Global| May 23 2013

Global| May 23 2013Flash PMIs gain ground in Europe: so what?!

Summary

In May the purchasing managers indices that assess the manufacturing and services sectors in the European Monetary Union are showing that both sectors continue to decline but that the rate of decline has been reduced for both [...]

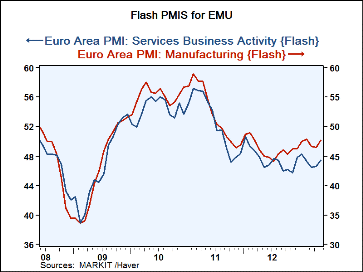

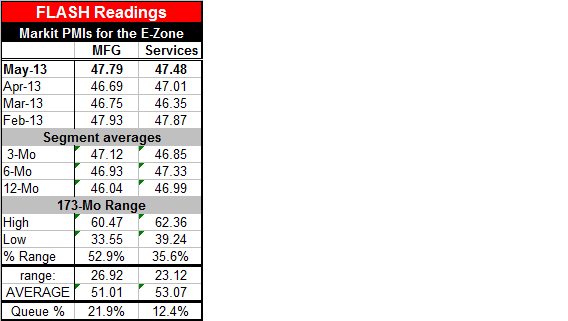

In May the purchasing managers indices that assess the manufacturing and services sectors in the European Monetary Union are showing that both sectors continue to decline but that the rate of decline has been reduced for both manufacturing and for services. In terms of the charting, both of the PMI sector indices are moving up, that indicates the improvement, but each of them remains below the 50% level which is the demarcation line between growth and slippage.

In May the purchasing managers indices that assess the manufacturing and services sectors in the European Monetary Union are showing that both sectors continue to decline but that the rate of decline has been reduced for both manufacturing and for services. In terms of the charting, both of the PMI sector indices are moving up, that indicates the improvement, but each of them remains below the 50% level which is the demarcation line between growth and slippage.

The graph shows that manufacturing index lies above the index for services and it appears to be advancing a slightly more rapid pace. The manufacturing PMI in fact resides in the bottom 21 percentile of its historic range. For services the PMI resides in the bottom 12% of its range. Both continue to occupy extremely low positions compared to their respective histories. And as the chart suggests, the services sector actually is lagging behind the manufacturing sector.

Despite the weak standing the increases made on the month were relatively strong. The 1.31 point increase for manufacturing as well as the 0.92 point increase for services are relatively strong monthly gains for each series. In the case of manufacturing, the size of the monthly increase lies in the top 87 percentile of the range of monthly changes; gains are stronger only about 13% of the time. For services the gain lies in the 77th percentile of its history of changes; monthly changes are stronger only about 23% of the time. So while the monthly standings are still week this month's increases are significant.

The upshot is that the private sector slippage in the Eurozone has slowed this month. In Germany slipping continues and but nearly back to neutral as its composite index sits at a 49.9 in May, as close as it gets to neutral. In France the composite index was unchanged at a level of 44.3 still a very low level for the composite. The good news is that the pace of decline in France did not accelerate but the level of activity remains very weak.

A host of other data tells us that all is not well in the Eurozone. In Italy retail sales declined more than expected in March. Danish retail sales declined for the second consecutive month in April.

The news that was moving markets today was not so much the PMI gauges on Europe. But China's manufacturing sector PMI backtracked to a seven month low at 49.6 in May moving lower from 50.4 in April. While this does take the PMI across the Rubicon that separates growth from contraction it still is a relatively mild monthly move.

The markets are hypersensitive about growth, especially in China, and especially after the Fed Chairman's testimony in the United States yesterday hinting that QE could be close to being pulled back. Today, the Federal Reserve seems to be engaged in some sort of damage control as several Fed officials, notably, Bill Dudley, President of the Federal Reserve Bank of New York and James Bullard, President of the Federal Reserve Bank of St. Louis, are saying that the Fed is not close to crimping its policy response under QE. Clearly markets are very wary about the prospects for growth but on this morning with better news for Europe in hand, markets took little satisfaction from it. Instead, we see a much greater weight being placed on activities in United States particularly on the perceived actions of the Federal Reserve and about China even though the data from China is probably not among the most reliable that we have.

I would say that the backtracking in markets today in the wake of yesterday's news and on the PMI data from China today suggests a very fragile market psyche despite some of the sharp increases that we've seen in some of the equity market indices. Japan, whose equity market has been the highest flyer, took a 7% set back today - a huge one-day loss. While some want to blame that on China because of Japan-China proximity and trade linkages, the China data were not so important or decisive. It's the Fed that has gotten the whole world nervous.

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates