Global| Oct 05 2007

Global| Oct 05 2007French Household Confidence Takes Sharp Reversal

Summary

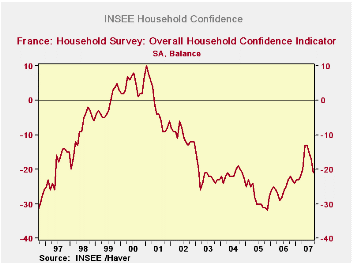

Household confidence in France fails to climb to or above -10. The chart on French consumer confidence shows that there is something around the level of -10 on the index that seems critical to the development of the direction on the [...]

Household confidence in France fails to climb to or above -10.

The chart on French consumer confidence shows that there is something around the level of -10 on the index that seems critical to the development of the direction on the index. In 1994-95 the index was about to move above +10 and eventually dipped to -30 before soaring above -10 to reach a peak of +10 in late 2000. From that peak confidence fell but once it broke below 10 in 2002 its fall accelerated. Now as confidence has tried to recover again it has once again failed to reach -10 or to climb above it. With that failure, confidence has fallen back sharply. Various line items on confidence are weak with the exception of plans to save with that indicator in the top 12 percent of its lifetime range.

| INSEE Household Monthly Survey | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Since Jan 1990 | Since Jan 1990 | |||||||||

| Sep 07 |

Aug 07 |

Jul 07 |

Jun 07 |

Percentile | Rank | Max | Min | Range | Mean | |

| Household Confidence | -21 | -17 | -15 | -13 | 27.9 | 109 | 10 | -33 | 43 | -17 |

| Living Standards | ||||||||||

| past 12 Mos | -50 | -47 | -46 | -45 | 19.0 | 139 | 18 | -66 | 84 | -37 |

| Next 12-Mos | -26 | -17 | -11 | -3 | 28.1 | 115 | 15 | -42 | 57 | -18 |

| Unemployment: Next 12 | 13 | 0 | -8 | -8 | 45.5 | 152 | 73 | -37 | 110 | 30 |

| Price Developments | ||||||||||

| Past 12Mo | 9 | 5 | 1 | -8 | 75.9 | 27 | 30 | -57 | 87 | -20 |

| Next 12-Mos | -15 | -20 | -26 | -28 | 49.5 | 16 | 31 | -60 | 91 | -34 |

| Savings | ||||||||||

| Favorable to save | 36 | 35 | 33 | 34 | 88.9 | 8 | 40 | 4 | 36 | 23 |

| Ability to save Next 12 | -6 | -5 | -4 | -4 | 58.6 | 67 | 6 | -23 | 29 | -8 |

| Spending | ||||||||||

| Favorable for major purchase | -8 | -6 | -3 | -7 | 58.6 | 51 | 16 | -42 | 58 | -12 |

| Financial Situation | ||||||||||

| Current | 16 | 15 | 15 | 14 | 61.9 | 39 | 24 | 3 | 21 | 12 |

| Past 12 MOs | -15 | -14 | -14 | -11 | 54.5 | 68 | -5 | -27 | 22 | -16 |

| Next 12-Mos | -4 | -3 | -1 | 4 | 44.4 | 159 | 11 | -16 | 27 | 0 |

| Number of observations in the period 208 | ||||||||||

Robert Brusca

AuthorMore in Author Profile »Robert A. Brusca is Chief Economist of Fact and Opinion Economics, a consulting firm he founded in Manhattan. He has been an economist on Wall Street for over 25 years. He has visited central banking and large institutional clients in over 30 countries in his career as an economist. Mr. Brusca was a Divisional Research Chief at the Federal Reserve Bank of NY (Chief of the International Financial markets Division), a Fed Watcher at Irving Trust and Chief Economist at Nikko Securities International. He is widely quoted and appears in various media. Mr. Brusca holds an MA and Ph.D. in economics from Michigan State University and a BA in Economics from the University of Michigan. His research pursues his strong interests in non aligned policy economics as well as international economics. FAO Economics’ research targets investors to assist them in making better investment decisions in stocks, bonds and in a variety of international assets. The company does not manage money and has no conflicts in giving economic advice.