Global| Feb 22 2008

Global| Feb 22 2008Euro Area Orders Drop Sharply in December

Summary

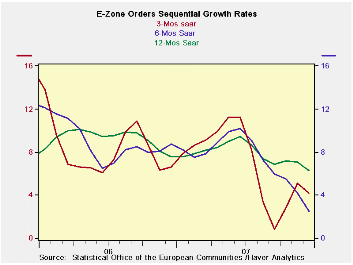

Rising order trends mask encroaching weakness. Despite a sharp 3.6% drop in orders in December EMU orders are still rising strongly over three months and a strong 8.5% in the quarter. Order trends are even turning higher despite the [...]

Rising order trends mask encroaching weakness.

Despite a sharp 3.6% drop in orders in December EMU orders are

still rising strongly over three months and a strong 8.5% in the

quarter. Order trends are even turning higher despite the sharp drop in

orders in December. But MFG sales already are very weak and are

declining in the quarter. Domestic orders are clearly weaker than

foreign orders. In the quarter domestic orders are up at nearly a 7%

pace and foreign orders are up at a nearly 14% pace. The country detail

shows that Germany is a major counterbalance to the overall results.

Germany’s orders are up by 20% in the quarter. France, Italy and the UK

are showing orders drop in the fourth quarter.

| E-zone and UK Industrial Orders & Sales Trends | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| Saar except m/m | % m/m | Dec 07 |

Dec 07 |

Dec 07 |

Dec 06 |

Dec 05 |

Qtr-2 Date |

||

| Euro Area Detail | Dec-07 | Nov-07 | Oct-07 | 3Mo | 6mo | 12mo | 12mo | 12mo | Saar |

| MFG Orders | -3.6% | 2.0% | 2.7% | 3.8% | -5.8% | 3.6% | 6.8% | 6.4% | 8.5% |

| MFG Sales | 0.0% | 0.1% | 0.0% | 0.3% | 0.5% | 3.6% | 7.3% | 6.3% | -0.3% |

| Consumer goods | 0.2% | 0.2% | 0.1% | 1.9% | 2.6% | 3.2% | 7.3% | 6.3% | 2.0% |

| Capital goods | -0.1% | -0.1% | 0.1% | -0.4% | 2.1% | 4.7% | 4.7% | 3.2% | 1.1% |

| Intermediate goods | 0.1% | 0.1% | -0.3% | 6.1% | -2.1% | 0.1% | 8.3% | 5.6% | 6.9% |

| MFG Orders | |||||||||

| Total Orders | -3.6% | 2.0% | 2.7% | 3.8% | -5.8% | 3.6% | 6.8% | 6.4% | 8.5% |

| E-13 Domestic MFG orders | -4.6% | 1.9% | 4.5% | 6.1% | -2.1% | 0.1% | 7.4% | -0.7% | 6.9% |

| E-13 Foreign MFG orders | -5.5% | 3.6% | 2.3% | 0.4% | -14.5% | 4.4% | 4.4% | 11.5% | 13.9% |

| Countries: | Dec-07 | Nov-07 | Oct-07 | 3Mo | 6mo | 12mo | 12mo | 12mo | Qtr-2 Date |

| Germany | -2.2% | 3.5% | 4.0% | 22.8% | -3.3% | 10.5% | 8.7% | 5.1% | 20.8% |

| France | -2.0% | -0.3% | 2.2% | -0.3% | -7.0% | 3.8% | 2.7% | 0.5% | -3.8% |

| Italy | -5.4% | 2.9% | -1.1% | -14.1% | -8.8% | 1.6% | 8.1% | 3.6% | -3.3% |

| UK | 5.2% | -4.2% | 2.6% | 14.0% | 7.2% | 13.9% | -2.8% | -2.6% | -20.6% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates