Global| Apr 26 2007

Global| Apr 26 2007French Business Climate Improves for Manufacturers this Month; Service Companies Experience Slight Updrift

Summary

French industry perceives its business climate as the best in over six years, according to the monthly survey by the French government statistics office INSEE. The "business climate index" stands at 111 this month, that is, 11% above [...]

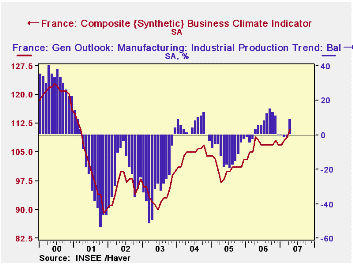

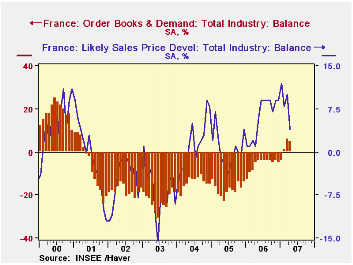

French industry perceives its business climate as the best in over six years, according to the monthly survey by the French government statistics office INSEE. The "business climate index" stands at 111 this month, that is, 11% above companies' long-run average. It rose 2 points from March and is 4 points ahead of 2006 as a whole. Among major factors, the trend in industrial production swung from a net balance of -2 in February and March to +9 this month, the first positive reading since last November. That is, the proportion of companies seeing an uptrend in production outnumbered those seeing a decline by 9 percentage points. Order books in particular are seen at +5 this month, a third consecutive positive count and the highest since April 2001. Foreign orders have had a positive balance for over a year, but until recently that has been more than offset by domestic weakness. So finally, domestic markets are improving enough to permit overall growth, rather than completely offsetting the foreign component.

Apparently growth in output is not expected to produce an acceleration in sales prices. Instead, perhaps, companies view stronger output as accompanying restraint in price increases. The "likely sales price development" among manufacturers moderated back to +4 for April from +10 in March. In Q1, this measure averaged +10, the highest quarterly figure since Q2 1995, but if April's reading is sustained, it would suggest a recognition by business that the generally tenuous environment necessitates holding the line on price increases.

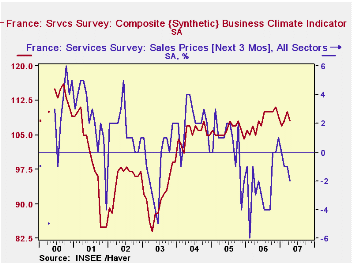

Among French service industries, the business climate has eased a bit this month to 108 from 110 in March. This sector has experienced a remarkably steady climate for just about three years, with a tight range of 104 to 111. Similarly, the companion measure of the "overall outlook" has ranged from -2 to +7 in the same time span, although the last 15 months or so give a hint of uptrend. This is reflected in "sales expected over next 3 months", which has averaged +14 in February, March and April, up from 12 in 2006 and 11 in 2005.

These firms do not generally expect to raise their prices. Their expectations for sales price increases have a balance of -2 for this month, and while there have not been any large negative readings, the only positive reading in the last year-and-a-half was a +1 in December. This mildly negative trend results from a mildly increasing trend for consumers and a declining path for business services. There is certainly little thought that demand will be strong enough to allow rising cost increases to be blithely passed on to customers.

"Services" in this survey have a more restricted definition than in most other data collections; here, they include real estate activities, business operations services and services for individuals. This last consists of travel agencies, hotels, restaurants, recreation, domestic services and the like. Notably, the category excludes transportation, finance and wholesale and retail trade.

| FRANCE, SA, %-Balance, except as noted* |

Apr 2007 | Mar 2007 | Feb 2007 | Year Ago | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|

| Industry Business Climate Indicator* | 111 | 109 | 108 | 109 | 107 | 101 | 104 |

| Industrial Production Trend Outlook | 9 | -2 | -2 | 3 | 5 | -12 | 5 |

| Order Books | 5 | 4 | 1 | -5 | -6 | -17 | -14 |

| Sales Prices Next 3 Mos. | 4 | 10 | 8 | 1 | 6 | 0 | 1 |

| Services Business Climate Indicator* | 108 | 110 | 108 | 105 | 108 | 106 | 105 |

| Overall Outlook | 7 | 6 | 6 | 2 | 4 | -0 | -0 |

| Sales Next 3 Mos. | 14 | 15 | 13 | 12 | 12 | 11 | 8 |

| Prices Next 3 Mos. | -2 | -1 | -1 | -3 | -2 | 1 | 2 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.

More Economy in Brief

Global| Feb 05 2026

Global| Feb 05 2026Charts of the Week: Balanced Policy, Resilient Data and AI Narratives

by:Andrew Cates