Global| Oct 31 2007

Global| Oct 31 2007EU Readings Still Strong…but FADING

Summary

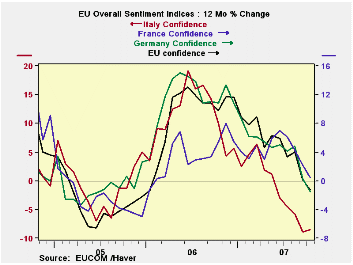

EU readings still strong…but countries and sectors are slowing The accompanying chart shows the diminished lift in the aggregate EU sentiment index and the same result for the largest EMU nations. Only France is still showing Yr/Yr [...]

EU readings still strong…but countries and sectors are slowing

The accompanying chart shows the diminished lift in the

aggregate EU sentiment index and the same result for the largest EMU

nations. Only France is still showing Yr/Yr gains in sentiment; the

rest have crossed the line to reveal Yr/Yr contraction. Not

surprisingly Italy, probably the least competitive of the large EMU

countries, is showing the sharpest contraction. Surprisingly France is

the most resilient, but the chart also tells why. France did not enjoy

the same degree of upswing that the others did. The EU and EMU members

plotted had Yr/Yr gains of 12% or more at some point. France’s peak

Yr/Yr gain came later and only amounted to 8%. In this way France seems

to be a laggard that is prospering off the growth of others. That

suggests that France’s decline will come later too. It does not promise

that France’s decline when it comes will be shallower.

The top panel in the table below shows the relative strength

of the individual sectors within EU. Construction is the relative

strongest in that it is at the highest relative point in its own range

at the 93.3 percentile. That is followed by the industrial and retail

sectors at about a percentile reading of 85, consumer confidence at

75.9 and services at 65.8.

In terms of the major EMU nations plus the UK, France as we

saw above is the relative strongest in EMU but, standing in the 88th

percentile of its range, the non-EMU UK is stronger still. The EMU

itself stands in the 73rd percentile of its range and the other major

EMU countries are below that with Germany in the 63rd percentile, Italy

in the 61st and Spain in the 50th. Over the last four months all of

these are showing slippage. Europe is slowing down. Is it the strong

euro or something else? With the spike in the inflation is the ECB

still going to hikes rates? All interesting questions to stay in touch

with, aren’t they?

| EU Sectors and Country level Overall Sentiment | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| EU | Oct 07 |

Sep 07 |

Aug 07 |

Jul 07 |

%tile | Rank | Max | Min | Range | Mean | R-SQ w/ overall |

| Overall | 109.5 | 110.6 | 113.1 | 113.3 | 82.9 | 48 | 117 | 74 | 43 | 100 | 1.00 |

| Industrial | 2 | 3 | 5 | 5 | 85.3 | 27 | 7 | -27 | 34 | -7 | 0.89 |

| Consumer Confidence | -5 | -4 | -3 | -2 | 75.9 | 42 | 2 | -27 | 29 | -10 | 0.82 |

| Retail | 2 | 1 | 6 | 5 | 85.2 | 14 | 6 | -21 | 27 | -6 | 0.47 |

| Construction | 0 | 1 | 0 | 0 | 93.3 | 14 | 3 | -42 | 45 | -18 | 0.44 |

| Services | 19 | 19 | 22 | 20 | 65.8 | 61 | 32 | -6 | 38 | 17 | 0.80 |

| % m/m | Based on Level |

Level | |||||||||

| EMU | -0.9% | -2.8% | -0.9% | -0.6% | 73.7 | 70 | 117 | 74 | 44 | 100 | 0.94 |

| Germany | -0.6% | -3.3% | -0.9% | -0.5% | 63.7 | 64 | 121 | 79 | 42 | 100 | 0.62 |

| France | 0.1% | -1.5% | -1.2% | 0.6% | 81.4 | 26 | 119 | 72 | 47 | 100 | 0.80 |

| Italy | -0.2% | -0.8% | -3.0% | -0.9% | 61.5 | 90 | 121 | 72 | 49 | 100 | 0.79 |

| Spain | -2.7% | -3.4% | 1.1% | -0.9% | 50.4 | 178 | 118 | 67 | 50 | 100 | 0.66 |

| Memo: UK | -2.0% | 1.1% | 4.5% | -5.7% | 88.3 | 15 | 119 | 69 | 50 | 101 | 0.39 |

| since 1990 except services (Oct 1996)208 | -count | services: | 126 | -count | |||||||

| Sentiment is an index, sector readings are net balance diffusion measures | |||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates