Global| May 17 2006

Global| May 17 2006Firm Q1 Growth in Singapore Prompts Hike in "Official" 2006 Forecast; Net Exports, Business Equipment Investment Lead

Summary

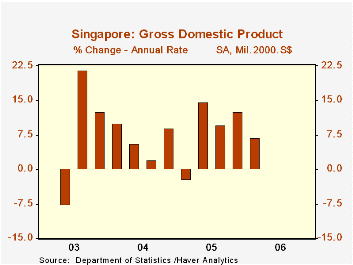

Singapore's economy turned in a much better than expected performance in Q1, with its GDP up 6.8% annualized from Q4 and 10.6% from a year ago. Forecasts had called for a greater slowdown after the strong close to 2005 in Q4, when GDP [...]

Singapore's economy turned in a much better than expected performance in Q1, with its GDP up 6.8% annualized from Q4 and 10.6% from a year ago. Forecasts had called for a greater slowdown after the strong close to 2005 in Q4, when GDP was up 12.5% from Q3. The good gain prompted the Singapore government to raise its official forecast for the entire year from 4%-6% projected in February to 5%-7%.

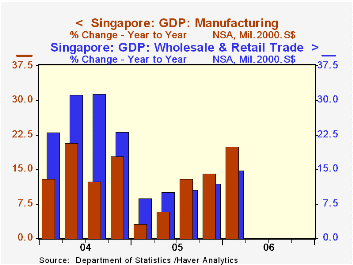

On a year-over-year basis, both goods- and service-producing sectors participated in the good growth. Goods were led by manufacturing, which expanded by 20%. Press reports cited strength in electronic products, a sizable portion of manufacturing in Singapore. Also, among the industry "cluster" data compiled by the Singapore Economic Development Board, biomedical production and transport engineering were also very strong.

Value added in service industries gained 8.1% year-on-year, its best showing since Q2 2004. Wholesale and retail trade was a leader here, reflecting, according to the Department of Statistics, the movement of re-exports, which expanded 39.5% from a year ago in current prices.

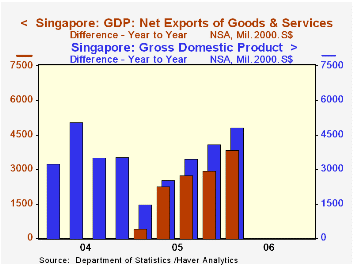

Net exports were a leading source of demand, accounting for nearly 80% of the yearly GDP growth. Among domestic sectors, demand for machinery and equipment increased 19% from a year ago.

| Singapore | Q1 2006 | Q4 2005 | Q3 2005 | Q2 2005 | 2005 | 2004 |

|---|---|---|---|---|---|---|

| GDP Qtr/Qtr | 6.8 | 12.5 | 9.6 | 14.6 | -- | -- |

| Year/Year | 10.6 | 8.6 | 7.6 | 5.7 | 6.4 | 9.2 |

| Goods Producing (Yr/Yr) | 16.3 | 12.0 | 10.7 | 4.9 | 7.7 | 8.6 |

| Service Producing (Yr/Yr) | 8.1 | 7.2 | 6.8 | 5.8 | 6.0 | 7.1 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates