Global| Jun 15 2012

Global| Jun 15 2012Foreign Investors Purchase Modest Amounts of U.S. Debt, Equity; China Liquidates, But Latin America Picks Up

Summary

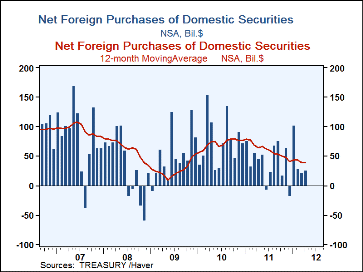

Foreign investors purchased $26.1 billion worth of U.S. long-term debt and equity securities in April, according the U.S. Treasury's International Capital ("TIC") data. This followed $21.9 billion worth in March, a similar amount in [...]

Foreign investors purchased $26.1 billion worth of U.S. long-term debt and

equity securities in April, according the U.S. Treasury's International Capital

("TIC") data. This followed $21.9 billion worth in March, a similar

amount in February, but over $100 billion worth in January; the resulting

four-month average is $44.9 billion, similar to the 2011 average of $41.1

billion.

Foreign investors purchased $26.1 billion worth of U.S. long-term debt and

equity securities in April, according the U.S. Treasury's International Capital

("TIC") data. This followed $21.9 billion worth in March, a similar

amount in February, but over $100 billion worth in January; the resulting

four-month average is $44.9 billion, similar to the 2011 average of $41.1

billion.

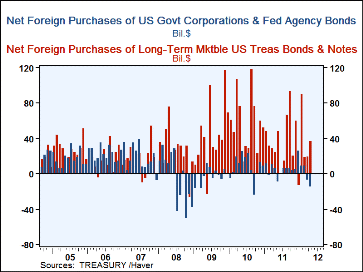

Foreign investors have concentrated on Treasury notes and bonds. April's net purchases were $37.3 billion, almost twice as much as in February and March, though less than January's $90.9 billion. The last two months have seen net liquidations of federal agency securities, $14.1 billion in April and $6.7 billion in March, as that sector continues the relative disinterest that set in during the 2008-09 financial crisis. Net corporate bond purchases turned positive in March after three months of liquidation, and remained barely positive in April. Foreign interest in this sector has been even more tepid than in agency securities since the crisis.

Corporate equity acquisition has been mildly positive in the first four months of 2012 after a striking turn to liquidation in the second half of last year. The amount in April was $2.7 billion, down, however, from $7.0 billion in March and $7.6 billion in February. Net foreign purchases of equities averaged right at $2.0 billion per month last year, but that included $19.4 billion in liquidation in September and net sales in four other months. So the resumption of net purchases for the last several months is encouraging.

Most attention is given to the participation of Chinese investors in U.S. markets, although that has retreated by a good deal recently. That group were net sellers of U.S. securities in April by $4.2 billion, reversing some sizable purchases in February and March. They averaged liquidation of $2.0 billion per month in 2011. Larger investment flows lately have come from Latin America, amounting to $14.8 billion in April and $11.6 billion in March. This region, with $6.2 billion on average for the last 12 months, even surpassed Europe's net purchases of $3.6 billion. European investors, including the financial center in London, often have larger monthly purchases, but they also occasionally transact larger monthly sales.

The TIC data are found in Haver’s USINT database. The information there also includes aggregate flows in Treasury bills and other short-term assets as well as banking system data on claims on and liabilities to foreign counterparties.

| Net Foreign Purchases of Long-Term U.S. Securities (Bil.$) | Apr | Mar | Feb | Jan | Monthly Average | ||

|---|---|---|---|---|---|---|---|

| 2011 | 2010 | 2009 | |||||

| Total | 26.1 | 21.0 | 28.9 | 102.6 | 41.1 | 75.7 | 53.2 |

| Treasuries | 37.3 | 20.1 | 19.5 | 90.9 | 36.0 | 58.6 | 44.9 |

| Federal agencies | -14.1 | -6.7 | 10.1 | 9.6 | 6.7 | 9.0 | -1.0 |

| Corporate bonds | 0.3 | 1.6 | -8.2 | -1.3 | -3.8 | -1.1 | -3.4 |

| Corporate stocks | 2.7 | 7.0 | 7.6 | 3.5 | 2.0 | 9.1 | 12.7 |

| China (All security types) | -4.2 | 13.8 | 20.9 | 9.8 | -2.2 | 2.4 | 9.3 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She has broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securites, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol is a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducts Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She has a PhD from NYU's Stern School of Business. She lives in Brooklyn, New York, and has a weekend home on Long Island.