Global| Mar 15 2018

Global| Mar 15 2018Empire State Manufacturing Index Rebounds

Summary

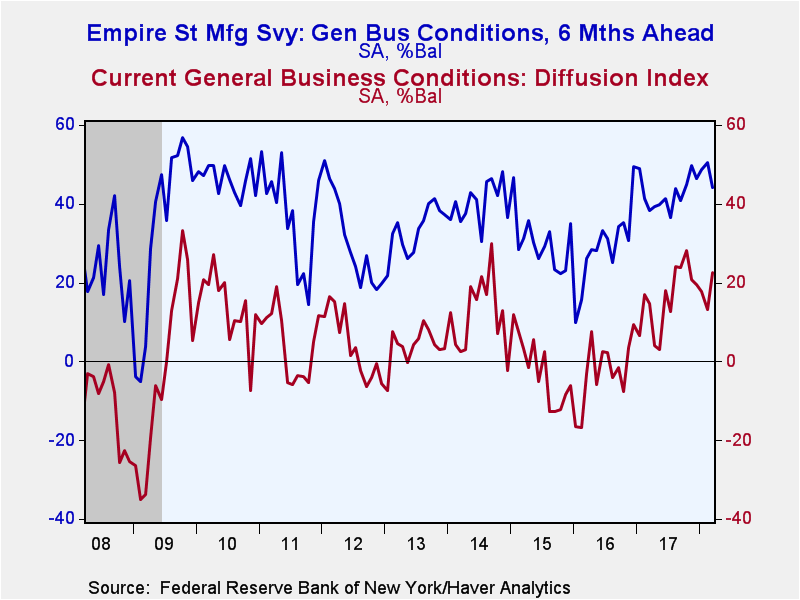

The Empire State Manufacturing Index of General Business Conditions jumped 9.4 points in March to 22.5 from 13.1 in February. This reading was well above the median expectation of 15.0 from the in the Action Economics Forecast Survey. [...]

The Empire State Manufacturing Index of General Business Conditions jumped 9.4 points in March to 22.5 from 13.1 in February. This reading was well above the median expectation of 15.0 from the in the Action Economics Forecast Survey. These data, reported by the Federal Reserve Bank of New York, reflect business conditions in New York, northern New Jersey and southern Connecticut.

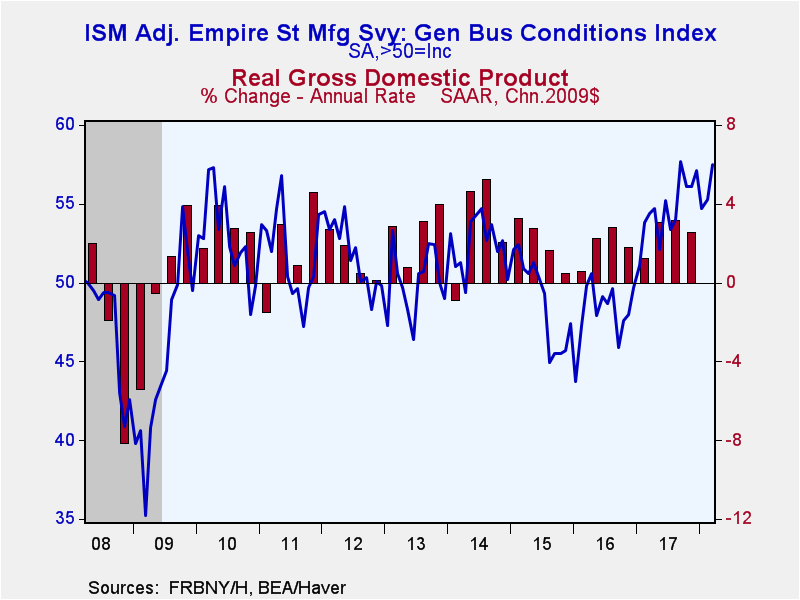

Eight out of the nine individual indices increased in March. Based on some of these measures, Haver Analytics calculates a seasonally adjusted index that is comparable to the ISM series. The calculated figure rose to 57.5 from 55.3. During the last ten years, the index had a 69% correlation with the quarter-on-quarter change in real GDP.

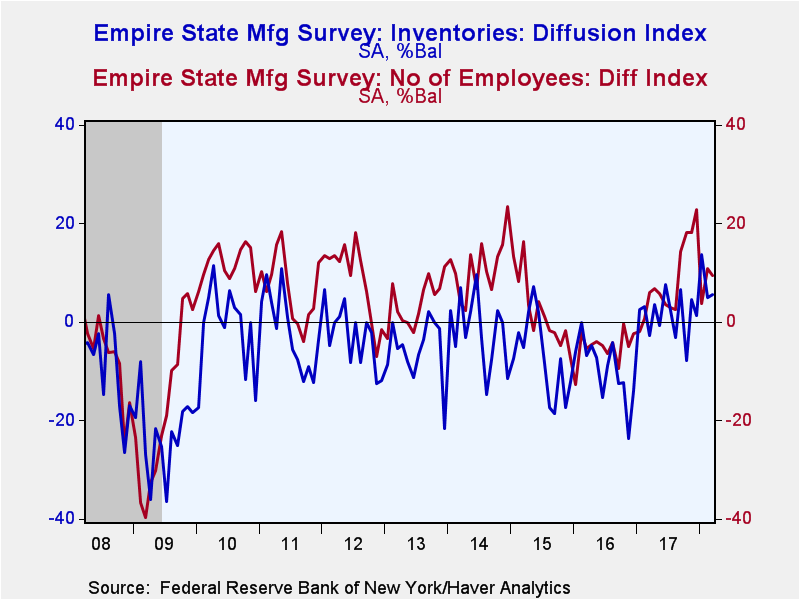

The number of employees was the only index which deteriorated, declining to 9.4, though this followed a healthy gain in February. During the last ten years, there has been a 77% correlation between the employment index and the month-on-month change in factory sector payrolls. While 25.8% of respondents reported a higher payroll level - up from 18.9% - 16.4% reported a lower level, up from 8.0% in February. The employee workweek reading increased to 5.9 from 4.6.

The new orders index rose to 16.8 in March from 13.5, while shipments more than doubled to 27.0 from 12.5. This is the highest level of shipments since October 2009. Delivery times jumped to 16.2 from 11.1, just besting the previous record of 16.1 in April 2017. The volatile inventories index edged up to 5.6.

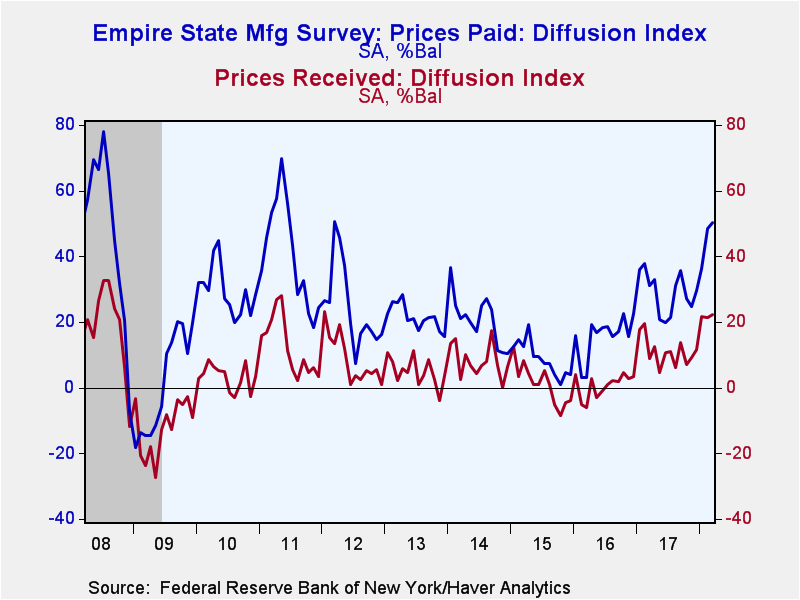

The prices paid index continued its steady climb, up 1.7 to 50.3, its highest level since March 2012. Fifty-three percent of respondents indicated increased prices, while just three percent reported a decrease. Prices received rose 0.9 to 22.4, its peak since January 2012.

Despite the increased optimism about current conditions, expectations of business conditions dropped to 44.1 in March from 50.5 in February. Expectations of new orders, shipments, unfilled orders, delivery times, average workweek, capital expenditure and technology spending showed declines. Prices paid and received, inventories, and the number of employees were expected to improve.

The Empire State figures are diffusion indexes, which are calculated by subtracting the percent of respondents reporting declines from those reporting gains. The data are available in Haver's SURVEYS database. The ISM-adjusted headline index dates back to 2001. The Action Economics Forecasts can be found in Haver's AS1REPNA database.

| Empire State Manufacturing Survey | Mar | Feb | Jan | Mar'17 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|

| General Business Conditions (Diffusion Index, %, SA) | 22.5 | 13.1 | 17.7 | 14.6 | 16.1 | -2.6 | -2.3 |

| General Business Conditions Index (ISM Adjusted, >50=Increasing Activity, SA) | 57.5 | 55.3 | 54.7 | 54.4 | 54.6 | 48.2 | 48.8 |

| New Orders | 16.8 | 13.5 | 11.9 | 17.4 | 14.6 | -0.8 | -5.6 |

| Shipments | 27.0 | 12.5 | 14.4 | 13.0 | 15.9 | 1.9 | 4.0 |

| Unfilled Orders | 12.7 | 4.9 | 4.3 | 14.2 | 1.9 | -8.8 | -10.5 |

| Delivery Time | 16.2 | 11.1 | 3.6 | 10.6 | 6.1 | -4.8 | -5.3 |

| Inventories | 5.6 | 4.9 | 13.8 | -2.7 | 1.5 | -9.6 | -7.1 |

| Number of Employees | 9.4 | 10.9 | 3.8 | 6.0 | 8.3 | -5.1 | 2.3 |

| Average Employee Workweek | 5.9 | 4.6 | 0.8 | 6.3 | 4.9 | -5.2 | -4.8 |

| Prices Paid | 50.3 | 48.6 | 36.2 | 31.0 | 29.0 | 15.7 | 8.8 |

| Prices Received | 22.4 | 21.5 | 21.7 | 8.8 | 11.0 | 0.7 | 1.2 |

| Expectations 6 Months Ahead | 44.1 | 50.5 | 48.6 | 38.3 | 42.6 | 29.0 | 30.3 |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates