 |

| New Orders | 6.6 | 3.4 | 3.7 | 6.6 | -4.3 | 3.3 | 16.4 |

| Shipments | 7.3 | 12.1 | 6.3 | 8.6 | -0.2 | 10.5 | 20.3 |

| Unfilled Orders | -5.5 | -3.6 | -11.9 | -2.7 | -7.7 | -6.0 | 3.5 |

| Delivery Time | 5.5 | 4.3 | 0.7 | -2.7 | 2.7 | -0.1 | 9.1 |

| Inventories | -0.7 | -4.3 | -8.6 | -0.7 | -3.9 | -0.9 | 5.9 |

| Number of Employees | 11.2 | 14.2 | 9.4 | 9.0 | -1.2 | 5.4 | 12.3 |

| Average Employee Workweek | 6.3 | 4.8 | 4.8 | 1.3 | -6.9 | 2.3 | 7.8 |

| Prices Paid | 45.5 | 37.1 | 29.1 | 31.5 | 21.5 | 26.3 | 45.8 |

| Prices Received | 15.2 | 10.0 | 11.3 | 14.4 | 4.8 | 10.3 | 19.3 |

| Expectations 6 Months Ahead | 31.9 | 36.3 | 33.9 | 23.6 | 29.7 | 23.9 | 35.2 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates