Global| Dec 14 2007

Global| Dec 14 2007EMU Inflation Surges as Core Dallies Over Top-Allowed Pace

Summary

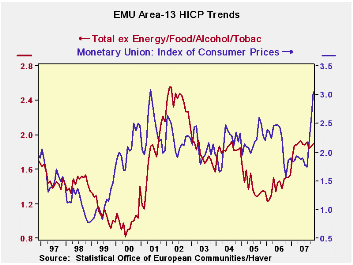

The inflation trends tell the story. It’s a clear story of angst at the ECB. The sequential growth rates (3Mo Vs 6Mo Vs 12Mo) show a steady quickening of the pace of inflation in the more recent time periods. Over 12 months (ECB’s [...]

The inflation trends tell the story. It’s a clear story of

angst at the ECB. The sequential growth rates (3Mo Vs 6Mo Vs 12Mo) show

a steady quickening of the pace of inflation in the more recent time

periods. Over 12 months (ECB’s preferred horizon) three of our four key

EMU countries show ex food ex energy and ex alcohol inflation at a pace

above the ECB ceiling. Over the more recent periods that situation has

only gotten worse. As to headline inflation: forget about it. The

history on the graph on the let shows that once headline inflation

spurts the core rise usually follows in a year or so. The year 2005 was

an exception when the core fell by itself. There is nothing automatic

about headline-> core inflation transmission. But there is

enough correlation to make the ECB’s fears of second or third round

effects real. On top of that the current core pace is simply

unacceptable.

If the multi-central bank dollar credit facility is

‘successful’ it could hasten the time when the ECB hikes rates. Whether

that widens interest differentials with the US depends on whether US

circumstances normalize and whether such normalization brings with it a

rebalancing of the economy (where consumer confidence is sagging so

badly and in a way that it does not appear to be wholly determined by

credit market issues).

While the credit turmoil, crisis, scam or whatever you may

want to call it, is a real and essentially global phenomenon, it is not

the only concern in town. And that applies to the evolution of European

growth as well as in the US. In Europe arguably much of the outlook

hangs in the balance on what the euro does from here on out. What

inflation does and how the ECB responds to it will be a large par of

that.

| Trends in HICP | |||||||

|---|---|---|---|---|---|---|---|

| % mo/mo | % saar | ||||||

| Nov-07 | Oct-07 | Sep-07 | 3-Mo | 6-Mo | 12-Mo | Yr Ago | |

| EMU-13 | 0.7% | 0.4% | 0.4% | 6.1% | 3.7% | 3.1% | 1.9% |

| Core | 0.3% | 0.3% | 0.2% | 3.4% | 2.5% | 2.3% | 1.6% |

| Goods | 1.0% | 0.8% | 1.0% | 11.8% | 3.7% | 3.4% | 1.7% |

| Services | -0.1% | 0.0% | -0.5% | -2.4% | 1.2% | 2.5% | 2.1% |

| HICP | |||||||

| Germany | 0.9% | 0.2% | 0.7% | 7.1% | 4.1% | 3.3% | 1.5% |

| France | 0.8% | 0.2% | 0.1% | 4.6% | 3.4% | 2.6% | 1.6% |

| Italy | 0.3% | 0.7% | 0.3% | 5.1% | 3.3% | 2.5% | 2.1% |

| Spain | 0.8% | 0.7% | 0.4% | 7.4% | 4.7% | 4.1% | 2.7% |

| Core Excl Food Energy & Alcohol | |||||||

| Germany | 0.4% | 0.2% | 0.3% | 3.5% | 2.5% | 2.4% | 1.1% |

| France | 0.3% | 0.2% | 0.1% | 2.6% | 2.3% | 1.9% | 1.4% |

| Italy | 0.2% | 0.5% | 0.4% | 4.3% | 2.7% | 2.2% | 1.8% |

| Spain | 0.3% | 0.7% | 0.2% | 4.9% | 3.9% | 3.3% | 2.7% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.