Global| Aug 05 2009

Global| Aug 05 2009EMU Retail and Auto Sales: the Good and the Ugly

Summary

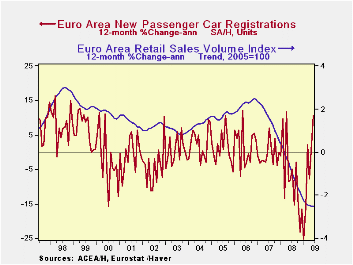

Sales fall -Retail sales fell in the Zone in June. While the growth rat of sales is not decaying further, retail sales volumes have been dropping at a pace of -2.5% to -2.2% over the past twelve months. The year-over-year pace for [...]

Sales fall -Retail sales fell in the Zone

in June. While the growth rat of sales is not decaying further, retail

sales volumes have been dropping at a pace of -2.5% to -2.2% over the

past twelve months. The year-over-year pace for retail sales seems to

have finally stopped falling, based on the trend in the chart above.

The Good and Ugly of it all - Europe has

not suffered the same sort of spurt in the rate of unemployment that we

have in the US. But its level of unemployment remains high and it has

become even more elevated than it was. Consumer confidence has been hit

and consumers, even though better supported in Europe than in the US by

government programs, have cut back spending. Various programs in Europe

to spur auto sales have been successful as the auto registration data

show. So even as retail sales volumes shrink there is a bright spot in

the retail sector even if it is one aided by government actions. It is

always good to see that when given an incentive the consumer can and

does respond – that is not always the case.

Underlying trends are improving - The PMI

index from Markit on the service sector shows some improvement in the

service sector but not much. Services has improved to a reading of

44.82 in may then they slipped to 44.65 in June and in July they have

risen to 45.69. German showed a rather sharp rise in July along with

Italy while France has back-slipped in July along with Spain. The UK,

an EU member not an EMU member, has just posted its third reading in a

row above 50 for services and is the only large EU country showing

service sector expansion.

Trends that matter are more favorable -

Since most of the jobs are in services and since jobs determine

spending we can be encouraged about prospects for retail sales progress

from these developments. Retail sales remain the back bone of GDP

growth.

| Euro Area Retail Sales Volume | ||||||

|---|---|---|---|---|---|---|

| M/M | Saar | |||||

| Jun-09 | May-09 | Apr-09 | 3-Mo | 6-MO | 12-Mo | |

| Euro Area Total | -0.2% | -0.2% | -0.2% | -2.2% | -2.5% | -2.5% |

| Food, Beverages, Tobacco | -0.1% | -0.1% | -0.2% | -1.8% | -2.1% | -2.1% |

| Registrations: | ||||||

| Motor Vehicle Registration | 6.4% | 2.3% | 6.3% | 79.6% | 45.1% | 10.6% |

| Non-Food Country Detail: Volume | ||||||

| Germany | -1.8% | -1.3% | 1.4% | -6.9% | -5.5% | -1.9% |

| UK(EU) | 1.2% | -1.0% | 0.8% | 4.0% | 1.3% | 2.8% |

| The EA 13 countries are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Slovenia | ||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates