Global| Aug 18 2010

Global| Aug 18 2010Fed Loan Officer Survey Shows Easier Lending Standards, Hints of Turnaround in Loan Demand

Summary

Bank lending policies have begun to shift toward easier standards, according to the quarterly Federal Reserve Senior Loan Officer Survey. Data covering the latter half of July were reported Monday, August 16; participants, 57 domestic [...]

Bank lending policies have begun to shift toward easier standards, according to the quarterly Federal Reserve Senior Loan

Officer Survey. Data covering the latter half of July were reported Monday, August 16; participants, 57 domestic banks and

23 U.S. branches or agencies of foreign banks, responded to queries about commercial lending, home mortgages and consumer

credit, regarding loan terms and loan demand. The survey began in the spring of 1990. The data are included in Haver's

SURVEYS database.

Bank lending policies have begun to shift toward easier standards, according to the quarterly Federal Reserve Senior Loan

Officer Survey. Data covering the latter half of July were reported Monday, August 16; participants, 57 domestic banks and

23 U.S. branches or agencies of foreign banks, responded to queries about commercial lending, home mortgages and consumer

credit, regarding loan terms and loan demand. The survey began in the spring of 1990. The data are included in Haver's

SURVEYS database.

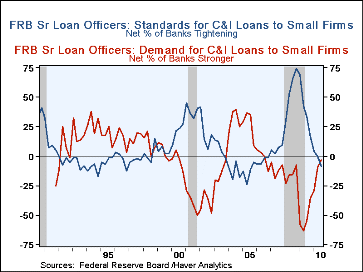

Lending policies for commercial and industrial loans ("C&I" loans) to medium- and large-size companies have shown net easing throughout 2010, as the share of banks tightening less the share easing reached -8.8% in July, indicating that more banks are now easing than tightening. Banks on balance had tightened their lending terms to these borrowers continuously from the middle of 2007 through the end of last year. More distinctly in the current survey, lending policies for small business showed net easing for the first time in July since the end of 2006; 9.1% more of banks eased their commercial lending policies for small firms than tightened them.

Demand for C&I loans is beginning to shift toward improvement; the share of banks reporting increased demand from medium and large firms was larger by 1.8 percentage points than those with weakening demand. Modest as this margin is, it is the first positive reading since Q2 2006 -- April, more than four years ago. Demand from small companies remains negative on balance at -3.6%, but this is the most favorable reading since 0 in Q3 2006.

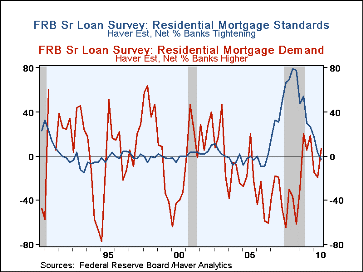

A similar pattern is apparent in lending policies for home mortgages. A special Haver-calculated series on total home mortgage lending standards stands at -2.6%, indicating the first net easing stance since Q3 2006. The Fed's source data show that 5.5% more banks are easing credit on prime mortgages than tightening, while standards remain somewhat tighter for non-traditional mortgages (interest-only, "Alt-A" and other types), with tightening at a net of 4.5% of banks. Information on subprime loans has been too fragmentary to report since Q1 2009. The Haver series combines these categories into an overall series meant to extend the original total mortgage data, which the Fed stopped in Q1 2007.

Mortgage demand was also positive in this latest survey, as the Haver estimates show 6.5% more banks had higher demand than lower demand. As evident in the graph here, demand has been uneven. It recovered for much of 2009, but weakened again during the first two quarters this year, so this latest upturn is a welcome development.

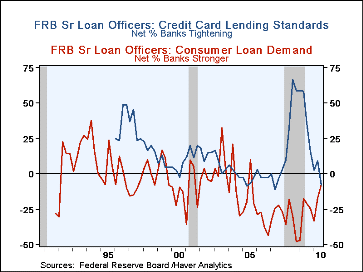

Among consumer lending, credit standards on credit cards were eased on balance in this latest report and they eased for a second quarter on other types of consumer credit. Demand for consumer loans in general remains weak, but the -7.5% is the "least weak figure since the middle of 2005.

| Senior Loan Officer Survey (Net % of Banks Responding) | July 2010 | April 2010 | Jan 2010 | Annual Averages | ||

|---|---|---|---|---|---|---|

| 2009 | 2008 | 2007 | ||||

| C&I Loan Standards, medium & large firms (net % tightening) | -8.8 | -7.1 | -5.5 | 37.3 | 57.2 | 5.8 |

| C&I Loan Demand, medium & large firms (net % stronger) | 1.8 | -7.1 | -25.5 | -49.2 | -9.2 | -15.2 |

| C&I Loan Standards, small firms | -9.1 | 0.0 | 3.7 | 40.4 | 55.5 | 6.1 |

| C&I Loan Demand, small firms | -3.6 | -9.3 | -29.6 | -42.9 | -15.6 | -11.0 |

| Mortgage Standards* | -2.6 | 2.7 | 17.1 | 39.2 | 72.9 | 32.5 |

| Mortgage Demand* | 6.5 | -18.9 | -14.5 | 3.8 | -48.1 | -30.6 |

| Credit Card Standards | -7.9 | 9.1 | 2.8 | 42.0 | 41.9 | -2.8 |

| Consumer Credit Demand | -7.5 | -17.3 | -33.3 | -27.6 | -33.0 | -26.4 |

* Estimated by Haver Analytics from Federal Reserve source data (see text)

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates