Global| Oct 16 2007

Global| Oct 16 2007EMU Inflation Trends a Narrow Line

Summary

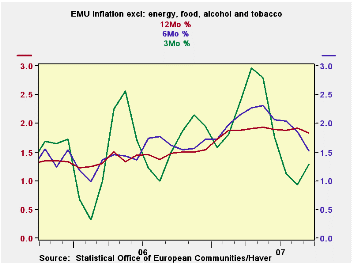

The inflation trends for EMU-13 core inflation excluding sin (alcohol and tobacco) shows a fairly well-behaved series. The six-month rate of inflation on this basis is still diving with the recent six-month pace at about 1.5%. Three- [...]

The inflation trends for EMU-13 core inflation excluding sin (alcohol and tobacco) shows a fairly well-behaved series. The six-month rate of inflation on this basis is still diving with the recent six-month pace at about 1.5%. Three-month inflation is even lower, below 1.5% but with some upward pressure. Year-over-year, core -X-sin inflation has plateaued and is showing signs of turning lower. These trends are at odds with the headline HICP which has popped up above the 2% mark, something the ECB will not like.

Over 12 months most of the main EMU indexes are over 2% and the two main EMU countries have headlines and core inflation rates pacing above 2% over the last 12 months. But the three-month inflation trends do NOT echo these pressures.

While the 12-month rates get most of the headlines the shorter-term gauges give us a better sense of what is happening now at the cost of somewhat greater volatility (less reliability). All of this is subverted, however, by the recent and new spurt in energy prices. Crude oil at $88/bbl poses some additional upside risks and could wreak havoc on existing trends - even core trends.

But what are these pressures? In the case of a product with inelastic demand like oil, the pressures are two fold. There is pressure on prices. But there is also an impact on consumer budgets, since inelastic demand that consumers cannot easily shift away form this item with its rising cost. Energy conservation is a concept that plays out over years and only prices are perceived to have risen and to have become sticky at a high point bringing about an economy wide response (demand side and supply side). And that is why oil prices, as well as being inflationary, are also deflationary.

As consumers commit more of their limited resources to energy, they have less to devote to other types of spending. In Europe with the euro running up at the same time, there is some respite from oil prices since oil is priced in dollars and the euro’s strength is keeping that cost pressure at bay. But the depressing impact of the euro mingles with whatever energy trends seep through.

For this reason Europe does not have the same degree of inflation risk as the dollar area, but even there inflation strains are not showing through. The dominant themes seem to be ‘things that subvert growth’. And that is the thing to watch in the months ahead more than the trend of the HICP, although money and credit growth trends will also continue to keep the ECB on edge.

| % mo/mo | % saar | ||||||

| Sep-07 | Aug-07 | Jul-07 | 3-Mo | 6-Mo | 12-Mo | Yr Ago | |

| EMU-13 | 0.4% | 0.0% | 0.1% | 1.8% | 2.5% | 2.1% | 1.7% |

| Core | 0.2% | 0.2% | 0.1% | 2.1% | 2.0% | 2.0% | 1.5% |

| Goods | 1.0% | 0.0% | -1.0% | 0.1% | 2.2% | 1.9% | 1.6% |

| Services | -0.5% | 0.2% | 0.8% | 1.8% | 2.5% | 2.5% | 2.0% |

| HICP | |||||||

| Germany | 0.7% | -0.1% | 0.2% | 3.1% | 3.1% | 2.6% | 1.0% |

| France | 0.1% | 0.3% | 0.0% | 1.8% | 2.7% | 1.6% | 1.5% |

| Italy | 0.3% | 0.2% | -0.1% | 1.5% | 1.7% | 1.8% | 2.3% |

| Spain | 0.4% | 0.0% | 0.2% | 2.3% | 2.8% | 2.7% | 2.9% |

| Core:xFE&A | |||||||

| Germany | 0.3% | 0.1% | 0.2% | 2.4% | 2.6% | 2.3% | 0.8% |

| France | 0.1% | 0.3% | 0.0% | 2.0% | 2.0% | 1.6% | 1.2% |

| Italy | 0.4% | 0.2% | 0.0% | 2.3% | 1.8% | 1.8% | 2.0% |

| Spain | 0.2% | 0.3% | 0.2% | 3.0% | 2.7% | 2.6% | 3.0% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.