Global| Jun 19 2019

Global| Jun 19 2019FOMC Leaves the Funds Rate Unchanged But Signals Cuts Soon

by:Sandy Batten

|in:Economy in Brief

Summary

The Federal Open Market Committee voted at today's meeting to leave the federal funds rate target in a range between 2.25% and 2.50%. The action was as expected in the Action Economics Forecast Survey. However, there was one [...]

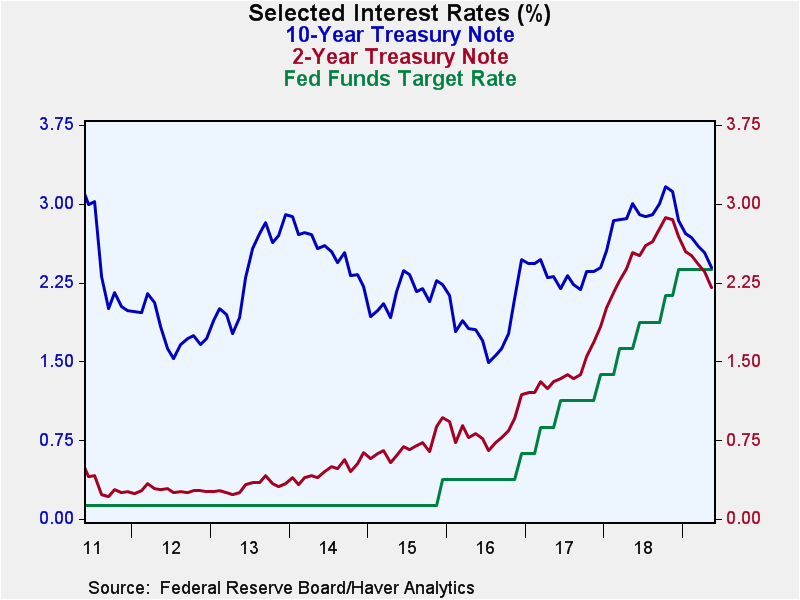

The Federal Open Market Committee voted at today's meeting to leave the federal funds rate target in a range between 2.25% and 2.50%. The action was as expected in the Action Economics Forecast Survey. However, there was one dissenting vote - James Bullard, President of the FRB St. Louis, who voted for a 25-bp reduction in the target. Importantly in parsing the Fed's statement for implications for the future, it omitted the word "patient" from the sentence describing how it would approach future rate decisions with the implication being that the time for patience may have ended. Indeed, in the ensuing press conference, Chairman Powell stated that "the case for somewhat more accommodative policy has strengthened". And in the accompanying Summary of Economic Projections (SEP), seven members of the FOMC expect two reductions in the fed funds rate target by the end of this year (there are only four FOMC meetings left in 2019; so this forecast implies a 25-bp rate cut at two of them). But apart from those two expected rate cuts, the FOMC members do not anticipate further cuts in 2020 and two look for some upward adjustment in 2021. Nonetheless, even with this relatively large group of committee members looking for two cuts this year, the median outlook was still for the funds rate to end this year where it is currently. For 2020 the median projection is now for one 25-bp cut in the fed funds rate, and for a 25-bp increase in 2021.

The Fed's view of the current economic environment was little changed from May, mostly reflecting recent data releases. Of note, it updated its view that household spending slowed in Q1 to a pickup from earlier in the year.

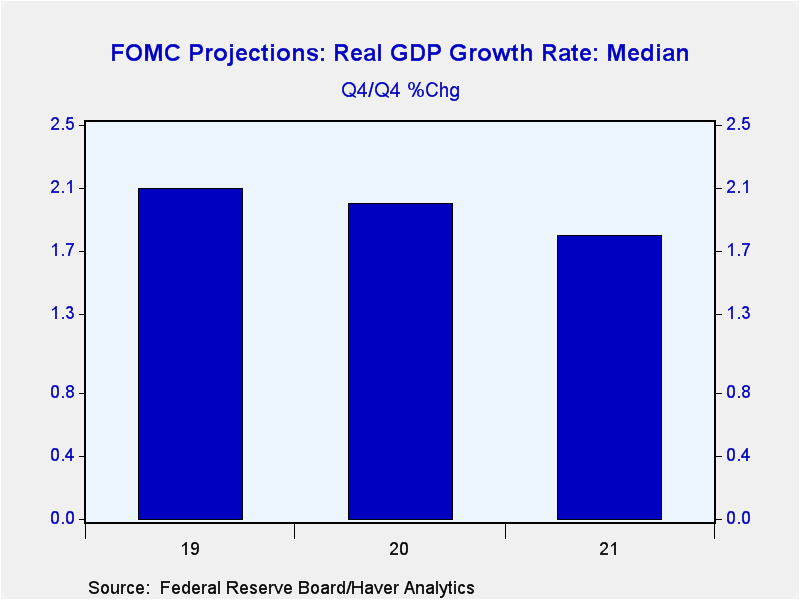

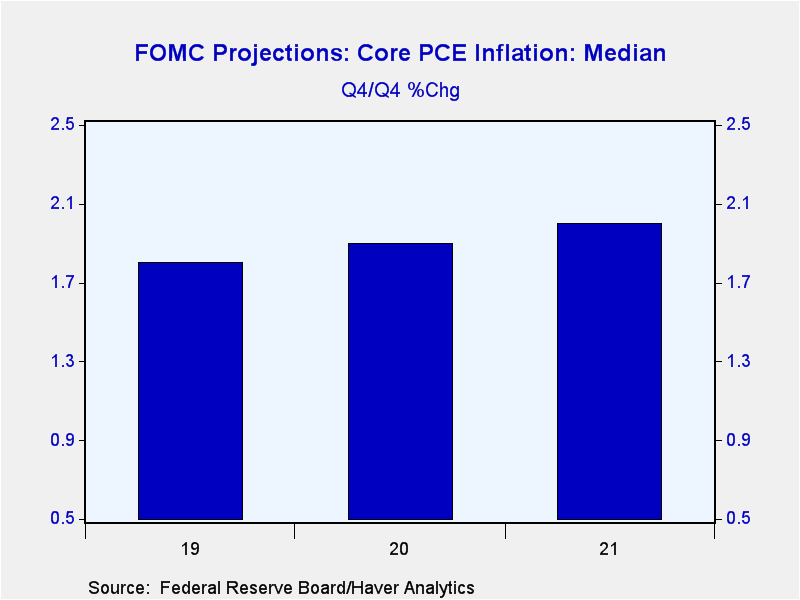

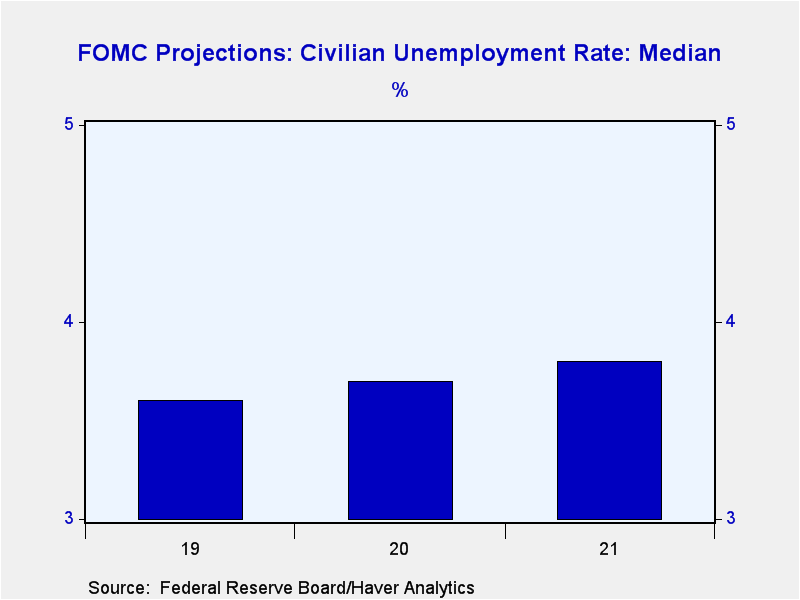

In the updated SEP, median forecasts of the economy were also little changed. Real GDP in 2019 is projected at 2.1%, the same as in March (the Fed only releases updated projections at every other FOMC meeting); the outlook for 2020 was nudged up to 2.0% from 1.9% while the outlook for 2021 was unchanged at 1.8%. Reflecting the fact that inflation continues to undershoot the fed's 2% target, the FOMC lowered its projection of headline PCE inflation for this year to 1.5% from 1.8% in the March SEP; and to 1.9% in 2020 from 2.0% in March. It also lowered its outlook for core PCE inflation, but more modestly - to 1.8% in 2019 and 1.9% in 2020 from 2.0% in each year in the March SEP. Also reflecting that the unemployment rate has undershot its past projections, the FOMC lowered its projection by 0.1%-pt for each year to 3.6%, 3.7% and 3.8%, respectively.

Finally, the FOMC's median estimate of the appropriate fed funds rate for the long run was reduced by 25 bps to 2.50% from 2.75% in the March SEP.

The press release for today's FOMC meeting can be found here.

| Current | Last | 2018 | 2017 | 2016 | 2015 | |

|---|---|---|---|---|---|---|

| Federal Funds Rate Target | 2.25% - 2.50% | 2.25% - 2.50% | 1.82% | 1.00% | 0.40% | 0.13 |

Sandy Batten

AuthorMore in Author Profile »Sandy Batten has more than 30 years of experience analyzing industrial economies and financial markets and a wide range of experience across the financial services sector, government, and academia. Before joining Haver Analytics, Sandy was a Vice President and Senior Economist at Citibank; Senior Credit Market Analyst at CDC Investment Management, Managing Director at Bear Stearns, and Executive Director at JPMorgan. In 2008, Sandy was named the most accurate US forecaster by the National Association for Business Economics. He is a member of the New York Forecasters Club, NABE, and the American Economic Association. Prior to his time in the financial services sector, Sandy was a Research Officer at the Federal Reserve Bank of St. Louis, Senior Staff Economist on the President’s Council of Economic Advisors, Deputy Assistant Secretary for Economic Policy at the US Treasury, and Economist at the International Monetary Fund. Sandy has taught economics at St. Louis University, Denison University, and Muskingun College. He has published numerous peer-reviewed articles in a wide range of academic publications. He has a B.A. in economics from the University of Richmond and a M.A. and Ph.D. in economics from The Ohio State University.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates