Global| Jun 23 2014

Global| Jun 23 2014EMU Gets a Setback; France Lags Badly

Summary

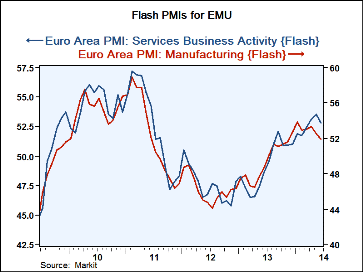

The overall EMU private sector activity index fell in June, dropping for the second month in a row. Both manufacturing and services components weakened although each continued to show expansion in its respective sector. Germany's [...]

The overall EMU private sector activity index fell in June, dropping for the second month in a row. Both manufacturing and services components weakened although each continued to show expansion in its respective sector.

The overall EMU private sector activity index fell in June, dropping for the second month in a row. Both manufacturing and services components weakened although each continued to show expansion in its respective sector.

Germany's private sector index fell relatively sharply in June, dropping to an eight-month low. France's overall index was down to 48.0, below 50 for two months running. Indeed, the French flash index has been below the level of 50 in 24 of its past 28 observations. It was last weaker four months ago.

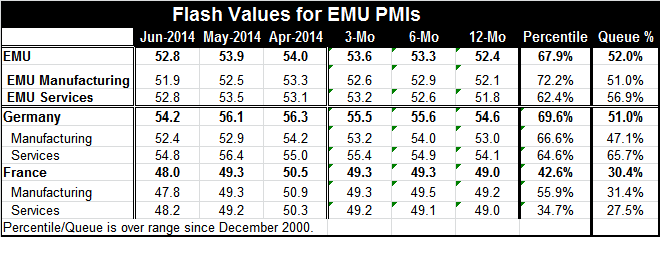

The main source of EMU weakness appears to be in manufacturing. For the EMU-wide figures, the averages from 12-months to six-months to three-months are steadily getting better for the services sector despite the drop off in June. However, for manufacturing progression, the trend-to-better readings stop at six months as the three-month value drops. German progressions see the exact same pattern as manufacturing slips in its three-month average compared to its six-month average while services trends press higher throughout. France sees the same misstep in manufacturing (on much smaller steps) as its services sector executes a series of improving averages on the thinnest of margins. Moreover, France shows figures averaging below 50 on each of its quarterly averages for each sector.

While there is a theme of services continuing to improve, it is barely in play in France. France is showing contraction overall as in each sector, manufacturing and services.

The queue percentile standings show us that for EMU the overall gauge stands above its midpoint (5%) at a level of 52%. The services sector is a relatively stronger on a relative to trend basis at its 56th percentile reading, compared to manufacturing at its 51st percentile. While the German overall PMI is higher than for EMU, it is nonetheless relatively weaker relative to its own history standing in the 51st percentile of its historic queue (compared to 52% for EMU). Moreover the German manufacturing sector is relatively weak; its queue standing puts it at its 47th percentile, below its historic median. Services in Germany are by contrast very strong; their queue standing is in the 65th percentile. France by comparison is in terrible shape. Its overall PMI stands only in its 30th percentile, well below its median value and well below the levels we see for Germany and the EMU as a whole. Moreover, France flips the queue standing for manufacturing and services as the French services standing at the 27th percentile is lower than manufacturing which stands in the 31st percentile. For France, the domestic sector appears to be relatively weaker than the tradable goods sector, manufacturing.

Since France is the second largest economy in the EMU area, this kind of weakness is a real problem for the European Central Bank. France's domestic weakness is a hard thing to re-stimulate. France has been under the burden of an austerity program to keep its debt-to-GDP ratio in check; it is skating close to the edge to keep that ratio contained. So France does not have any extra latitude to jolt its economy to stronger growth. France's current PMI ratios not only are weak (below 50, indicating contraction) but their momentum is poor.

We have been chronicling the difficulties of the euro area all through the crisis. This uneven growth is not new. It is not new to see that France is lagging. But most troublesome is how badly France continues to be lagging compared to the EMU average. That means that if ECB policy is aimed at the average, it will fall well short of France's needs. As we explained above, France has no room for extra fiscal stimulus. Since there is not fiscal sharing in the EMU, there is no opportunity for funds from any other region to help France. France would appear to be in a very difficult spot right now and the euro area is right there with it. Moreover, France is not Greece; France is the second largest economy in the euro area.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.