Global| Oct 25 2007

Global| Oct 25 2007French Biz Climate Indicator Holds Mostly Steady

Summary

Frances industry survey from its statistical agency INSEE remains quite firm throwing off readings that are at the top one-third or higher of their respective ranges since 1990: Business climate, production, production trends, orders [...]

France’s industry survey from its statistical agency INSEE remains quite firm throwing off readings that are at the top one-third or higher of their respective ranges since 1990: Business climate, production, production trends, orders and demand - the whole lot of it remains firm. While the various readings have been slipping recently, in a broader sense, they have steadied at this top one-third of range mark, at a fairly firm level.

What is a touch less firm is INSEE’s assessment of the French MFG sector. A similar survey of just MFG shows the outlook for production at its 64th percentile and its trend at the 60th percentile. These are slightly weaker readings than for overall industry. The recent and likely trends for IP get stronger marks at 68Th percentile and 77TH percentiles, respectively. Orders and demand come in with readings at the 69th and 66th percentiles. On balance the French surveys for Industry and MFG remain on the firm side. MFG shows a touch more slippage than the overall.

Of course, there has been a lot of criticism from France recently over the exchange rate. A report I produced earlier in the week showed that within EMU France had gained competitiveness Vs the general EMU level but was lagging Germany by a significant amount. As the euro remains strong or becomes stronger this positioning could be a factor in how the French economy performs.

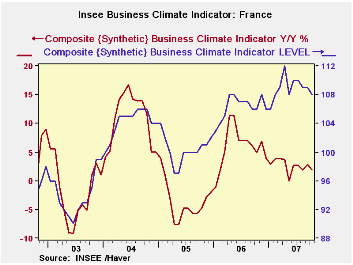

The chart at the top reminds us of two things. The first is that the French index is off peak. The second is that the Yr/Yr gain in the index has dissipated almost entirely. That suggests that there is almost no further upward momentum to the growth rate, not that the industry or MFG growth rates themselves will not remain positive.

| INSEE Industry Survey | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Since Jan 1990 | Since Jan 1990 | |||||||||

| Oct 07 |

Sep 07 |

Aug 07 |

Jul 07 |

%tile | Rank | Max | Min | Range | Mean | |

| Climate | 108 | 109 | 109 | 110 | 70.0 | 49 | 123 | 73 | 50 | 101 |

| Production | ||||||||||

| Recent Trend | 9 | 6 | 11 | 17 | 65.7 | 61 | 44 | -58 | 102 | -6 |

| Likely Trend | 33 | 32 | 33 | 31 | 68.8 | 18 | 63 | -33 | 96 | 7 |

| Orders/Demand | ||||||||||

| Orders & Demand | -1 | 1 | 1 | 2 | 70.1 | 42 | 25 | -62 | 87 | -15 |

| Fgn Orders & Demand | 4 | 10 | 8 | 6 | 69.7 | 51 | 31 | -58 | 89 | -11 |

| Prices | ||||||||||

| Likely Sales Prices Trend | 9 | 13 | 11 | 9 | 68.1 | 30 | 24 | -23 | 47 | 0 |

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates