Global| Jan 17 2008

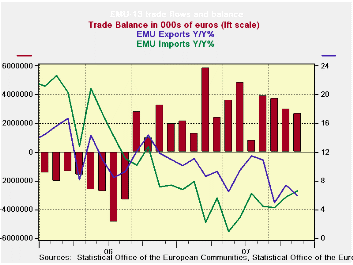

Global| Jan 17 2008Exports Slowing in the Zone; Imports improving...at least Yr/Yr

Summary

Yr/Yr EMU import growth is now exceeding export growth. Import growth is creeping up at a faster pace while export growth is being damped and is faltering. But sequential growth rates within the past year shows that most components [...]

Yr/Yr EMU import growth is now exceeding export growth. Import

growth is creeping up at a faster pace while export growth is being

damped and is faltering. But sequential growth rates within the past

year shows that most components within the import aggregate are seeing

growth tail off with the exception of food. For exports sequential

growth rates also indicates a slowing. The sequential growth rate

parses the data over the past year to allow us to get a sense of the

intra-yearly pattern. What we see there makes us wonder about demand

within the Euro Area since imports are slowing within that horizon.

Since Euro Area exports are slowing on that horizon as well we are left

to wonder if export markets for EMU are also slowing or if it is an

impact of the strong euro value or of both.

Global growth

As we begin to get evidence of Europe’s slowing we are also getting re-thinks on the growth rates for member countries. The Bank of France’s survey is pointing to a softer rate of growth in Q4. Germany is said to be considering a reduction in its new forecast as some private outlooks have been cut. The EU Commission is now reported to be in the process of revamping its outlook to find Europe less insulated from the effect of a US slowdown. Japan has been slowing and the government has been reluctant to downgrade growth, as has the BOJ. China is suffering though some overheating and despite it’s trying to forestall any slowing until after the Olympic games, it has been forced into a more defensive monetary policy sooner than it desired.

On balance there is a considerable amount of evidence to support the notion of slowing growth on a widespread global scale. Commodity prices are just beginning to reflect this shift. But so far we have no indication how much the slowdown might progress. Some hold out hope that demand will remain in place in the developing world and will buffer the growth in the main industrial countries. There is little evidence of that or that such a small amount of essentially infrastructure spending that might be resilient might support global growth. Instead, the evidence seems to be falling on the side of showing that the US slowdown drags the world with it and that it is happening again.

| Ezone 13-Trade trends for goods | ||||||

|---|---|---|---|---|---|---|

| m/m% | % Saar | |||||

| Nov-07 | Oct-07 | 3-Mo | 6-Mo | 12-Mo | 12-Mo Ago | |

| Balance* | €€ 2,718 | €€ 2,984 | €€ 3,141 | €€ 3,160 | €€ 3,024 | €€ (1,251) |

| Exports | ||||||

| All Exports | 0.3% | 1.2% | 0.5% | 9.9% | 5.9% | 11.9% |

| Food and Drinks | -0.7% | 1.6% | -3.4% | 13.7% | 8.3% | 11.5% |

| Raw materials | -1.3% | 1.0% | 2.6% | -0.6% | 0.9% | 22.4% |

| Other | 0.4% | 1.2% | 0.7% | 10.0% | 5.9% | 11.7% |

| Manufacturing | -0.7% | 0.3% | -8.1% | 8.2% | 1.9% | 15.4% |

| Imports | ||||||

| All Imports | 0.5% | 1.9% | 4.4% | 11.8% | 6.6% | 7.2% |

| Food and Drinks | -3.4% | -1.2% | 23.7% | 26.0% | 14.7% | 5.4% |

| Raw materials | -3.9% | 1.1% | -24.3% | -5.7% | -3.7% | 27.7% |

| Other | 1.0% | 2.1% | 5.0% | 12.0% | 6.7% | 6.4% |

| Manufacturing | -2.4% | -0.9% | -19.2% | 1.1% | -0.2% | 10.6% |

| *Eur mlns; mo or period average | ||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates