U.S. NFIB Small Business Optimism Index Declines Sharply in March

by:Tom Moeller

|in:Economy in Brief

Summary

- Economic & sales expectations weaken.

- Employment plans fall but job openings rise.

- Prices decline but price expectations rise.

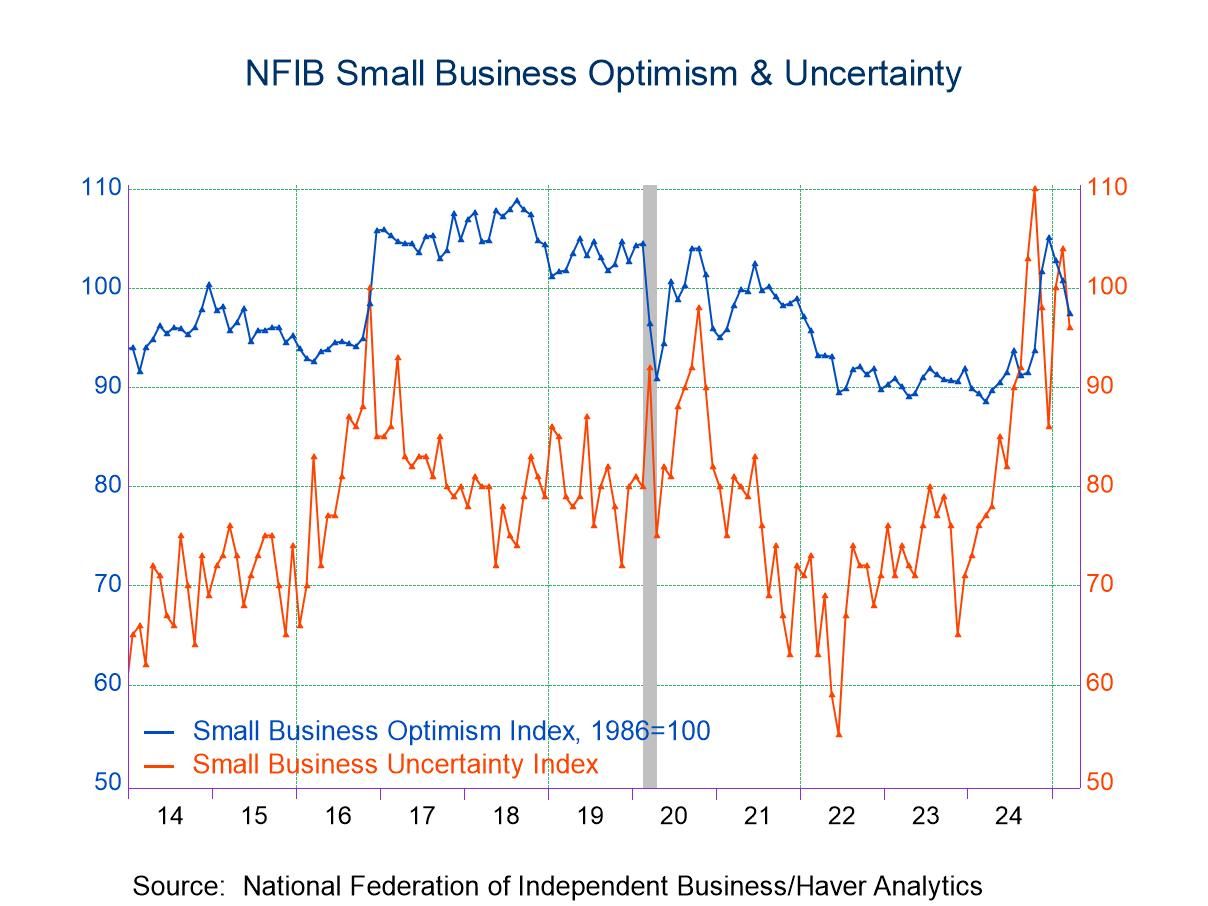

The NFIB Small Business Optimism Index declined 3.3% to 97.4 during March after falling 2.0% to an unrevised 100.7 in February and 2.2% to 102.8 in January, according to the Small Business Economic Trends survey conducted by the National Federation of Independent Business. The index fell 10.1% y/y, and seven of the ten index components fell last month. The NFIB Small Business Uncertainty Index fell 7.7% (+24.7% y/y) in March to 96 after rising sharply in February. It remained higher than its recent low of 65 in November 2023.

The outlook for business conditions deteriorated in the latest survey. The net balance of respondents expecting the economy to improve fell to 21% last month from 37% in February, but remained up versus a record-low of -61% in June 2022. A lessened 3% expected higher real sales in six months, compared to 14% in February from 20% in January. The latest reading has increased from a low of -29% in July 2022. A lessened 9% of respondents indicated that now was a good time to expand the business. The figure nevertheless remained up from 4% in September.

Plans to make capital outlays improved to 21% of firms after slipping to 19% in February. Plans to add to inventories held at -1% of survey respondents. The index of expected credit conditions fell to -4% last month and reversed the February improvement to -3%. It remained up from a low of -11 in November 2023.

On the labor front, a lessened 47% of businesses reported few or no qualified workers to fill job openings in March, after rising to 56% in August of last year. These readings remained below a high of 61% in May 2022. On balance, 12% respondents planned to increase employment in March after the 15% in February.

The net percent of firms reporting higher earnings weakened last month, after holding fairly steady in February. The figure fell to -28% from -24% in February, but was increased from the August low of -37.

On the pricing front, the net percent raising their average selling prices fell to 26% last month after rising to 32% in February. The percentage planning to raise prices rose to 30% in March from 29% in February. Worker compensation rose as a net 38% of respondents were lifting compensation during the last three months versus 33% in the last survey. Compensation peaked at 50% of firms in January 2022. A greatly lessened net 19% of firms plan to raise worker compensation in the next three months, below November’s high of 28%.

The quality of labor was reported as the single most important issue facing small businesses, as reported by 19% of NFIB members in March. Taxes were reported as the most important problem by a greatly increased 18% of small businesses. Inflation was reported by a lessened 16% as the most important problem. Other major concerns were the cost of labor (11%) and government requirements (8%).

According to the Small Business Administration, there are 33 million small businesses in the United States, which employ 62 million workers. The NFIB surveys anywhere from 500 to 2000 respondents each month and the typical firm employs 10 people and reports gross sales of about $500,000 a year. The NFIB figures can be found in Haver’s SURVEYS database.

Tom Moeller

AuthorMore in Author Profile »Prior to joining Haver Analytics in 2000, Mr. Moeller worked as the Economist at Chancellor Capital Management from 1985 to 1999. There, he developed comprehensive economic forecasts and interpreted economic data for equity and fixed income portfolio managers. Also at Chancellor, Mr. Moeller worked as an equity analyst and was responsible for researching and rating companies in the economically sensitive automobile and housing industries for investment in Chancellor’s equity portfolio. Prior to joining Chancellor, Mr. Moeller was an Economist at Citibank from 1979 to 1984. He also analyzed pricing behavior in the metals industry for the Council on Wage and Price Stability in Washington, D.C. In 1999, Mr. Moeller received the award for most accurate forecast from the Forecasters' Club of New York. From 1990 to 1992 he was President of the New York Association for Business Economists. Mr. Moeller earned an M.B.A. in Finance from Fordham University, where he graduated in 1987. He holds a Bachelor of Arts in Economics from George Washington University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates