Global| Jan 31 2008

Global| Jan 31 2008EU and Country Level Confidence is Still Sinking

Summary

At 103.2, the EU confidence index fell by two points following a nearly one point drop in December. The sentiment index now resides at the border of the 70th percentile of its range since 1990. In absolute terms services and the [...]

At 103.2, the EU confidence index fell by two points following

a nearly one point drop in December. The sentiment index now resides at

the border of the 70th percentile of its range since 1990. In absolute

terms services and the industrial sector give the most lift to the

region. But once alternatively ranked within their own ranges (since

1990) the sectors are repositioned. The industrial sector becomes the

strongest residing in the 85th percentile of its range with

construction, a battered sector, still doing ‘relatively’ well in the

84th percentile of its range. While the service sector has a high raw

score, that is simply the nature of trend-dominated services. When

placed within its range, its relative contribution is much diminished.

At a percentile reading of 44.7% services in EU is the relative weakest

sector, followed by consumer confidence (58th percentile) and retailing

(66th percentile). So far only services are performing at a level that

is short of their usual mid-point. And the service sector is losing

momentum fast.

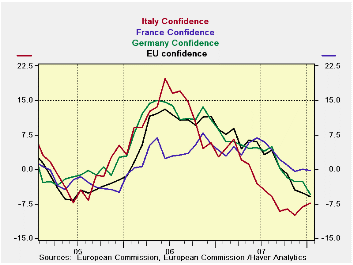

On a country level sentiment is near its range mid-point in

Italy (54.4 percentile) and Spain (46.5 percentile). Germany (58.4

percentile) and France are doing better than that but still are fading.

France, especially, is staying in its range’s 75th percentile. The UK,

an EU member, is also still strong in the 70th percentile of its range

for economic sentiment.

But make no mistake about it, the trends are poor. The

weakness extends back to about June. EMU sentiment has dropped (m/m) in

each of the past eight months. French and UK sentiment has dropped in

five of eight of those months. Spain’s sentiment fell in six of eight

months; Italy and Germany in seven of eight.

Over this period the EMU index has shed 9.9 points, Italy has

lost 10.4 points and the UK has dropped 9.4 points. German sentiment

dropped 8.5 points, Spain’s sentiment fell by 7.4 points and France’s

eroded by just 4.9 points.

From their cycle peaks, however, not just the past eight

months, Italy (-12.9) and Spain (-12.6) have made the largest drops

followed by the UK (-11.0). Germany (-8.5) and France have declined the

least with France’s cycle peak to current skid of 5.7 points being the

smallest among the largest EMU economies. Still, its momentum points

lower.

In various ways we can construct measures of country and sector weakness. It is clear that weakness is widespread across countries and regions in the e-Zone. It is not yet clear how far this trend to weakness will play out. But one very disturbing fact is the lack of participation in the recovery and outright weakness of the consumer and in retailing. Expansion cannot last without bringing the consumer along.

| EU Sectors and Country level Overall Sentiment | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| EU | Jan 08 |

Dec 07 |

Nov 07 |

Oct 07 |

%tile | Rank | Max | Min | Range | Mean | R-SQ w/ Overall |

| Overall | 103.2 | 105.8 | 106.6 | 108.8 | 69.9 | 81 | 116 | 73 | 43 | 100 | 1.00 |

| Industrial | 2 | 2 | 3 | 2 | 85.3 | 28 | 7 | -27 | 34 | -7 | 0.88 |

| Consumer Confidence | -10 | -7 | -7 | -5 | 58.6 | 97 | 2 | -27 | 29 | -10 | 0.83 |

| Retail | -3 | 2 | 4 | 2 | 66.7 | 49 | 6 | -21 | 27 | -6 | 0.46 |

| Construction | -4 | -3 | -1 | 0 | 84.4 | 27 | 3 | -42 | 45 | -17 | 0.43 |

| Services | 11 | 15 | 14 | 19 | 44.7 | 91 | 32 | -6 | 38 | 17 | 0.81 |

| % m/m | Based on Level | Level | |||||||||

| EMU | -1.6% | -0.7% | -1.2% | -0.8% | 65.1 | 91 | 117 | 73 | 44 | 100 | 0.94 |

| Germany | -1.9% | -0.3% | 0.2% | -0.7% | 58.4 | 83 | 121 | 79 | 42 | 99 | 0.65 |

| France | -0.8% | -1.6% | -0.5% | 0.5% | 75.4 | 54 | 119 | 72 | 47 | 100 | 0.79 |

| Italy | -1.3% | 2.3% | -4.2% | -0.2% | 54.4 | 112 | 121 | 71 | 50 | 100 | 0.78 |

| Spain | -1.6% | -1.4% | -0.1% | -2.7% | 46.5 | 182 | 118 | 67 | 51 | 100 | 0.65 |

| Memo: UK | -2.2% | -1.0% | -4.5% | -2.0% | 70.5 | 91 | 118 | 69 | 50 | 100 | 0.42 |

| Since 1990 except Services (Oct 1996) 208 | -Count | Services: | 126 | -Count | |||||||

| Sentiment is an index, sector readings are net balance diffusion measures | |||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates