Global| May 31 2013

Global| May 31 2013EMU Unemployment Continues to Rise

Summary

Unemployment rates in April in the European Monetary Union continue to rise, as the overall EMU rate is moving up to 12.2% in April from 12.1% in March. The March rate was steady at the same pace as in February. Over three months the [...]

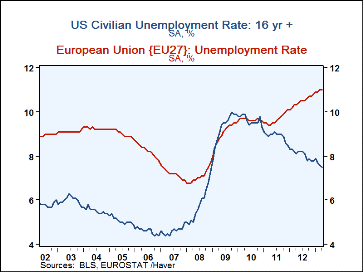

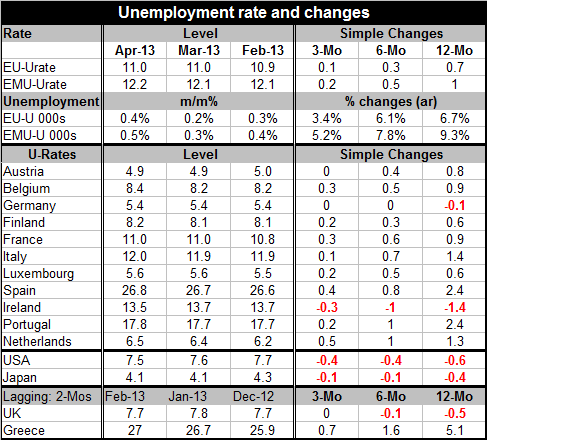

Unemployment rates in April in the European Monetary Union continue to rise, as the overall EMU rate is moving up to 12.2% in April from 12.1% in March. The March rate was steady at the same pace as in February. Over three months the EMU unemployment rate is up by 0.2%; over six months it's up by 0.5%; over 12-months it's up by 1.0%. By comparison with the Economic Union which contains the same EMU countries plus some that are not part of the exchange rate mechanism, the increases in unemployment over those horizons were lower in each case.

Unemployment rates in April in the European Monetary Union continue to rise, as the overall EMU rate is moving up to 12.2% in April from 12.1% in March. The March rate was steady at the same pace as in February. Over three months the EMU unemployment rate is up by 0.2%; over six months it's up by 0.5%; over 12-months it's up by 1.0%. By comparison with the Economic Union which contains the same EMU countries plus some that are not part of the exchange rate mechanism, the increases in unemployment over those horizons were lower in each case.

Of the 11 European countries named in the table six saw increases in their unemployment rates month-to-month in April only one of them, Ireland saw a decrease. Over three months eight of these countries have net increases in their rates of unemployment, again, Ireland is an exception with a sizable drop of 0.3 percentage points. Over six months all European countries the table show unemployment rate increases except Germany which is flat and Ireland the unemployment rate is down by 1%. Over 12 months we see that familiar pattern with all countries having a higher unemployment rate except Ireland where the rate falls by 1.4% in Germany with the rate tics down by 0.1%. Ireland has been the exception with a declining unemployment rate over the last year on a consistent basis although its rate of unemployment is still high: it has the third highest unemployment rate in the table despite its recent dropping trend. During this period when the European unemployment rates have risen, Germany's rate has been for the most part flat with one small net decline over 12 months.

When we compare the European countries in the table to the United States and Japan we see that the US rate has been falling rather consistently and even Japan has been able to reduce its rate which is extremely low by European standards. Moving to the bottom of the table, where the unemployment data lag for the UK and Greece, we see that Greek unemployment has continued to rise although data are only available through February. We also see that the UK, which is an EU member not in the EMU currency mechanism, has its unemployment rate net lower over six months and net lower by 0.5% over 12-months.

While European inflation has been modest and generally declining, in the current month there's been a slight increase in inflation for the European monetary zone as a whole. There is also evidence that bad weather may have been a factor at least in the German economy where retail sales have declined for the third consecutive month in the midst of extreme winter weather that has been unseasonably cold and rainy. Europe's growth indicator the euro coin index for May has dropped for the first time in nine months; it had last fallen in August 2012.

With Eurozone unemployment moving up to a new record we more easily understand why several European countries were the given a little bit more time to reach their austerity goals. And in data released today we see that Spain's current account has shifted into surplus in March on the back of imports which fell 13.5% and exports that backed off only slightly. So this is progress? A surplus is 'bought' at the cost of throttling growth? Economic activity in the Zone continues to be adversely impacted by austerity and when we compare the European Monetary Union countries to the Economic Union members who not currency union members, we see that the monetary union members having more trouble as they are burdened by the corset of the common currency. Also the US and Japan, that, of course, have different circumstances and independent monetary policies are doing generally much better than the European Monetary Union in their ability to reduce their unemployment rates.

Still unemployment is a thorny problem in this global economy where virtually all countries participated in the same world war are undergoing the same demographic developments. Technology that has brought labor saving methods to the market is adding its depressing effect to employment growth at the same time that the expansion of growth and export behavior in some key and very large developing economies has displaced labor in the developed countries of the West.

It's a time that would normally call for more vigor and growth but instead policymakers in the West did not position themselves well for this shock and it hit them while they were in a position of excess of debt. The decision to try to reduce debt in the midst of these pressures rather than to try to string along growth is one of the main factors that's behind the ongoing grind and rise in unemployment rates around the world. Supply can simply be generated with much greater facility and with less labor in this modern economy at a time that demand has been forcibly restricted by policy. The work around which has been the keep fiscal policy tight while stimulating monetary policy has been a little bit like putting your foot on the brake at the same time you put the other on the accelerator there has been a whole lot of noise but not a lot happened, by excesses are building and you really don't want to keep doing this. So far there is not much evidence that that's changing.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.