Global| Sep 17 2007

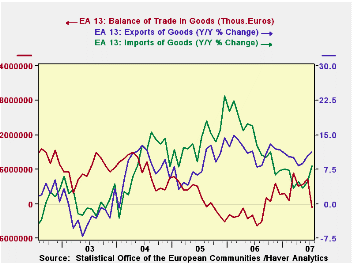

Global| Sep 17 2007Euro Area Exports and Imports Revive as Surplus Erodes

Summary

With the euro rising, it is not surprising to see the EMU areas trade surplus erode. But the sharpness in the July erosion and the spurt in imports is good news that makes that erosion look more like it is due to a rekindling for [...]

With the euro rising, it is not surprising to see the EMU area’s trade surplus erode. But the sharpness in the July erosion and the spurt in imports is good news that makes that erosion look more like it is due to a rekindling for growth than to a loss in competitiveness. This report is not a clear sign of export prospects. Retail data from Germany on export orders and on industrial output has showed some weakening. The export picture does not revive those fears nor does it ease them. To be sure the German wise-man Bofinger already has been talking of the prospect of using foreign exchange intervention - a clear sign that someone is getting hurt by the strong euro. But this month’s EMU trade erosion looks more like it is due to the good news of improved growth as the balance erosion is mostly due to the spurt in imports. With the dangers of financial contagion lurking, this report is somewhat reassuring. That, of course, does not mean that the ECB will no longer be under pressure or that Sarkozy will stop complaining about ECB policy. But an economy on stronger footing will make the ECB’s decisions somewhat easier if this hint of strength proves to be lasting.

| m/m% | % Saar | ||||

| Jul-07 | Jun-07 | 3M | 6M | 12M | |

| Balance* | €€ (651) | €€ 4,355 | €€ 2,346 | €€ 2,686 | €€ 1,796 |

| Exports | |||||

| All Exports | -0.5% | 1.9% | 8.0% | 5.2% | 11.3% |

| Food and Drinks | -- | 1.1% | 4.0% | 10.3% | 8.3% |

| Raw Materials | -- | -1.4% | 5.0% | 10.4% | 8.2% |

| MFG | -- | 0.9% | 1.9% | 4.4% | 9.5% |

| Imports | |||||

| All Imports | 3.6% | 1.1% | 22.5% | 9.5% | 8.3% |

| Food and Drinks | -- | 0.0% | 0.7% | 7.9% | 6.7% |

| Raw Materials | -- | -1.2% | 9.0% | 5.6% | 12.4% |

| MFG | -- | 0.2% | 2.2% | 2.3% | 7.6% |

| *Mil.Euros; mo or period average | |||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.