Global| May 28 2014

Global| May 28 2014EU Indices Show Gains in EU and EMU

Summary

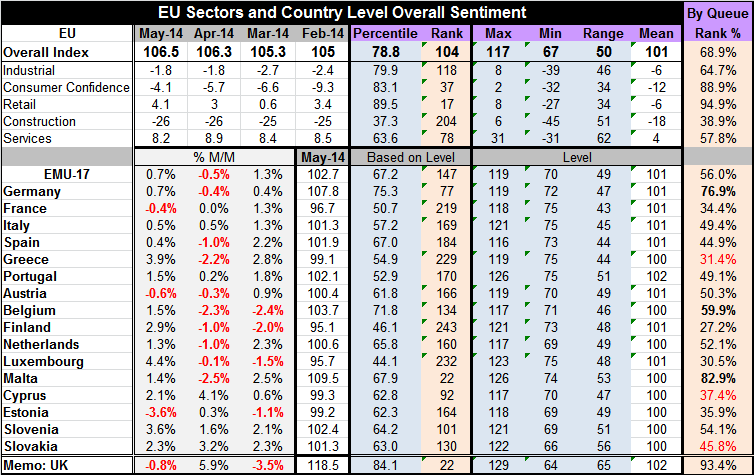

The EU Commission indices for the entire EU advanced to a level of 106.5 in May from 106.3 in April. For the European Monetary Union, the index advanced by 0.7% in May, rebounding from a 0.5% decline in April. Among the 17 EMU members [...]

The EU Commission indices for the entire EU advanced to a level of 106.5 in May from 106.3 in April. For the European Monetary Union, the index advanced by 0.7% in May, rebounding from a 0.5% decline in April.

Among the 17 EMU members in the table, only three showed declines in overall sentiment in May, a strong improvement from the nine that showed declines in April. Taking the EMU index as percentage of its historic queue, it sits in the 56th percentile of that queue. Interestingly, only three of the 17 countries in the table stand at a percentile that is greater than 56%. They are Germany, Belgium and Malta. The rest of the 14 countries in the table have percentile standing center below and for many substantially below the EMU marker of the 56th percentile (unweighted average of 41.7). This exercise points out the extraordinary importance of a large weight of Germany in setting the measure for the EMU as a whole. Germany sits in the 76th percentile of its historic queue and has a lot to do with the overall EMU measure being as high as it is.

The sector indices at the top of the table are for all of the European Union. They show continued negative readings in three of the five sectors. The industrial sector at -1.8 in May is at same level as in April. But those two months have improved significantly from their March and February levels. Consumer confidence has made a steady improvement from -9.3 in February, to -6.6 in March, to -5.7 in April, and to -4.1 in May. Retailing improved in May, moving up to 4.1 from April's 3.0 reading. Construction was flat in May at a -26 level; the April/May readings reflect deterioration in construction from the February/March readings. The services sector hasn't changed very much this year. The index for May fell to 8.2 from April's 8.9, but that compares to 8.4 in March and 8.5 in February. It is not clear if we should view May as some real slippage or average it with April and see it as steady.

Ongoing progress has been made in the EMU, but the rate of increase has slowed markedly and continues to be somewhat varied among the largest EMU countries.

Industrial confidence in the EMU rose to -3 in May from -4 in April. Industrial confidence is in the 76th percentile of its historic queue. Germany stands in the 74th percentile of its historic queue, followed by Spain at 67%, Italy at 62% and France at 57%. These are the four largest EMU economies.

Consumer confidence in the EMU also improved in May. The reading increased to -7 from April's -9 and stands in the 75th percentile of its historic queue. Among the large EMU countries in the table, Germany has the highest percentile standing for confidence at the 87th percentile, followed by Spain in the 77th percentile, Italy in the 74th percentile and France in the 37th percentile. The UK, an economic union member but not a monetary union member that subscribes to the common currency, has confidence at a period high (back to July 1993).

Retailing in the EMU has been flat at a reading of -3 from February to May. The percentile standing for retailing is in the 75th percentile. Retailing has the strongest percentile standing in Spain (in its 94th percentile), followed by Italy in its 76th percentile, Germany in the 67th percentile and France at the 46th percentile. Once again, the UK retail sector is the strongest during this period. Germany, that by some measures has been showing a rebound in its retailing sector, shows steady deceleration on this measure from February to March to April to May. In May the German retail reading stands at -1, compared to a reading of 2 back in February.

The services sector in the EMU was flat in May at a plus 4 reading, the same as April. Services sit in the 50th percentile of their historic queue. In the EMU, the large countries show more clustered readings for the sector than for most with the highest reading in France at the 53rd percentile, followed by Spain in the 52nd percentile, Germany in the 49th percentile, and Italy in the 30th percentile. Once again the UK has a relatively strong standing for services in the 93rd percentile of its historic queue although the UK reading backed off in May compared to April.

Monetary Policy in EMU

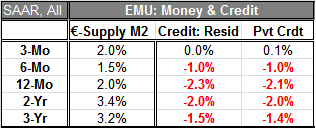

I would be remiss to talk about the activity data for the EMU alone without looking at the new data on money and credit. The credit figures in the EMU are very weak, but private credit actually ticked up over the last three months. In the EMU, money supply growth also picked up a little bit. It posted a 2% annualized growth rate over three months, up from 1.5% over six months and in the same pace as its 12-month growth rate. However, over two in three years, the money growth rate has been more on the order of 3.2% to 3.4%. With the weakness in the EMU coupled with an ongoing undershoot of the price target set by the European Central Bank has created a presumption that the ECB is about to become more aggressive in its policy setting. This remains a somewhat controversial market expectation. There are somewhat mixed expectations trapped between the idea that ECB President Mario Draghi is going to do something dramatic and the view that either he will still be opposed on the Monetary Board or that the sorts of stimulus that he plans is not technically able to be done in the EMU at this time.

What we see in the European Monetary Union is that the union is growing and that there is still a great deal of irregularity among members. It's probably not very useful to characterize the EMU by its benchmark figures because it's so clear that Germany is in one world and that the rest of the union is in another. This is an ongoing situation that has been in play since the financial crisis was brewing. It is simply another impediment to running a single monetary policy in this union with such disparate conditions among members.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates