Global| Aug 01 2018

Global| Aug 01 2018FOMC Leaves Fed Funds Target Unchanged

Summary

At the two-day meeting of the Federal Open Market Committee that ended today, the members voted unanimously to keep federal funds rate target unchanged in a range between 1.75% and 2.00%. This outcome is in line with expectations from [...]

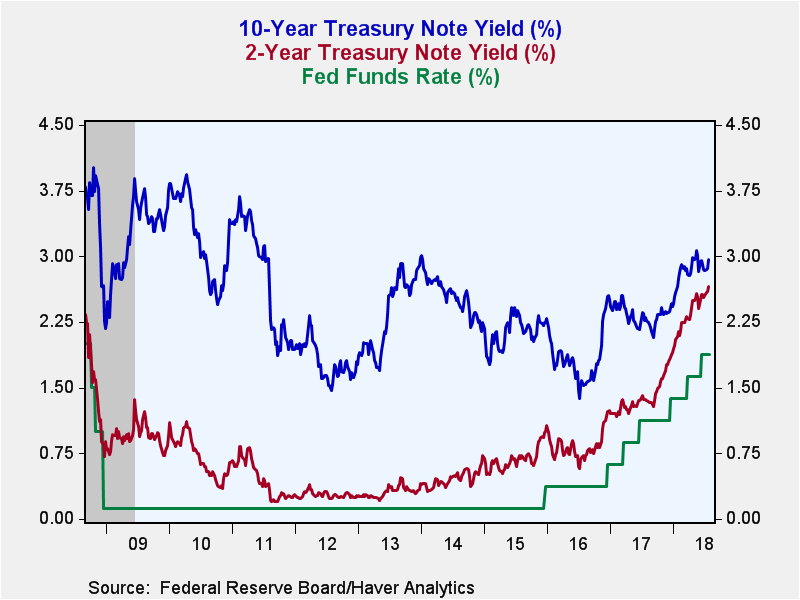

At the two-day meeting of the Federal Open Market Committee that ended today, the members voted unanimously to keep federal funds rate target unchanged in a range between 1.75% and 2.00%. This outcome is in line with expectations from the Action Economics Forecast Survey. The statement from today's meeting suggested that additional rate increases are likely to be forthcoming.

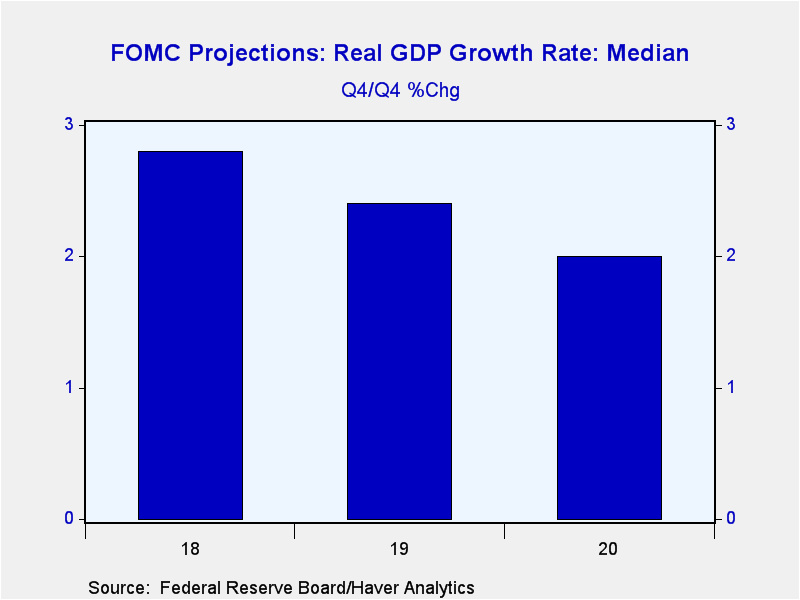

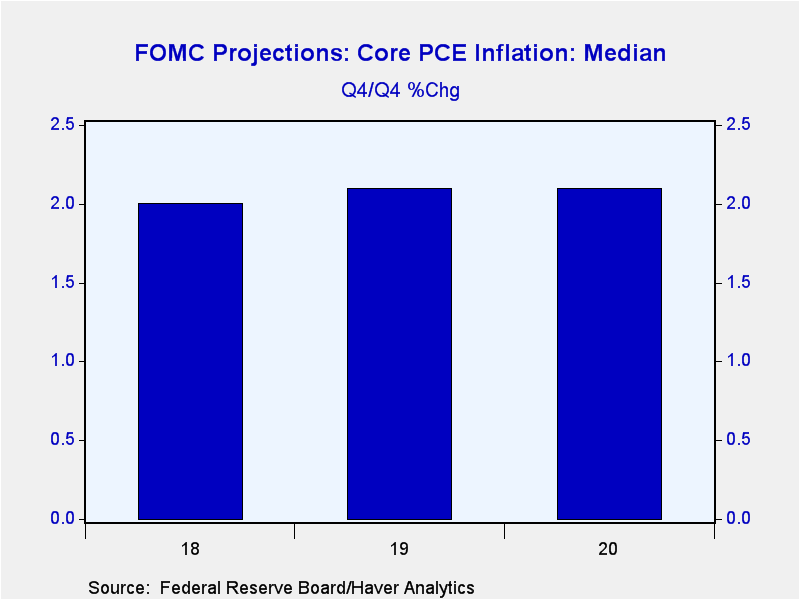

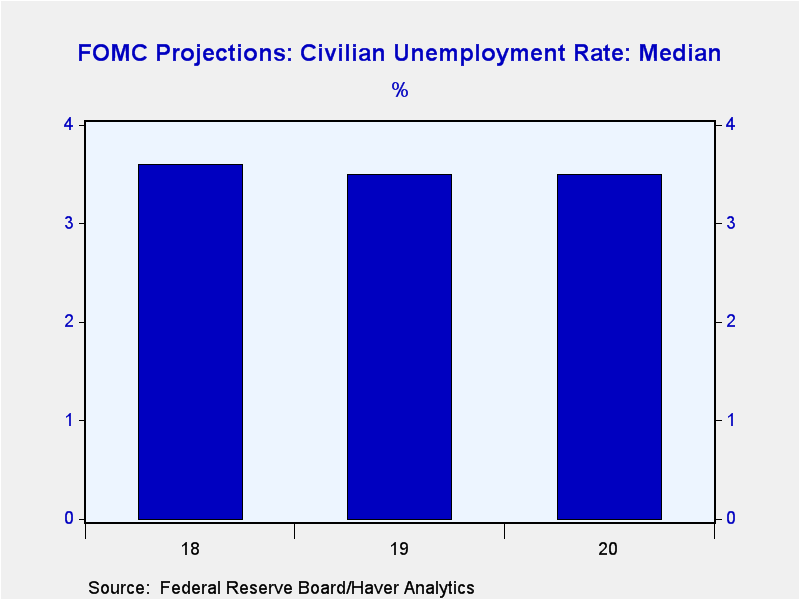

The FOMC noted "that the labor market has continued to strengthen and that economic activity has been rising at a strong rate." Meanwhile, overall inflation and inflation less food & energy remain near the 2% objective, and longer-term inflation expectations are little changed. Despite the strength of the economy, "risks to the economic outlook appear roughly balanced."

The Fed's statement also indicated that the "stance of monetary policy remains accommodative, thereby supporting strong labor market conditions and a sustained return to 2 percent inflation."

The press release for today's FOMC meeting can be found here.

The Action Economics Forecast Survey can be found in the AS1REPNA database. Haver's SURVEYS database contains the economic projections from the FOMC (with the latest from June 12-13 meeting).

| Current | Last | 2017 | 2016 | 2015 | 2014 | |

|---|---|---|---|---|---|---|

| Federal Funds Rate Target | 1.75% - 2.00% | 1.75% - 2.00% | 1.00% | 0.40% | 0.13% | 0.09% |

Gerald D. Cohen

AuthorMore in Author Profile »Gerald Cohen provides strategic vision and leadership of the translational economic research and policy initiatives at the Kenan Institute of Private Enterprise.

He has worked in both the public and private sectors focusing on the intersection between financial markets and economic fundamentals. He was a Senior Economist at Haver Analytics from January 2019 to February 2021. During the Obama Administration Gerald was Deputy Assistant Secretary for Macroeconomic Analysis at the U.S. Department of Treasury where he helped formulate and evaluate the impact of policy proposals on the U.S. economy. Prior to Treasury, he co-managed a global macro fund at Ziff Brothers Investments.

Gerald holds a bachelor’s of science from the Massachusetts Institute of Technology and a Ph.D. in Economics from Harvard University and is a contributing author to 30-Second Money as well as a co-author of Political Cycles and the Macroeconomy.