Global| May 18 2007

Global| May 18 2007Gasoline Price Hits New Record, as Springtime Inventories Are Low

Summary

Gasoline prices in the US hit a record high last week (ended May 14), $3.103 a gallon for regular grade, according to the Department of Energy, up 4.9 cents from the week before. And the main summer driving season hasn't started yet. [...]

Gasoline prices in the US hit a record high last week (ended May 14), $3.103 a gallon for regular grade, according to the Department of Energy, up 4.9 cents from the week before. And the main summer driving season hasn't started yet.

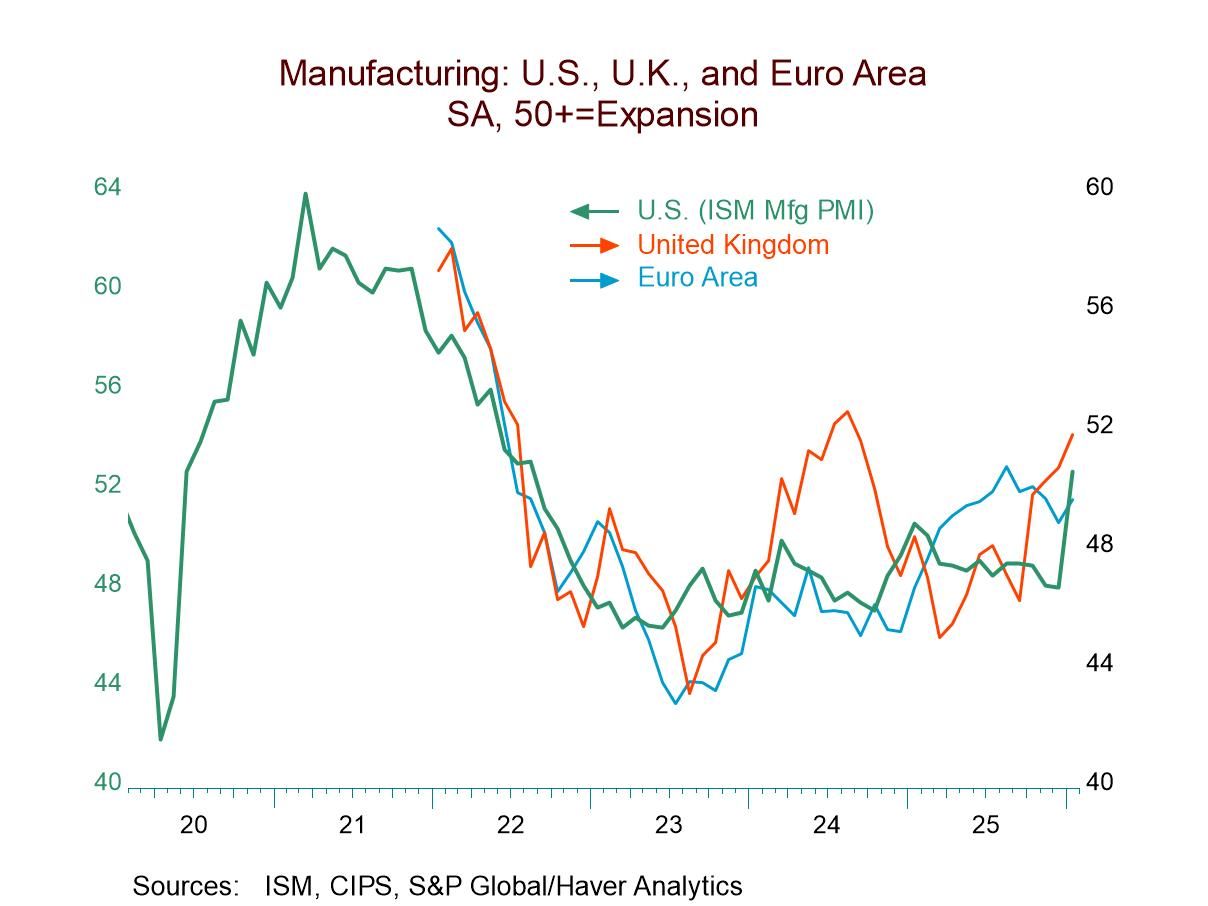

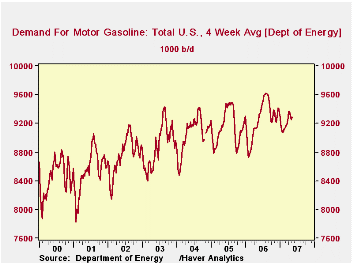

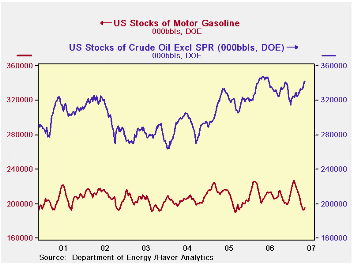

Oddly, it seems, the price of gasoline has risen more than proportionately with crude oil prices. This is readily apparent in the first graph, which includes regular gasoline and two crudes, West Texas Intermediate and UK Brent Blend. We see there that in the last two years of dramatically higher petroleum prices, gasoline prices have fallen more sharply in the winter and risen more in the spring. The extremity of the up-move this year is greater than last year. In the second graph, it is evident that demand for gasoline did not fall as much over the winter as in any recent year. Consequently, gasoline inventories are lower now than usual in the spring, seen in graph 3, so prices are rising more rapidly.

The other feature of the energy markets that continues to fascinate us is the growth of demand for petroleum generally in emerging market countries and in China. The last graph -- another illustration of the new multiple-series and calculation features of the upcoming version of DLXVG3 software -- shows that Europe has decreased markedly as a share of world petroleum demand. The US is up slightly in the most recent few months, touching almost exactly 25% in April; but this is still modestly lower than the range that prevailed before 2004. China, in sharp contrast, is expanding rapidly, basically doubling its share since 1995 and raising its use by 60% in the last 5 years.

The data here on prices and US inventories are in the OILWKLY database, and those on international demand comparisons are in the OMI database, which is provided by Haver's partner in energy information, Energy Intelligence.

| May 14 | May 7 | Apr 2007 | Yr-Ago Week | 2006 | 2005 | 2000 | |

|---|---|---|---|---|---|---|---|

| Gasoline, US Regular Grade (cents/gal) | 310.3 | 305.4 | 284.5 | 294.7 | 257.2 | 227.0 | 148.4 |

| Crude Oil, UK Brent ($/barrel) | May 11 | May 4 | 67.58 | 70.47 | 65.19 | 54.58 | 28.53 |

| 66.92 | 66.92 | ||||||

| West Texas Intermed | 61.90 | 63.79 | 63.91 | 71.60 | 66.13 | 56.50 | 30.36 |

Carol Stone, CBE

AuthorMore in Author Profile »Carol Stone, CBE came to Haver Analytics in 2003 following more than 35 years as a financial market economist at major Wall Street financial institutions, most especially Merrill Lynch and Nomura Securities. She had broad experience in analysis and forecasting of flow-of-funds accounts, the federal budget and Federal Reserve operations. At Nomura Securities, among other duties, she developed various indicator forecasting tools and edited a daily global publication produced in London and New York for readers in Tokyo. At Haver Analytics, Carol was a member of the Research Department, aiding database managers with research and documentation efforts, as well as posting commentary on select economic reports. In addition, she conducted Ways-of-the-World, a blog on economic issues for an Episcopal-Church-affiliated website, The Geranium Farm. During her career, Carol served as an officer of the Money Marketeers and the Downtown Economists Club. She had a PhD from NYU's Stern School of Business. She lived in Brooklyn, New York, and had a weekend home on Long Island.