Global| Sep 14 2007

Global| Sep 14 2007EMU Headline Inflation Moves Lower as Core Moves Higher: Fiddle Dee Dee?

Summary

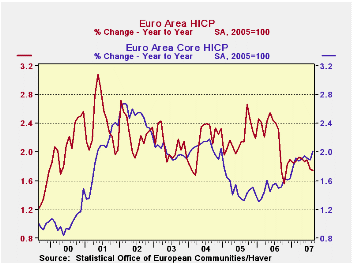

The table below flags higher period to period inflation with a red number. Cleary inflations acceleration is not a broad trend although the Y/Y pace for the core is up compared to last month (chart) and compared to its pace of one [...]

The table below flags higher period to period inflation with a red number. Cleary inflation’s acceleration is not a broad trend although the Y/Y pace for the core is up compared to last month (chart) and compared to its pace of one year ago (table). And inflation is up steadily and significantly for services; services make up a large portion of CPI prices. Goods inflation in the Euro area saw prices drop by 3.8% helping to contain the pressures from services prices. Still, services prices have accelerated steadily over six months compared to a year ago and over three months compared to six months. Surely equilibrium for this economy will not come with goods prices falling by nearly 3% at an annual rate. This brings to light the tenuous battle among the forces of inflation and deflation in the Euro area. While inflation trends are good for the month, the core rate is up over its 2% threshold and even though the core itself is not formally accelerating (in its sequential growth rates in the table) we can see a lot of pressures of various sorts pent up in the Euro area (goods Vs services) and evident in the Yr/Yr inflation plot, with the core accelerating and doing so ON TREND.

The continued rise in the euro could help to keep goods prices weak for some time, but the cauldron of brewing service sector inflation will not be much affected by that. We have already heard calls for FX intervention from one ‘wiseman’ in Germany (Bofinger) drawing attention to the adverse growth consequences of the strengthening euro. While most eyes are on the weakening dollar, it is the strengthening Euro that is doing the most damage. It will play a role in Euro area growth as well as in its inflation dynamics, a more problematic role, perhaps if the euro stops its rise and backtracks. That could put inflation back over the top of its range and the put the ECB on the hot seat at the same time the euro’s past strength has undermined growth.

| % mo/mo | % saar | ||||||

| Aug-07 | Jul-07 | Jun-07 | 3-Mo | 6-Mo | 12-Mo | Yr Ago | |

| EMU-13 | 0.0% | 0.1% | 0.2% | 1.4% | 2.2% | 1.7% | 2.3% |

| Core | 0.2% | 0.1% | 0.1% | 1.7% | 2.0% | 2.0% | 1.5% |

| Goods | 0.0% | -1.0% | 0.0% | -3.8% | 2.4% | 1.2% | 2.5% |

| Services | 0.2% | 0.8% | 0.2% | 5.0% | 3.8% | 2.6% | 1.9% |

| HICP | |||||||

| Germany | -0.1% | 0.2% | 0.2% | 1.2% | 1.8% | 2.0% | 1.7% |

| France | 0.3% | 0.0% | 0.2% | 2.3% | 2.7% | 1.3% | 2.1% |

| Italy | 0.2% | -0.1% | 0.3% | 1.5% | 1.6% | 1.7% | 2.3% |

| Spain | 0.0% | 0.2% | 0.3% | 2.0% | 2.7% | 2.2% | 3.8% |

| Core ex Food, Energy and Alcohol | |||||||

| Germany | 0.1% | 0.2% | 0.1% | 1.6% | 1.8% | 2.2% | 0.8% |

| France | 0.3% | 0.0% | 0.1% | 1.9% | 2.0% | 1.6% | 1.4% |

| Italy | 0.2% | 0.0% | 0.1% | 1.2% | 1.6% | 1.9% | 1.6% |

| Spain | 0.3% | 0.2% | 0.2% | 2.8% | 2.4% | 2.5% | 3.1% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates