Global| Nov 18 2016

Global| Nov 18 2016Euro Current Account Surplus Withers But Remains Large

Summary

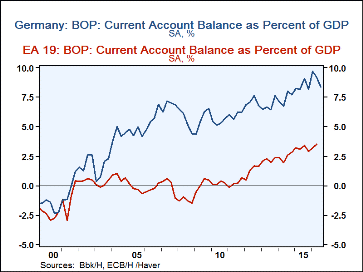

The trends still largely tell the story as the EMU trade and current account deficits relative to GDP are massive and still trending higher. In September, the current account deficit for the EMU-19 fell to 25.3 billion euros from 29.1 [...]

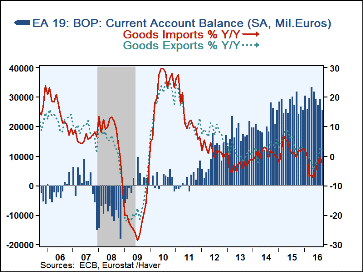

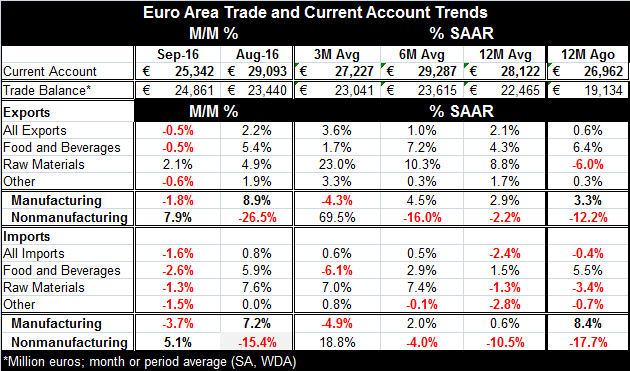

The trends still largely tell the story as the EMU trade and current account deficits relative to GDP are massive and still trending higher. In September, the current account deficit for the EMU-19 fell to 25.3 billion euros from 29.1 billion euros in August. Goods exports fell in September and goods imports fell faster. The trade surplus in goods as a result of this export/import mix is slightly wider in September as the larger drop in goods imports has helped to make the trade surplus larger.

The trends still largely tell the story as the EMU trade and current account deficits relative to GDP are massive and still trending higher. In September, the current account deficit for the EMU-19 fell to 25.3 billion euros from 29.1 billion euros in August. Goods exports fell in September and goods imports fell faster. The trade surplus in goods as a result of this export/import mix is slightly wider in September as the larger drop in goods imports has helped to make the trade surplus larger.

To focus on trends, we will next look at the performance in the trend of manufactures trade and try to eliminate most of the volatility that is introduced by the inclusion of commodities and especially oil during this period when oil prices are dominantly gyrating.

Export trends

Manufacturing exports fell 1.8% in September but after an 8.9% surge in August. Still, they are falling over three months. There is no clear acceleration/deceleration trend, and at a 2.9% rise over 12 months, exports are only slightly weaker that the 3.3% rise they had posted over the previous 12 months to that. Over the last two years, year-over-year exports have been stuck at about a 3% nominal growth rate.

Import trends

Manufacturing imports fell by 3.7% in September but after a 7.2% spurt in August. Yet, manufactured goods imports also are declining over three months, at a 4.9% annualized rate. They have an ambiguous trend on performance within the past year. However, manufacturing imports are up by only 0.6% over 12 months, and that registers a slowing from their 8.4% gain over the previous 12 months.

Exports and imports together

Exports and imports together

Over the last 12 months, import growth has slowed down while export growth has remained slow but steady in nominal terms. In response, the EMU current account surplus has remained large and it has continued to grow relative to GDP boosting growth in the EMU region.

Ain't misbehavin'...really?

Of course, in this upside down global environment, nothing is behaving as it should. There are paradoxes everywhere. The euro economy is faltering and this has pushed its current account into an extreme state of surplus. Still, that has not been enough by itself to revive growth. The surplus should cause the euro exchange rate to strengthen. But because growth in the EMU is weak, the exchange rate has actually been weakening and that tends to reinforce the growth of the surplus. In cyclical terms, this seems like the right response since Europe is weak and needs to be stimulated. But since its external accounts already are in such a protracted and intense state of surplus, a weaker currency is not appropriate from a longer term perspective. Moreover, the weakness in the global economy has caused attention to focus on potential beggar-thy-neighbor policies under which countries seek and advantage to boost domestic growth through tapping external demand while riding on the back of a too-weak currency. Europe's situation fits this mold. Meanwhile, in the U.S., the dollar is at/near a 14-year high as the U.S. economy is reasonably well-performing but only relative to current global standards not relative to its own past standards. The dollar should not be rising in the face of such a deficit. But the U.S. central bank is poised to hike rates again while other central banks are generally still pursuing pro-stimulus policies; that mix sends the dollar higher. The U.S. current account deficit is huge, large relative to GDP, and has become a permanent global fixture. Exchange rates simply do not work to re-equilibrate anyone's current account anymore and at the moment exchange rate positions and movements are making the U.S. and European current account imbalances both worse. Fluctuating exchange rates were envisioned to be ameliorating not exacerbating to economic imbalances like these. Something is going very wrong in the global economy and there are so many other problems no one is focused on the steady breaking down of the exchange rate system which is becoming increasingly unhelpful.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates