Global| Nov 02 2018

Global| Nov 02 2018Euro Area Manufacturing Loses Steam

Summary

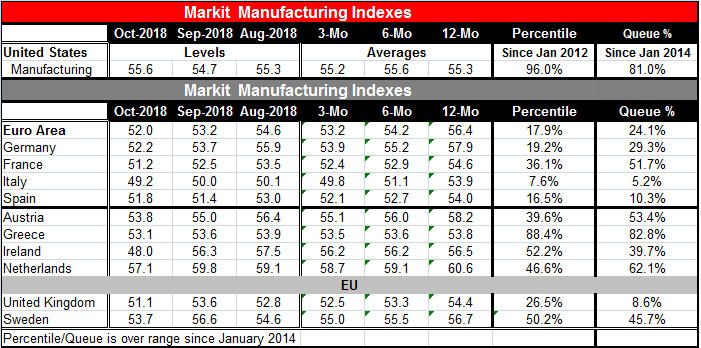

Euro area manufacturing is turning lower while the Markit reading for the U.S. turns higher. The Market manufacturing PMI for Europe fell to 52.0 in October while the U.S. Markit reading rose to 55.6 from 54.7. The more closely [...]

Euro area manufacturing is turning lower while the Markit reading for the U.S. turns higher. The Market manufacturing PMI for Europe fell to 52.0 in October while the U.S. Markit reading rose to 55.6 from 54.7. The more closely watched ISM manufacturing index for the U.S. fell relatively sharply in October, putting it more in line with the results we see here for Europe.

Euro area manufacturing is turning lower while the Markit reading for the U.S. turns higher. The Market manufacturing PMI for Europe fell to 52.0 in October while the U.S. Markit reading rose to 55.6 from 54.7. The more closely watched ISM manufacturing index for the U.S. fell relatively sharply in October, putting it more in line with the results we see here for Europe.

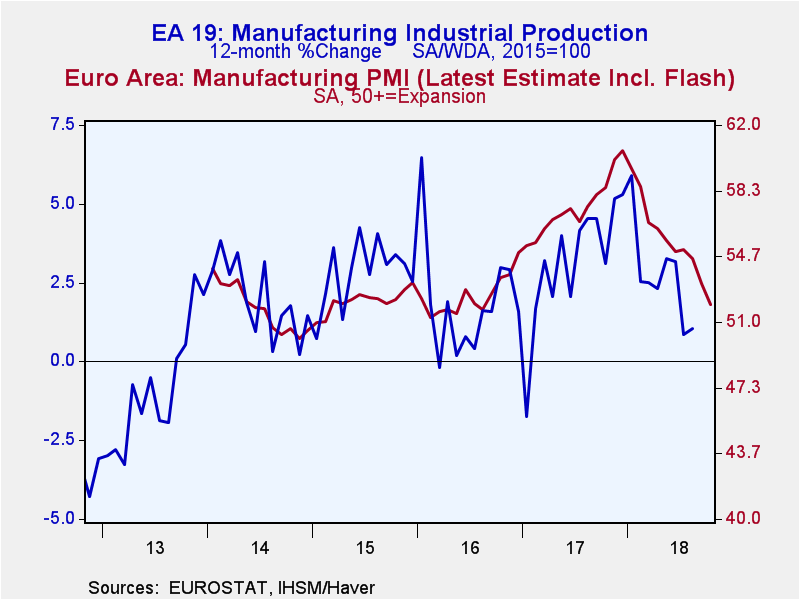

The chart shows that in Europe IP changes have lagged behind readings in the Markit manufacturing index in this cycle. The IP index never got as strong as the Markit index suggested it would and now on the way down while the Markit index is maintaining its relatively higher level. In 2014 and 2015, on the same basis the IP gains tended to outstrip the readings in the Markit barometer. Those day are gone.

Even so the Markit manufacturing index points the way to lower to weaker manufacturing IP results.

The queue standing for manufacturing in the euro area lies in its 24.1 percentile since 2014. The October reading is the bottom quarter of its queue of values. Manufacturing in the EMU has been stronger since January 2014 fully 75% of the time. The October reading of 52.0, a drop from 53.2 in September, leaves the index quite weak.

Germany has a 29th queue percentile standing; France has a 51st percentile standing; Spain has a 10th percentile standing; and Italy has a 5th percentile standing - plus a manufacturing diffusion reading that shows Italy's manufacturing sector is contracting. Manufacturing in the euro area is uniformly weak with only the French reading in October rising above its median reading calculated since 2014 (above a queue percentile standing of 50).

Momentum

Momentum is slipping in Europe while it is stable in the U.S. The U.S. average for the manufacturing PMI readings are remarkable stable around a reading of 55 across the various horizons. The euro area shows declining averages from their 12-month to six-month to three-month metrics. That pattern of erosion permeates the top four EMU economies. For other EMU members Austria, Greece, Ireland and the Netherlands, that same momentum slippage is evident. For the U.K. and Sweden, the pattern is also in place. The slowdown is epidemic.

It is beyond clear that a manufacturing slowdown has been and is still progressing in Europe. So far, U.S. participation in it is unclear and many Americans think that the U.S. economy is still strengthening. I am doubtful about that. In Europe, the change in the manufacturing PMIs from the three-month average to the most recent month is greater than the change from six-months to three-months. That is a clear signal that the move to weakness is still intense and that it has not abated.

Trade war fear

Companies seem to be preparing or bracing for the impact from trade restrictions. While there are many forces in play, trade seems to be dominant. Global data still do not show that trade volumes have been impacted. But there are concerns about the future and economies are already feeling the pinch. Overnight the U.S. stock market exploded to the upside in the wee hours of the morning on a report that the Trump Administration was preparing a trade deal for China. However, later in the day, even after a solid U.S. jobs report was issued the disclaimer by the administration that that ‘the mid-night report' was false helped to take the DJIA from a triple-digit point gain to a triple-digit decline. A bad report for Apple also played a role in the dismemberment of that optimism. Very clearly the trade situation is on the forefront of investors' minds.

However, it is believed that the Chinese, who have played their tariffs on the U.S. for all the political clout they could muster, do not want a deal until after the elections so they can gauge the strength of the Trump Administration on its own. Still, it is not clear how circumstance and a potential for trade war would be different if Democrats made inroads and even if they captured the House. There is one narrative that such a development would cripple Trump. But that is not even clear.

The New World: Economics IS Politics

Global economics and politics are intertwined. Not only is China gauging its relationships for their political impact but there is foreign influence through social media on the elections themselves perpetrated by unknown entities some of which are believed to be foreign (often Chinese and Russian). Democracy never felt so fragile.

Trump's hard line on trade is the one policy that I think makes absolute sense. I also think it is remarkable that such a stand is being taken by a Republican President since it amounts to an attack on multinational corporate business practices. I would have expected this from a Democrat president, but none of them ever took the stand. Nonetheless, this kind of stirring of the pot is not appreciated globally. But then most countries do take advantage of the U.S. on the trade front so it isn't surprising that none of them are happy and that the U.S. isolated, is it? It's not a sign that U.S. policy is ‘wrong' only that making a change is not popular. Bully for us!

Who is running the euro-show?

We know who runs Europe. The European Central Bank is still looking to remove monetary stimulus – looks like another case of bad central banker timing. That is unless the ECB is making policy for the German economy where the unemployment rate is at a post-unification low. Brexit is still playing out with a hard line on the U.K. And Italy is not being allowed the freedom it needs to escape the economic sink hole it has fallen into because of structural EU Commission rules. Do the Europeans have a clue about what they are doing and who it benefits? How much longer will Germany and tight-fisted Germanic rules continue to hold sway across the euro area? Germany has been able to thrive in the euro area framework because the region adopted German rules. But the rest of the EMU has struggled. Only now with trade in upheaval is Germany in a tailspin of its own. The German economy – the economy with the highest ratio of current account surplus to GDP in the world- has the largest manufacturing PMI setback over the last three months of any European country reporting a manufacturing PMI result. Germany has the second largest PMI deterioration over six months and over 12 months, surpassed only by Switzerland over six months and by Italy over 12 months. The large German current account surplus that Germany has refused to address year in and year out, despite being out of compliance with EMU principles, may finally have become a liability as we enter the era of trade wars.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.