Global| Oct 18 2007

Global| Oct 18 2007EMU Trade Surplus Grows as Imports Steady and Exports Accelerate

Summary

European trade is proving to be resilient in the face of a strongly rising euro currency. Some of this is undoubtedly the reflection of true strength, but some is also the acumen of the European exporters who have learned to use [...]

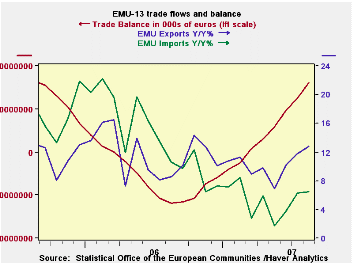

European trade is proving to be resilient in the face of a strongly rising euro currency. Some of this is undoubtedly the reflection of true strength, but some is also the acumen of the European exporters who have learned to use markets to hedge and some perhaps to giving back some profit margins as the euro puts an increasingly strong squeeze on margins and makes even hedging less of a dodge for foreign exchange rate induced pressures. Euro area data show that foreign orders have been slipping and remarks by policymakers and businesses leaders indicate that businesses are feeling the pinch. So far the data only show that exports are not just growing but also accelerating. Imports have slowed and that is particularly clear in the six-month growth rates. Over three months both exports and imports are locked into some real strength. The growing surplus is again poised to augment EMU growth in Q3.

| m/m% | % Saar | ||||

| Aug-07 | Jul-07 | 3M | 6M | 12M | |

| Balance* | €€ 4,345 | €€ 809 | €€ 3,301 | €€ 3,650 | €€ 2,679 |

| Exports | |||||

| All exports | 4.9% | -0.9% | 28.9% | 11.9% | 12.8% |

| Food and drinks | 2.8% | 2.5% | 36.5% | 10.7% | 13.4% |

| Raw materials | -0.6% | -1.5% | 0.4% | 9.5% | 12.6% |

| MFG | 2.8% | -0.3% | 26.1% | 6.3% | 11.5% |

| Imports | |||||

| All imports | 2.0% | 2.4% | 27.7% | 7.1% | 6.5% |

| Food and drinks | -0.1% | 0.7% | 22.7% | -2.7% | 6.2% |

| Raw materials | 0.2% | 2.3% | 19.5% | 2.1% | 6.1% |

| MFG | 0.5% | 1.5% | 23.3% | -0.8% | 8.7% |

| *Million Euros; mo or period average | |||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.