Global| Aug 14 2012

Global| Aug 14 2012Flash Estimates of 2Q GDP Point to Recession in Europe. Germany's Financial Community Concurs

Summary

Flash Estimates of second quarter gross domestic product in the European Union and the Euro Area were released today and can be found in the data base, EUDATA. Both areas are expected to experience declines of 0.2% in the second [...]

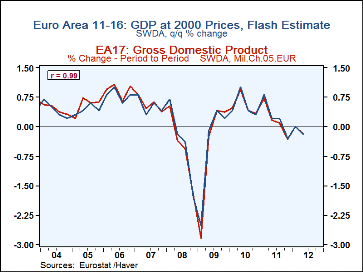

Flash Estimates of second quarter gross domestic product in the European Union and the Euro Area were released today and can be found in the data base, EUDATA. Both areas are expected to experience declines of 0.2% in the second quarter after showing no change in the first quarter. The quarter to quarter changes in GDP for the Euro Area are shown in the first chart compared with the Flash Estimates. The Flash Estimates for the entire Euro Area are based on data from 11 to 16 of the 17 countries in the area. The current estimate excludes data from Greece, Ireland, Luxembourg, Malta and Slovenia. In spite of the lack of information on some countries at the time the Flash Estimates are made, the high correlation, .99, between the Flash Estimates and the actual data means that the Flash Estimates are good indicators of the actual result.

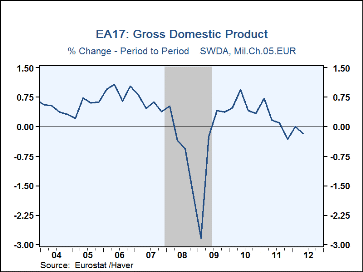

The Flash Estimates for the second quarter GDP of the Euro Area are pointing towards recession for the Euro Area. Six countries--Belgium, Cyprus, Finland, Italy, Portugal and Spain--reported lower second quarter GDPs and it is probable that most of those countries for whom data are not available will have experienced declines in their GDPs in the second quarter. Only four countries, Estonia, Germany, the Netherlands and Slovakia reported increased GDPs. France showed no change in its GDP in either the first or second quarters. The quarter to quarter changes in the Euro Area GDP are shown in the second chart together with recession shading for the most recent recession. If the declines in the recent quarters are harbingers of a recession, they suggest one of somewhat less severity than that of the 2008 recession.

| Gross Domestic Product (Q/Q % chg) | Q2 '12 | Q1 '12 | Q4 '11 | Q3 '11 | Q2 '11 | Q1 '11 |

|---|---|---|---|---|---|---|

| Euro Area | -0.2P | 0.0 | -0.3 | 0.1 | 0.2 | 0.7 |

| Belgium | -0.6 | 0.3 | -- | -- | -- | -- |

| Cyprus | -0.8 | -0.3 | -- | -- | -- | -- |

| Finland | -1.0 | 1.3 | -- | -- | -- | -- |

| Italy | -0.7 | -0.8 | -- | -- | -- | -- |

| Portugal | -1.2 | -0.1 | -- | -- | -- | -- |

| Spain | -0.4 | -0.3 | -- | -- | -- | -- |

| France | 0.0 | 0.0 | -- | -- | -- | -- |

| Estonia | 0.4 | 0.5 | -- | -- | -- | -- |

| Germany | 0.3 | 0.5 | -- | -- | -- | -- |

| Netherlands | 0.2 | -0.2 | -- | -- | -- | -- |

| Slovakia | 0.7 | 0.8 | -- | -- | -- | -- |

The ZEW Financial Market Survey continues to be wary of prospects for the Euro Area. Its index of current conditions for the Euro area is -75.1% in August, compared with -72.9% in July. Expectations for the Euro Area economy six months ahead improved slightly to -21.2% in August from -22.3% in July but are still dominated by the naysayers. The German financial community has become increasingly pessimistic about the German economy. The excess of optimists over pessimists regarding the current situation dropped to 18.2 % in August from 40,7% in May. And expectations continue to be dominated by the pessimists. In August, the pessimist exceeded the optimists by 25.5% up from 19.6% in July.

| ZEW | Aug | Jul | Jun | May | Apr | Mar | Feb | Jan |

|---|---|---|---|---|---|---|---|---|

| Germany | ||||||||

| Current Conditions | 18.2 | 21.1 | 38.2 | 44.1 | 23.4 | 22.3 | 5.4 | -21.6 |

| Expectations | -25.5 | -19.6 | -16.9 | 10.8 | 40.7 | 37.6 | 40.3 | 28.4 |

| Euro Area | ||||||||

| Current Conditions | -75.1 | -72.9 | -73.2 | 60.2 | 49.0 | -48.4 | -49.1 | -51.8 |

| Expectations | -21.2 | -22.3 | -20.1 | -2.4 | 13.1 | 11.0 | -8.1 | -32.5 |

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates