Global| Feb 26 2009

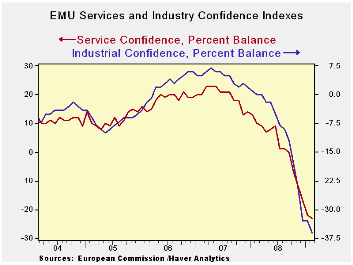

Global| Feb 26 2009EU/EMU Indices Crash Again In February

Summary

As the COIN index had predicted earlier in the week, the Euro area continues to labor under downward pressure in February. The sector indices for EU were mostly lower again in February as the EU sentiment index was at a new all-time [...]

As the COIN index had predicted earlier in the week, the Euro

area

continues to labor under downward pressure in February. The sector

indices for EU were mostly lower again in February as the EU sentiment

index was at a new all-time low, at 61. The EMU sentiment index was on

an all-time low as well. No EU sector looks to be anything other than

in bad shape. The best of the sectors (construction) was in the bottom

10 percentile of its range and it still dropped by two points in the

month of February. Retail sales did improve by one point in February to

rise to a reading of -24.

Without splitting hairs, the country indices for sentiment are

all very weak as well.

Looking a bit more closely at sector detail for industry, most

of

the components for this sector worsened on the month and worsened

sharply. For example order volume fell from -49 to -57. Export order

volume fell from a reading of -49 to -58. The production trend fell to

-47 from -39. Employment was trimmed slightly compared to those metrics

falling to -34 from -32. But then, employment does tend to lag other

measures. Germany, France, Italy, Spain and the UK each saw a further

deterioration in their industrial sectors in February.

Consumer confidence has spilled out to its lowest level in EU

history. Its details are not reassuring. Respondents put their

financial situation in the next 12-months in about the bottom 20th of

its historic range. The economic situation in the next 12-months, too,

is assessed as the worst ever. Expectations for unemployment are the

highest in the history of the survey. All this worsens as we realize

that respondents assess the past 12-months as the worst ever (since

1990). Clearly government support/stimulus programs are climbing up a

steep slope to reassure people.

Retailing is somewhat better across EU. Retail sentiment

components

are generally in the bottom 10% to 15% of their respective ranges. The

retail measure itself is in the bottom 7th percentile of its range and

rose by one point on the month. Retailing improved in three of five

major reporting EU nations, and one other country saw the sector’s

sentiment gauge unchanged in Feb.

The service sector index fell by one point in EU and it fell

across

its components save for current demand holding steady at a reading of

-19. Expected demand weakened by three points and both current and

expected employment gauges fell. All services indicators were at the

bottom of their respective all-time ranges. The five largest EU

countries all had service sectors that ranked at about the bottom 20th

percentile of their historic ranges.

The EU/EMU survey was uniformly weak again this month. There

is no

sign of stabilization but the rate of descent has slowed a bit in the

last few months. Since we are at all-time lows, that slowing is to be

expected. Still we don’t know if that slowing is for real, if the

slowing in the pace of the drop will reverse, or when the trend might

reverse. The forward-looking aspects of the various surveys are not

encouraging us to be optimistic.

| EU Sectors and Country level Overall Sentiment R-SQ | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| EU | Feb 09 |

Jan 09 |

Dec 08 |

Nov 08 |

Percentile | Rank | Max | Min | Range | Mean | w/ Overall |

| Overall | 61 | 63.2 | 66.6 | 73.5 | 0.0 | 220 | 116 | 61 | 55 | 99 | 1.00 |

| Industrial | -37 | -33 | -32 | -25 | 0.0 | 220 | 7 | -37 | 44 | -8 | 0.88 |

| Consumer Confidence | -32 | -31 | -28 | -24 | 0.0 | 220 | 2 | -32 | 34 | -11 | 0.85 |

| Retail | -24 | -25 | -25 | -18 | 3.2 | 218 | 6 | -25 | 31 | -6 | 0.60 |

| Construction | -38 | -36 | -32 | -28 | 8.9 | 206 | 3 | -42 | 45 | -18 | 0.44 |

| Services | -29 | -28 | -23 | -18 | 0.0 | 145 | 32 | -29 | 61 | 15 | 0.86 |

| %m/m | Feb 09 |

Based on Level | Level | ||||||||

| EMU | -2.7% | -2.5% | -10.3% | 65.4 | 0.0 | 220 | 117 | 65 | 52 | 99 | 0.95 |

| Germany | -1.6% | -4.0% | -6.4% | 73.2 | 0.0 | 220 | 121 | 73 | 48 | 99 | 0.68 |

| France | -0.8% | -0.7% | -10.6% | 74.2 | 4.7 | 219 | 119 | 72 | 47 | 99 | 0.81 |

| Italy | -0.4% | -1.4% | -11.7% | 71.6 | 0.0 | 220 | 121 | 72 | 50 | 100 | 0.81 |

| Spain | -3.2% | 3.7% | -7.2% | 67.0 | 0.6 | 219 | 117 | 67 | 50 | 100 | 0.71 |

| Memo: UK | -6.3% | -10.9% | -0.6% | 56.4 | 0.0 | 220 | 117 | 56 | 61 | 100 | 0.55 |

| Since 1990 except Services (Oct 1996)247 | -Count | Services: | 145 | -Count | |||||||

| Sentiment is an index, sector readings are net balance diffusion measures | |||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates