Global| May 28 2013

Global| May 28 2013EMU-Era Low in French Confidence

Summary

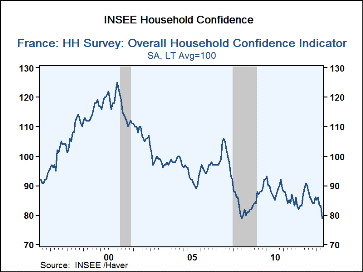

Household confidence in France took a sharp step down in May dropping to a level of 79 from a level of 83 in April. The drop this month in the INSEE survey index has fallen to its lowest level since the monetary union was formed. [...]

Household confidence in France took a sharp step down in May dropping to a level of 79 from a level of 83 in April. The drop this month in the INSEE survey index has fallen to its lowest level since the monetary union was formed. That's right, the index has tied its recession low of the current cycle in what is supposed to be a recovery.

Household confidence in France took a sharp step down in May dropping to a level of 79 from a level of 83 in April. The drop this month in the INSEE survey index has fallen to its lowest level since the monetary union was formed. That's right, the index has tied its recession low of the current cycle in what is supposed to be a recovery.

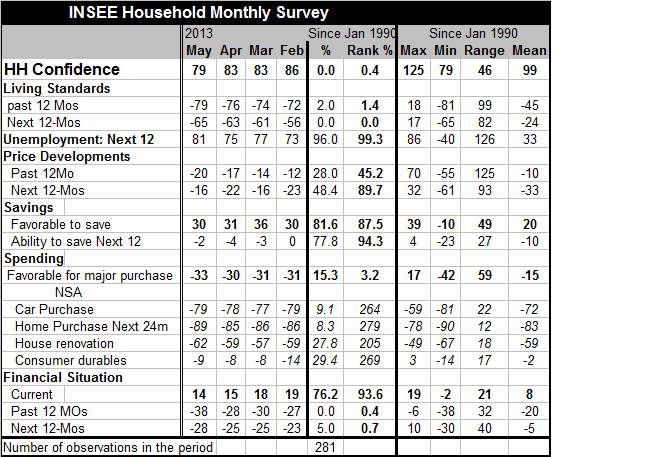

Households assess their living standards as in the bottom 2% of their historic percentiles and queue standings. Looking ahead over the next 12 months both the percentile and the queue standings of the responses being given for expected living standards are the worst ever. Unemployment expectations for the next 12 months are ranked worse than this only 0.7% of the time. The raw percentile reading for expected unemployment stands in the top 4% of its historic range.

Price developments are somewhat worrisome; over the past 12 months the ranking for price developments is the 45th percentile of its historic queue that's pretty much a middle of the pack finding; but looking ahead to next 12 months the standing is in the 89th percentile.

The environment, however, has been favorable for savings: that reading stands in the top 13% of its historic queue. The forward assessments of the ability to save are in the top 6% of their historic queue. The assessments for spending are commensurately worse: the spending environment is thought to be in the bottom 3% of its historic queue, worse only about 3% of the time. The financial situation currently and as expected is abysmal. Both readings, for the past and future financial situation put the historic queue rankings in the bottom 1% of their respective ranges.

There have been a lot of things said about the French economy and while there are some expectations that perhaps the slowdown there has been nearing its end, consumers appear to feel that extremely harsh conditions are expected as conditions are going to worsen.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates