Global| Sep 27 2013

Global| Sep 27 2013EMU Gets Better...But

Summary

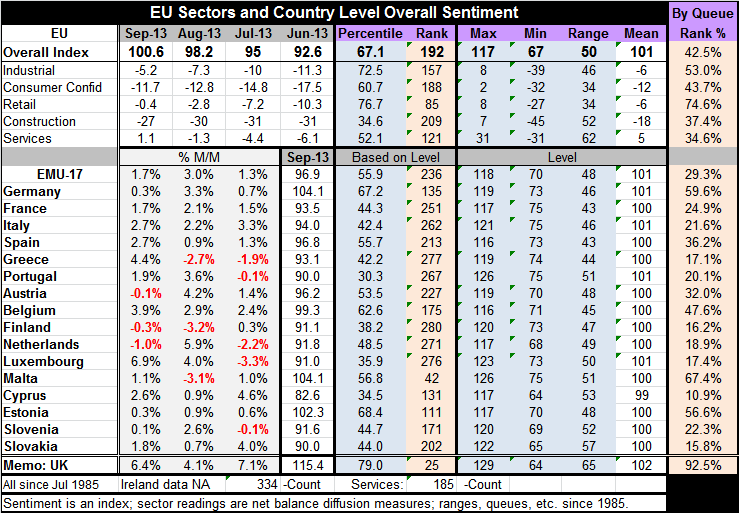

European Union's overall consumer sentiment index improved in September to 100.6 from 98.2. The reading was last stronger in March 2011 at a level of 102.6. Of the 18 European Union countries that report separate sentiment indices, [...]

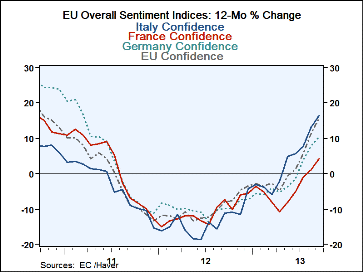

European Union's overall consumer sentiment index improved in September to 100.6 from 98.2. The reading was last stronger in March 2011 at a level of 102.6. Of the 18 European Union countries that report separate sentiment indices, only three fail to show improvements in September, only three failed showed improvement in August, and all but five EU nations showed improvements in July. Clearly improvement is the most common trend across the European Union and the trend itself has been improving. But.is that enough? Recall the inequality: improvement ? sustained improvement.

European Union's overall consumer sentiment index improved in September to 100.6 from 98.2. The reading was last stronger in March 2011 at a level of 102.6. Of the 18 European Union countries that report separate sentiment indices, only three fail to show improvements in September, only three failed showed improvement in August, and all but five EU nations showed improvements in July. Clearly improvement is the most common trend across the European Union and the trend itself has been improving. But.is that enough? Recall the inequality: improvement ? sustained improvement.

The UK is leading the show with extremely strong gains in readings in each of the last three months. Conditions in the UK are doing so well that Mark Carney, the head of the Bank and of England, has said that no more QE is needed for now. but he suggests that if there were weakening it could still implement more.

While the breath of Europe's improvement is impressive, the levels of the sentiment indicators for the monetary union as a whole and for individual countries continue to signal ongoing weak conditions. For example, the indicator for the overall union is lower than its current reading only about 29% of the time. The German reading is lower only about 60% of the time (queue ranking) making its current reading a top 40% observation- and that is the second best in EMU. If I were teaching and this were the best grade in the class it would be a `D'. Within the monetary union only tiny Malta is relatively better at the 67th percentile of its historic queue (a "D-plus'). EU member, the UK, has been stronger less than 8% of the time. It shows the best economy of the lot right now. These measures count from 1985, or from the EMU formation, or by country, when the individual country surveys began.

The message from the European Union and the monetary union is that conditions are improving over quite a number of countries but many of them are still pretty far behind. Cyprus's indicator is still in the lower 11% of its range. Slovakia is in the bottom 16% of its range along with Finland. Greece and Luxembourg are in the bottom 17 percentile of their respective ranges; The Netherlands is in the lower 19 percentile of its range. Portugal is in the lower 20th percentile of its range. Italy is in the lower 22 percentile of its range along with Slovenia and so on. Ten countries (out of eighteen) present sentiment indicators that are in the lower 25th percentile of their historic queue of readings. That means for these countries conditions historically have been better 75% of the time - or more. For some of them that means nearly 90% of the time things were the better. How happy are they with monetary union membership?

The report we issued yesterday that looked at the developments in monetary growth and credit growth in the monetary union was considerably less upbeat than the data in this report. What's true is that the economy in Europe is improving. Everybody wants to jump on the improving European bandwagon touting everything from optimism to investment themes. However, not only do the data show that Europe has a long way to go (and that could be a very good thing for people who want to explore the investment themes) but it has not yet achieved conditions necessary to make the current improvement sustainable. (And that's where the risk lies.)

It's a bit like pushing your car up in icy slope in the winter. If you make progress in moving the car up the hill you can look back with some degree of satisfaction. But you can't let up; you can't stop pushing. When you push a car up in icy slope there is just no stopping until you reach the top because of the threat of backsliding. EMU countries continue to make progress, but there is still the risk of backsliding.

The German elections are out of the way; it may be possible for Europe to look a little bit more clearly and at its future without the contamination of politics. On the other hand, there is still a lot left to do and, in the wake of greater political certainty, there continues to be substantial certainty about existing divisions within Europe on how to proceed. In addition as the rankings of the sentiment indicators clearly shows, countries are in very different positions cyclically. This means that they will have different priorities in terms of where to start, how to start, how fast to go, and (of course) WHERE to go...

After the abject pessimism that pervaded Europe in the depths of its crisis it's not surprising to see optimism blooming now that the crisis has its worst moments put in the past, and with Europe having survived as a single unit. However, like the guy pushing the car up the slippery slope, the job is not done. And this is where I urge caution.

Europe continues to have big banking sector problems. As we have seen, economic growth is beginning to spread but money growth remains weak and credit growth is still contracting. Credit growth is not just weak- credit is shrinking! That's no basis for sustainable growth. Optimism requires a better foundation than this. Having a bright view on these fundamentals is more like dreaming than optimism. Perhaps it's okay to be optimistic but to realize that it is too early to be engaging in European investment themes without a clear notion of the risk involved. Europe still has a long way to go and the pitfalls along the road are many.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates