Global| May 04 2011

Global| May 04 2011EMU Services Sag

Summary

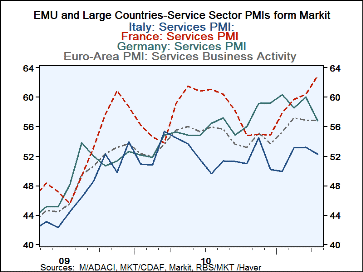

The EMU services sector took a step back in April and sets up just below its standing in February. The service sector in France is still pushing ahead for improvement; Spain's index while still below its February standing rose in [...]

The EMU services sector took a step back in April and sets up just below its standing in February. The service sector

in France is still pushing ahead for improvement; Spain's index while still below its February standing rose in April.

The EMU services sector took a step back in April and sets up just below its standing in February. The service sector

in France is still pushing ahead for improvement; Spain's index while still below its February standing rose in April.

For EMU and Germany the standings of the current services index between its high/low readings is at about the 80th percentile. For France this standing is near the 90th percentile. Italy and Spain are near their respective 60th percentiles.

The service sector is the jobs-producing sector. It has recovered despite this month's set-back. But it has not recovered fast enough to boost consumer confidence significantly. Consumer confidence is strong only in German where it lies in the 83rd percentile of its range in April. For the whole of the Euro-Area the standing is in the 61st percentile. But for the next strongest large country reading, after Germany, the metric drops to the 50th percentile for Spain, the 45th percentile in France and to the 17th percentile in Italy. In the UK, an EU member, confidence stands in the 28th percentile.

As we saw earlier this week the manufacturing sectors are doing relatively better across EMU. But the service sector while improving has lost ground this month and is lagging behind. Jobs gains are not coming fast enough in most EMU members- Spain continues to post extremely high levels of unemployment. Amid these conditions with inflation said to be too-high by the ECB interest rates have risen and are expected to rise again soon. The euro exchange rate has risen sharply too and that casts a pall over MFG in the weaker EMU nations that are struggling more with their competitiveness.

| Various Looks at the UK, EU and EMU Services Sector | |||||||

|---|---|---|---|---|---|---|---|

| Apr-11 | Mar-11 | Feb-11 | 3Mo | 6Mo | 12Mo | %-ile | |

| Euro-Area | 56.73 | 57.16 | 56.75 | 56.88 | 56.04 | 55.58 | 80.9% |

| Germany | 56.82 | 60.06 | 58.58 | 58.49 | 59.03 | 57.36 | 78.9% |

| France | 62.94 | 60.41 | 59.73 | 61.03 | 58.46 | 58.96 | 89.7% |

| Italy | 52.20 | 53.26 | 53.07 | 52.84 | 52.17 | 51.80 | 57.4% |

| Spain | 50.43 | 48.70 | 50.85 | 49.99 | 48.96 | 49.39 | 68.0% |

| Ireland | #N/A | 51.15 | 55.07 | #N/A | #N/A | #N/A | #N/A |

| EU only | |||||||

| UK (CIPs) | #N/A | 57.11 | 52.60 | #N/A | #N/A | #N/A | #N/A |

| Percentile is over range since May 2000 | |||||||

| EU Commission Indices for EU and EMU | |||||||

| EU Index | Apr-11 | Mar-11 | Feb-11 | 3Mo | 6Mo | 12Mo | %-ile |

| EU Services | 7 | 10 | 10 | -11.00 | -10.67 | -12.17 | 61.1% |

| EMU | Apr-11 | Mar-11 | Feb-11 | 3Mo | 6Mo | 12Mo | %-ile |

| Services | 10 | 11 | 11 | 10.67 | 10.17 | 7.08 | 61.7% |

| Cons Confidence | -12 | -11 | -10 | -11.00 | -10.67 | 0.67 | 61.1% |

| Consumer Confidence by Country | |||||||

| Germany-Ccon | 8 | 9 | 9 | 8.67 | 9.33 | 4.33 | 93.2% |

| France-Ccon | -19 | -18 | -20 | -19.00 | -18.50 | -19.08 | 45.0% |

| Ital-Ccon | -26 | -24 | -24 | -24.67 | -24.17 | -23.08 | 17.1% |

| UK-Ccon | -24 | -22 | -24 | -23.33 | -21.17 | -17.58 | 28.9% |

| Percentile is over range since May 2000 | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates