Global| Jun 27 2019

Global| Jun 27 2019EU Commission Indexes Weaken for EMU

Summary

The EU commission index for the EMU fell to 103.3 in June; it was last weaker in August 2016 for one month and in 2016 March and April for two months. But it was last persistently weaker than this level from May 2011 through June 2015 [...]

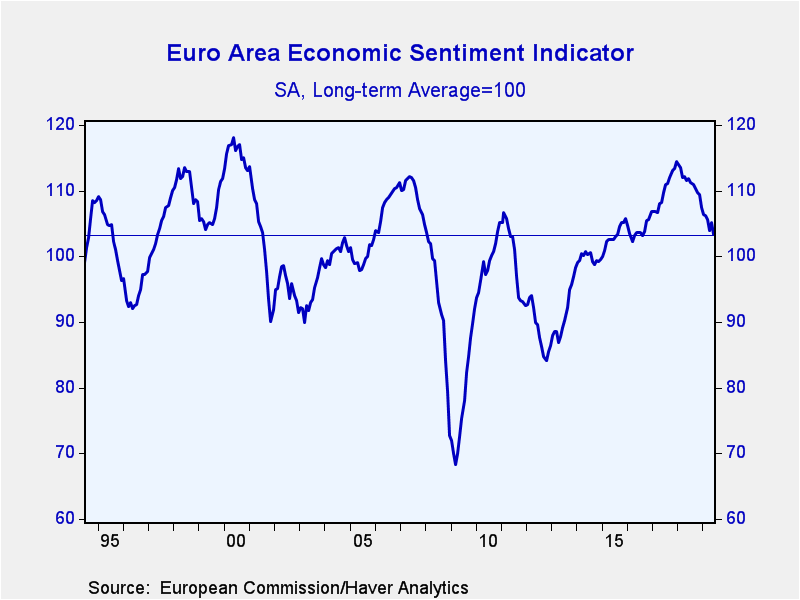

The EU commission index for the EMU fell to 103.3 in June; it was last weaker in August 2016 for one month and in 2016 March and April for two months. But it was last persistently weaker than this level from May 2011 through June 2015 when Europe fell into its economic black hole in the wake and turbulence of the global recession and its repercussions. This was the second dip since Europe made its primary reactive plunge from February 2008 through October 2010. The EMU then had a minor period of consolidation from November 2010 through April 2011 after which the second wave of weakness hit.

The EU commission index for the EMU fell to 103.3 in June; it was last weaker in August 2016 for one month and in 2016 March and April for two months. But it was last persistently weaker than this level from May 2011 through June 2015 when Europe fell into its economic black hole in the wake and turbulence of the global recession and its repercussions. This was the second dip since Europe made its primary reactive plunge from February 2008 through October 2010. The EMU then had a minor period of consolidation from November 2010 through April 2011 after which the second wave of weakness hit.

The graphic makes those previous declines clear and puts this month’s reading (with a reference line at 103.3) in a broader historic context. Graphically, the 103.3 reading takes the EMU index back to its last level of consolidation when the region was recovering from its second recession-induced dip.

The graphic makes those previous declines clear and puts this month’s reading (with a reference line at 103.3) in a broader historic context. Graphically, the 103.3 reading takes the EMU index back to its last level of consolidation when the region was recovering from its second recession-induced dip.

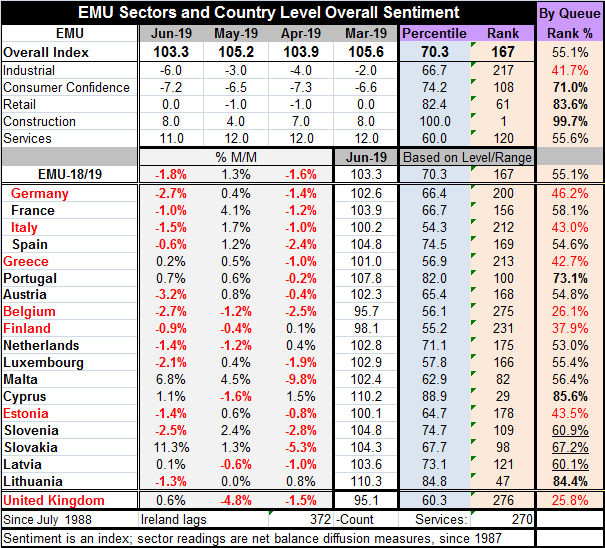

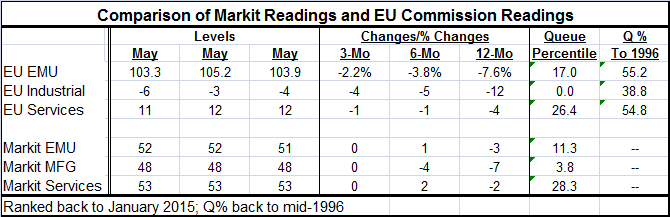

If we rank the EMU index and its industrial and services components back to January 2015, a period for which the Markit PMIs are widely available, we find very similar rankings for the industrial EU index and the manufacturing Markit index. Similarly on that timeline, the services sector rank is highly similar for the EU scheme and for Markit. We can be somewhat assured that the two surveys are measuring the same things. As the chart shows the comparison to data since 2015 makes a comparison versus a time when the EMU economy was quite strong. Assessing today’s levels by that standard will produce an unduly pessimistic result. The EU Commission index re-ranked on the long period since 1996 shows an overall ranking in the 55th percentile, a weak industrial reading in the 38th percentile, well below its historic median (which always lies at a rank of 50 in this framework), and a services ranking in the 54th percentile.

While the industrial and services sectors seem alarmingly weak on a scale derived since 2015, they are not so worrisome on a scale derived on data back to 1996 –although manufacturing is still quite adversely impacted.

June in Context

Turning back to the overall survey and to Table: EMU Sectors and Country Level Overall Sentiment, we find only 6 of 18 early reporting EMU members with sentiment readings that improve in June compared to May. After a sizeable improvement in May, June has brought a sizeable setback and one with substantial negative breadth.

As of June, only three of 18 EMU nations have queue standings on data back to late-1988 (where applicable) with readings in the top 30% of their historic queues of values. These include Lithuania and Cyprus (two countries with much shorter histories) and Portugal. On the other hand, there are six counties with rankings below their historic medians on this timeline and they include Germany, Italy, Greece, Belgium, Finland, and Estonia (Estonia has a shortened history). The United Kingdom, for the moment still an EU member, has a lower 25th percentile standing, although it improved on the month.

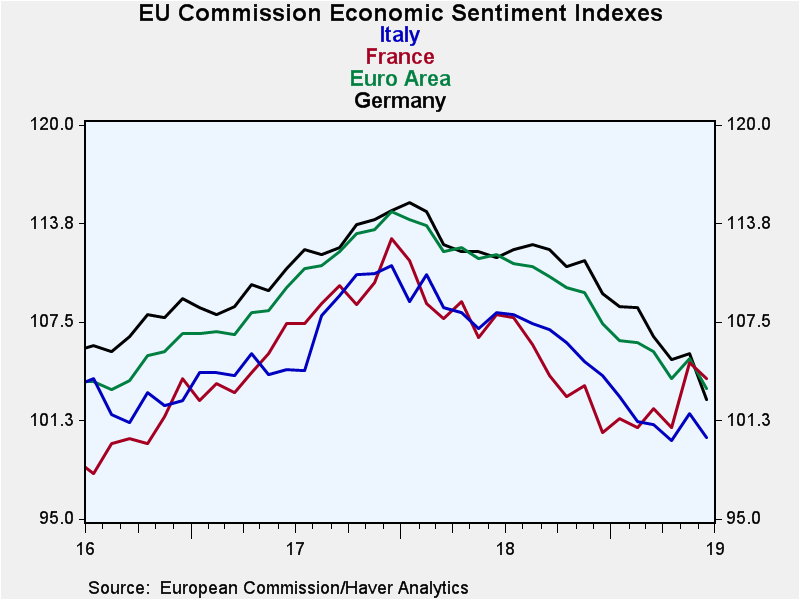

The last three months have made a great deal of weakness. The three-month moving average on the proportion of reporting EMU members with sentiment rising month-to-month has been around or below 40% with just a few exceptions since early-2018. From 2014 onward, the proportion was rising and usually around 50 working its way to 60% from late-2016 to late-2017. These pressures tend to come and go in waves. Right now the wave is growing for weakness.

By sector in June, there is a small improvement in retailing and a more substantial jump up in construction that takes that sector to an all-time high reading. But historically, retailing and construction have the lowest correlations with the headline. The services sector backed off in June to its lowest reading since January. The industrial reading fell sharply to -6 in June, its lowest reading since September 2013, from -3 in May. Consumer confidence also slipped to -7.2 from May’s -6.5, but still not back to its April low of -7.3. There were few scatter weaker readings in late-2018 as well; otherwise, the current spell of consumer confidence weakness was last worse in 2016 when a collection of weak confidence readings emerged.

On balance, the EU Commission survey shows a great deal of weakness and weakness that has spread across the EMU. However, its intensity is not focused except in the manufacturing sector and thus far services have proved resilient to the weakness in manufacturing. However, inflation in Germany is proving stubborn although it is still below the overall pace sought by the ECB for the whole of the EMU. Weakness not inflation remains as the number one concern in Europe. But since weakness is being transmitted through the manufacturing sector, all eyes are on the G20 meeting in Japan and anticipation is building for the Trump-Xi meeting scheduled for Saturday to discuss their ongoing conflict over trade.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.