Global| Feb 05 2008

Global| Feb 05 2008EMU Retail Sales Sink…Again

Summary

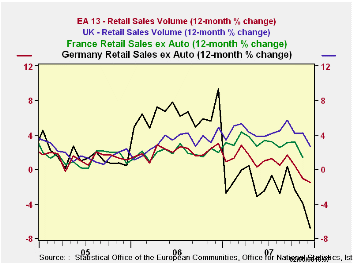

EMU retail sales are doing badly. German sales look worse than they are in the yr/yr graph due to the comparison with the December base in 2006 just ahead of the introduction of the VAT hike in 2007. That pushed activity into Dec of [...]

EMU retail sales are doing badly. German sales look worse than they are in the yr/yr graph due to the comparison with the December base in 2006 just ahead of the introduction of the VAT hike in 2007. That pushed activity into Dec of 2006 and robbed it from early 2007. Still on shorter horizons Euro retail sales are not doing well as the growth rate in the table reminds us. Moreover German sales are doing really poorly even without suing a year/year comparison.

For the quarter-to-date EMU retail sales volumes are dropping at a 4.3% annual rate. Food is off at a 3.1% pace, and no food purchases are falling at a 4.5% pace. Germany leads this quarter–to-quarter weakness with a sales volume drop for nonfoods of 10.5%. That compares to a rise at a 2.6% pace in France and a rise in the UK (an EU, not EMU, country) of 3.1%.

What is worst is that the progressive growth rates (12-Mo to 6-Mo to 3-Mo) show that a slowing is underway in the Euro Area as well as in Germany, in Italy, in the UK and partly for France.

While the raw results for December and the fourth quarter are disquieting, the ongoing trend decline in retail sales volumes is even more disturbing. We cannot yet tell if the manufacturing sector will remain strong enough to hold growth aloft or if this weakness in the consumer sector is enough to drag the EMU economics lower.

It is hard to tell how much special factors like the strong euro or the weak finical sector or whatever drove the January services PMI lower might be responsible. What is clear is that there is more weakness in train than we had previously thought and it is showing up in various places at slightly different times.

| Dec-07 | Nov-07 | Oct-07 | 3-Mo | 6-MO | 12-Mo | |

| Euro Area (13) Total | -0.1% | -0.7% | -0.6% | -5.4% | -1.8% | -1.5% |

| Food | 0.0% | -1.0% | -0.4% | -5.3% | -1.6% | -1.6% |

| Non food | -0.1% | -0.4% | -0.8% | -5.3% | -2.0% | -1.4% |

| Textiles | #N/A | -0.5% | -3.1% | -6.3% | 3.9% | -0.2% |

| Household goods | #N/A | -0.7% | -0.5% | -9.9% | -1.2% | -2.4% |

| Books news, etc | #N/A | -0.1% | 0.2% | -1.6% | 2.8% | 0.9% |

| Pharmaceuticals | #N/A | 0.2% | 0.3% | 4.2% | 3.7% | 3.7% |

| Other Nonspecial goods | #N/A | -0.6% | 0.1% | 0.0% | 1.0% | -1.1% |

| Mail Order | #N/A | -1.1% | -1.1% | -8.2% | -4.1% | -2.3% |

| Non-food Country detail: Volume | ||||||

| Germany | 0.7% | -1.0% | -2.4% | -10.2% | -4.7% | -6.3% |

| France | 0.7% | -0.2% | 0.4% | 2.6% | 4.0% | 3.8% |

| Italy (Total, Value) | #N/A | -1.0% | 0.6% | -4.0% | -2.5% | -2.9% |

| UK(EU) | -0.1% | 0.4% | 0.1% | 1.5% | 3.4% | 4.0% |

| Shaded areas calculated on a one-month lag due to lagging data | ||||||

| The EA 13 countries are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal, Slovenia | ||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.