Global| Jun 18 2014

Global| Jun 18 2014EMU's Construction Sector Lags and Weakens

Summary

The construction sector in the European Monetary Union backtracked in May. The index which already signaled contraction slipped to a weaker 43.3 in May from 44.4 in April. Diffusion indices signal expansion when their values exceed 50 [...]

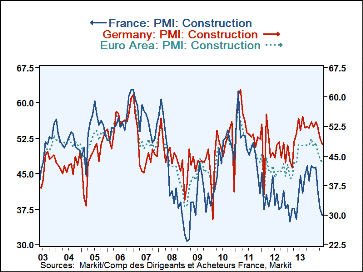

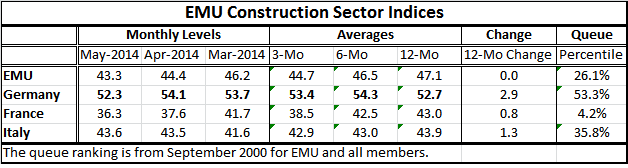

The construction sector in the European Monetary Union backtracked in May. The index which already signaled contraction slipped to a weaker 43.3 in May from 44.4 in April. Diffusion indices signal expansion when their values exceed 50 and contraction when they fall short of 50. The EMU construction sector was last above 50 in April 2011. The three-month drop in the construction PMI is its 19th largest three-month drop since September 2000, a period of 165 months. Drops larger than this occur only 11% of the time; however, there were only nine episodes of drops larger than this (large drops tend to be clustered).

The construction sector in the European Monetary Union backtracked in May. The index which already signaled contraction slipped to a weaker 43.3 in May from 44.4 in April. Diffusion indices signal expansion when their values exceed 50 and contraction when they fall short of 50. The EMU construction sector was last above 50 in April 2011. The three-month drop in the construction PMI is its 19th largest three-month drop since September 2000, a period of 165 months. Drops larger than this occur only 11% of the time; however, there were only nine episodes of drops larger than this (large drops tend to be clustered).

The German construction sector PMI has been above 50 since July 2013. Germany is also the only one of the big three EMU economies whose construction index stands above the 50th percentile of its historic queue. Italy stands in the lower 35th percentile of its queue and France stands at an extremely low 4.2 percentile. The French construction sector gets weaker than it is in May less than 4% of the time. For all of EMU, helped by the strong German reading, the percentile standing is in the 26th percentile of its historic queue (back to September 2000). Obviously, this sector is the Achilles heel of European growth. Consider these metrics: since October 2009, the German construction sector has been expanding 68% of the time; the French sector has been expanding 25% of the time; and the Italian sector has been expanding only 5.4% of the time. The EMU-wide construction sector has been expanding 7.2% of the time.

The construction sector PMI is considerably weaker in the EMU than either the manufacturing PMI or services PMI.

Despite low interest rates and an ongoing program by the European Central Bank to try to stimulate lending, the construction sector in the EMU is moribund. Even Germany reached its peak reading of this cycle in January of 2014 and has since lost ground.

The French reading exceeded 50 for a time in 2011, indicating some expansion in the sector. But then the index edged below 50, hitting a new local low of 37.4 in February 2012. It stumbled even somewhat lower before recovering and rallied to a reading of 46.7 in December 2013. The French construction PMI struggled to hold near that level until April 2014, when it took its most recent series of steps down. In the last three months, the French construction index has fallen by over 10 PMI points. That is a sharp collapse from an already weak level. This drop is a sad indictment of conditions in the euro area and especially in France; it's the second-largest EMU economy and its construction sector is doing very badly. It is difficult to put full stock in the recovering PMI gauges for services and manufacturing when the construction sector is unraveling so sharply. Clearly, France is still struggling but so are the construction sectors in the other large economies.

Italy is another weak case. Its construction sector last poked its head above the 50 level in March 2011. The Italian index then slipped and recovered to a local peak of 46.9 in June 2013. Like France, albeit to a lesser degree, the Italian construction sector, too, has been slipping.

The German construction sector, while doing as well as it is in relative terms, reached a local peak at 56.5 in January 2014 and has been slipping since.

Still, over 12 months the German index shows the greatest lift, a rise of 2.9 points. Over that same period France, despite its recent drop, has gained 0.8 points and Italy has gained 1.3 points. The EMU construction sector has been flat over the last 12 months.

The ongoing weakness in the construction sector is another reminder to put the gains in the services and manufacturing sectors aside to some extent. There is some recovery in the EMU and as we can see by any `indicator du jour' it is always better in Germany. But the rest of the euro area is struggling mightily. The degree of disinflation, especially in peripheral economies, is a testament to that. Europe has a long way to go to get back to normalcy. The construction sector has even farther to go.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates