Global| Mar 21 2013

Global| Mar 21 2013Europe's PMIs Sag as Lift Off is Turned Back - How Bad is it?

Summary

The EMU PMIs for March have turned lower, after a short hopeful push higher. The services sector is pretty much without upward momentum as the chart plainly shows. Its recent bump up is really nothing more than that, a bump. But even [...]

The EMU PMIs for March have turned lower, after a short hopeful push higher. The services sector is pretty much without upward momentum as the chart plainly shows. Its recent bump up is really nothing more than that, a bump. But even with the manufacturing set-back in March the manufacturing sector is showing some life. The overall MFG index, as for services, is still below the key level of 50 which is the demarcation line for growth to begin. But there is still improvement in place for manufacturing, a trend which says that the degree of decline is being redressed. There is not so much in the way of positive spin for the services sector this month.

The EMU PMIs for March have turned lower, after a short hopeful push higher. The services sector is pretty much without upward momentum as the chart plainly shows. Its recent bump up is really nothing more than that, a bump. But even with the manufacturing set-back in March the manufacturing sector is showing some life. The overall MFG index, as for services, is still below the key level of 50 which is the demarcation line for growth to begin. But there is still improvement in place for manufacturing, a trend which says that the degree of decline is being redressed. There is not so much in the way of positive spin for the services sector this month.

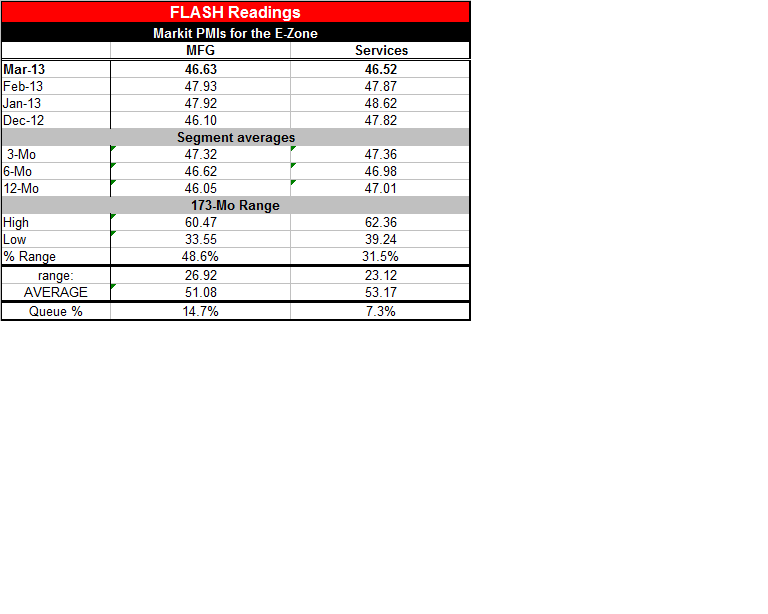

March's MFG reading of 46.63 takes it back below levels the index had achieved in January and February to sit just about one half of one point above its December level, But well up from its July 2012 low of 44.12.

With the situation in Cyprus in flux and having the potential to create knock-on effects the outlook for Europe has turned more speculative. In Italy the Five Star Movement is petitioning for a chance to form a government. This will be no bite-the-bullet technocrat government if it succeeds. The anti-austerity movement or push back against the Northern European austerity nexus is in full swing in the euro-Zone. It's coming at a time that the Zone's momentum is called to question.

Setting momentum aside, at their current levels the respective services and manufacturing indices are extremely week. Positioning them in the queue of their historic profiles the manufacturing index sits in the lower 14.7 percent of its queue and the services reading sits lower still in the bottom 7.3% of its queue.

These statistics tell us that MFG has been weaker 14% of the time and services weaker 7% of the time. These are obviously extremely low readings. Still, at the 48.6% mark of its high-low range the MFG reading is nearly equidistant below its global low and its global high. This standing points out that while the manufacturing reading is rarely lower, its worst low reading is a lot farther down. Still the MFG gauge is still nearly 10% below its median value. For services the EMU sector is weaker only 7% of the time and the current reading still is positioned at a weak 31% of its historic high-low range. The services reading in March stands some 13% below its median.

The good news is that while the upward momentum may have been cut, and while the levels for the two sectors are still weak, the uptrends have not been reconfigured into downtrends. The manufacturing reading still seems to have some upward momentum in play while services have only the barest whiff of that- but there is no evidence of a fresh downturn...unless on is just beginning now. And with the fate of Cyprus and Italy hanging in the balance all bets are off on that.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.