Global| Jun 20 2007

Global| Jun 20 2007European PPIs: Energy Hits Early in Germany and Relief Is Already Evident; Estonia and Slovenia Postpone Impact, [...]

Summary

Several European countries today reported their PPI data for May. After considerable upward pressure during 2005 and 2006, Germany has experienced some relief that began last autumn. For May, the total PPI was up 0.3%, following just [...]

Several European countries today reported their PPI data for May. After considerable upward pressure during 2005 and 2006, Germany has experienced some relief that began last autumn. For May, the total PPI was up 0.3%, following just 0.1% in April and the index stands 1.9% above a year ago.

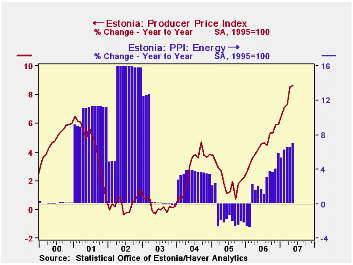

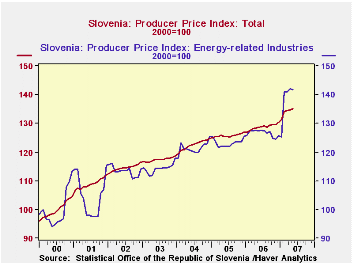

Estonia and Slovenia, by contrast, are presently seeing greater wholesale price pressure than previously. Estonia's overall index was up 0.5% in May and is ahead of May 2006 by 8.7%. In Slovenia, it's a little better, with 0.4% in May and 5.1% over the year ago.

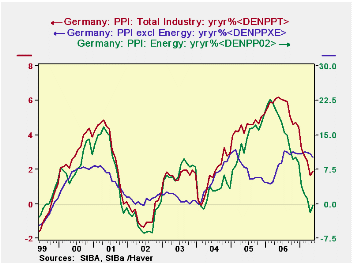

Energy, as elsewhere, makes a difference in all three countries. Germany's energy costs rose dramatically from mid-2004 through summer of 2006, erratically, to be sure, but with a strong trend. Then, inflation in that sector slowed notably in the autumn and continued easing, so that now, the status of energy costs shows them modestly below year-ago levels. Other prices have firmed somewhat since 2004. This may be related to higher energy costs, but probably also to higher prices for other raw materials, especially metals.

The pattern in Estonia and Slovenia is different. It appears that in those regions, energy prices were restrained initially. In fact, in Estonia, they were cut in early 2005. Now, however, at least some of the higher world cost of energy is making its way into manufacturers' prices. So producer prices overall just began to reflect this in early 2006 and, with the added push of other raw materials, they continue to accelerate now.

In Slovenia, prices in energy-related industries were raised in early 2004, then held back until this year. They jumped 12.5% this February and have crept somewhat higher since then. Some of this movement is apparently generated by utilities, an area where prices are often administered, which would account for the lurches in its path.

So we see that even if the full impact of higher energy costs is postponed, it eventually must hit, contributing to increases in overall price measures. At the same time, we continue to see only limited evidence that non-energy prices have been impacted. They are probably as susceptible to moves in industrial commodity prices as to those in energy goods and services; this would be a good empirical question for some interested econometrician.

| Producer Price Indexes | May 2007* | Apr 2007* | Mar 2007* | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Germany | 0.3 | 0.1 | 0.2 | 1.9 | 5.5 | 4.6 | 1.6 |

| ex Energy | 0.2 | 0.4 | 0.1 | 2.7 | 2.3 | 2.0 | 1.4 |

| Energy (NSA) | 0.7 | -0.8 | 0.4 | -0.3 | 16.0 | 14.0 | 2.5 |

| Estonia | 0.5 | 1.5 | 0.6 | 8.7 | 4.5 | 2.1 | 2.9 |

| Energy | 0.6 | 0.3 | 0.5 | 6.9 | 1.9 | -1.5 | 3.5 |

| Slovenia | 0.4 | 0.0 | 0.5 | 5.1 | 2.3 | 2.7 | 4.3 |

| Energy-related | 0.3 | 0.8 | 1.2 | 11.3 | 2.8 | 1.5 | 6.2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates