Global| Jun 04 2012

Global| Jun 04 2012Foreign Banks' Exposure to Spanish Banks

Summary

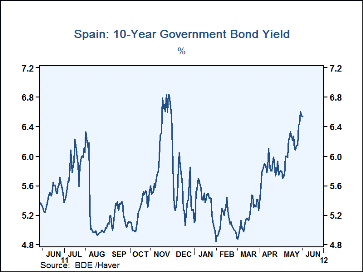

Spain is in trouble once again. Capital is leaving the country and interest rates are rising, as can be seen in the attached chart. The 10 year bond rate was 6.5% on June 1st and probably higher today. The European Central Bank, the [...]

Spain is in trouble once again. Capital is

leaving the country and interest rates are rising, as can be seen in the

attached chart. The 10 year bond rate was 6.5% on June 1st and

probably higher today. The European Central Bank, the European Commission

and the International Monetary Fund together with the Spanish government

are engaged in trying to find ways to ameliorate the situation while the

foreign banks that have lent to Spanish banks in the past are

worried about their exposure to these banks.

Spain is in trouble once again. Capital is

leaving the country and interest rates are rising, as can be seen in the

attached chart. The 10 year bond rate was 6.5% on June 1st and

probably higher today. The European Central Bank, the European Commission

and the International Monetary Fund together with the Spanish government

are engaged in trying to find ways to ameliorate the situation while the

foreign banks that have lent to Spanish banks in the past are

worried about their exposure to these banks.

Some Information on foreign banks' exposure to Spanish banks, as well as to Greece, Ireland and Portugal, can be found in Haver. In The Bank of International Settlements (BIS) data base, there is a table "Foreign Exposure to Greece, Ireland, Portugal and Spain" under the section, Consolidated International Claims on BIS Reporting Banks. Data are quarterly and begin in 2010. Most data end in the fourth quarter of 2011. Countries covered are Germany, France, Italy, Other Euro Area, Japan. U. S. U. K. and Rest of the World. U. S. banks appear to have the largest exposure, $227.7 billion dollars, to Spanish banks followed by Germany and other European Countries. Japanese and Rest of the World banks have much smaller exposures to troubles in the Spanish Banks.

| Exposure of Banks to Claims from Greece, Ireland, Portugal and Spain, Q4 2011 (Billions USD) | ||||

|---|---|---|---|---|

| Spain | Portugal | Ireland | Greece | |

| U.S. Banks | 227.7 | 59.1 | 95.3 | 50.7 |

| U. K. Banks | 137.5 | 33.3 | 192.1 | 22.3 |

| German Banks | 186.1 | 36.6 | 127.2 | 17.2 |

| French Banks | 144.2 | 26.7 | 55.7 | 51.3 |

| Other Euro Area* | 179.6 | 21.9 | 67.2 | 33.5 |

| Japanese Banks | 25.4 | 1.7 | 19.9 | 0.9 |

| Rest of World Banks* | 41.3 | 5.7 | 57.3 | 9.5 |

| * Data are as of Third Quarter, 2010 | ||||

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates