Global| Feb 05 2008

Global| Feb 05 2008Europe’s Service Index Drops as US ‘Service’ Index Collapses

Summary

So much for de-coupling The US and Europe, arguably, have never been more in sync (or maybe I should say sink) than they are right now. Europes MFG PMI is holding up as is the MFG index in the US. Oddly, in both countries, it is [...]

So much for de-coupling…

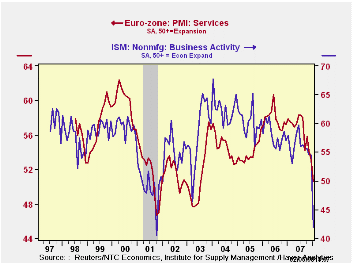

The US and Europe, arguably, have never been more in sync (or maybe I should say ‘sink’) than they are right now. Europe’s MFG PMI is holding up as is the MFG index in the US. Oddly, in both countries, it is the non-MFG index that is falling sharply. In the US Manufacturing tends to be the most directional of these two sorts of surveys, while in Europe they have tended to move more in concert. Still, the rise in the manufacturing PMI in Europe for January as the service index sinks lower is unconventional.

Across the Euro Area there is plenty of evidence of service sector weakness with Spain‘s index on an all-time low and Italy’s near the bottom of its all-time range. Germany’s Service sector is below the midpoint of its normal range. France’s absolute reading is strong but it is also eroding with a new sense of urgency.

There is something unique about this cycle if a down leg is being featured. It is that it is being led by services… AND that services weakness seems to be leading weakness even in the job market where that sector makes a much more than a proportionate contribution.

As a cyclical signal, these PMI readings are the worst in the US and in Europe while other gauges like consumer spending and consumer confidence are lower, they are only lower and not ‘signaling’ anything. It is unusual for the PMIs to lead the parade of weakness lower. In Europe the fall is sharp in January. In the US drop off is more dramatic and clearly recessionary in nature. These are clearly variables whose trends we will want to watch; we will also want to watch to see if Manufacturing PMI’s eventually succumb to this weakness or not.

| Jan-08 | Dec-07 | Nov-07 | 3Mo | 6Mo | 12Mo | Percentile | |

| Euro-13 | 50.56 | 53.14 | 54.14 | 52.61 | 54.32 | 55.97 | 27.3% |

| Germany | 49.17 | 51.24 | 53.09 | 51.17 | 53.57 | 55.74 | 33.2% |

| France | 56.60 | 58.89 | 59.15 | 58.21 | 58.05 | 58.41 | 46.8% |

| Italy | 47.86 | 49.71 | 50.77 | 49.45 | 52.28 | 54.23 | 3.8% |

| Spain | 44.24 | 50.99 | 50.69 | 48.64 | 50.71 | 53.31 | 0.0% |

| Ireland | 51.90 | 53.53 | 52.81 | 52.75 | 54.41 | 56.39 | 29.9% |

| EU only | |||||||

| UK | 52.46 | 52.36 | 51.95 | 52.26 | 54.02 | 55.69 | 43.2% |

| percentile is over range since May 2000 | |||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.