Global| Jan 25 2008

Global| Jan 25 2008Excluding Energy, Trends are Turning in Germany

Summary

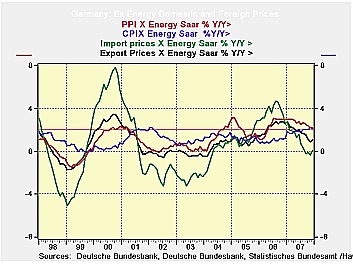

German import prices surged by 0.5%. But strip out energy and the rise is reduced to 0.1%; export prices excluding energy are flat, too. Year-over-year import prices excluding energy are up by 0.1%; export prices on that basis are up [...]

German import prices surged by 0.5%. But strip out energy and

the rise is reduced to 0.1%; export prices excluding energy are flat,

too. Year-over-year import prices excluding energy are up by 0.1%;

export prices on that basis are up by 1.0%. The CPI ex energy is close

to the ECB 2% ceiling at 2.1% and the PPI ex-energy is up by 2.2%, both

over 12 months. Despite some spiking inflation early in the year and in

mid-2006 even for ex energy prices inflation has settled down in the

Germany ex-energy economy.

Still, the ECB is not an Ex-energy or Core inflation targeting

central bank. The ECB speaks in terms of headline inflation and in

Germany that is still hot; in the Euro area it is hotter still. The ECB

is also wary of what has been excessive growth in money and in credit.

But the ex energy price indices are a strong indication that true

inflation is not brewing in the monetary union. Energy prices have been

boosted strongly but those effects have not spread. What the ECB and

the Bundesbank are now worried about is contagion via wage deals that

are being negotiated and where workers seem to be thinking in terms of

headline inflation, which is the rate that most affects them. So wage

restraint is the ECB’s main reason to keep policy tight, and to keep

warm the rhetoric about needing to cool inflation.

| German International and Domestic Inflation Trends | |||||||

|---|---|---|---|---|---|---|---|

| % m/m | % Saar | ||||||

| SA | Dec-07 | Nov-07 | Oct-07 | 3-Mo | 6-Mo | 12-Mo | Yr-Ago |

| Export Prices | 0.1% | 0.2% | 0.1% | 1.5% | 0.6% | 1.3% | 2.4% |

| Import Prices | 0.5% | 1.1% | 1.0% | 10.8% | 3.9% | 3.8% | 2.2% |

| NSA | |||||||

| Exports excl Petrol | 0.0% | -0.1% | 0.0% | -0.4% | 0.0% | 1.0% | 2.5% |

| Imports excl Petrol | 0.1% | -0.4% | 0.4% | 0.4% | -1.2% | 0.1% | 2.7% |

| Memo: SA | |||||||

| CPI | -0.3% | 0.6% | 0.3% | 2.5% | 2.5% | 2.7% | 1.4% |

| CPI excl energy | 0.1% | 0.2% | 0.3% | 2.2% | 2.4% | 2.1% | 1.2% |

| PPI | 0.0% | 0.9% | 0.3% | 5.1% | 2.9% | 2.5% | 4.3% |

| PPI excl energy | 0.1% | 0.1% | 0.2% | 1.4% | 1.6% | 2.2% | 2.9% |

| Oil on Import Prices | 0.4% | 1.5% | 0.6% | 10.4% | 5.1% | 3.7% | -0.5% |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates